Amount borrowed: One to high interest ‘s the restrict loan amount available because of for every single option

When you compare design money and you will home security money, it is critical to measure the interest levels and costs relevant with each choice. By given these types of products, borrowers can make the best decision that aligns due to their financial goals and needs.

six. Flexibility and you may Usage of Fund

Flexibility and you will access to finance are very important you should make sure whenever deciding between a housing mortgage note and a home security financing. Both selection offer benefits and drawbacks, and you will insights these types of products will assist you to build the best decision you to definitely aligns with your monetary goals and you will construction needs.

step 1. Framework mortgage notes typically provide a high amount borrowed because they are designed to coverage the whole price of design. While doing so, domestic equity fund are limited by the degree of guarantee you enjoys of your house. When you yourself have good-sized equity, a house security mortgage is sufficient to suit your construction endeavor.

dos. Disbursement Process: The procedure of accessing financing is another foundation to take on. Design loan notes normally disburse loans inside amount, also known as brings, since framework moves on. This permits to have freedom and you may means fund try put-out centered on the complete really works. Family collateral funds, on the other hand, always offer a lump sum initial. While this is generally convenient for most plans, may possibly not be most readily useful if you wish to control the move of loans and just pay for finished construction milestones.

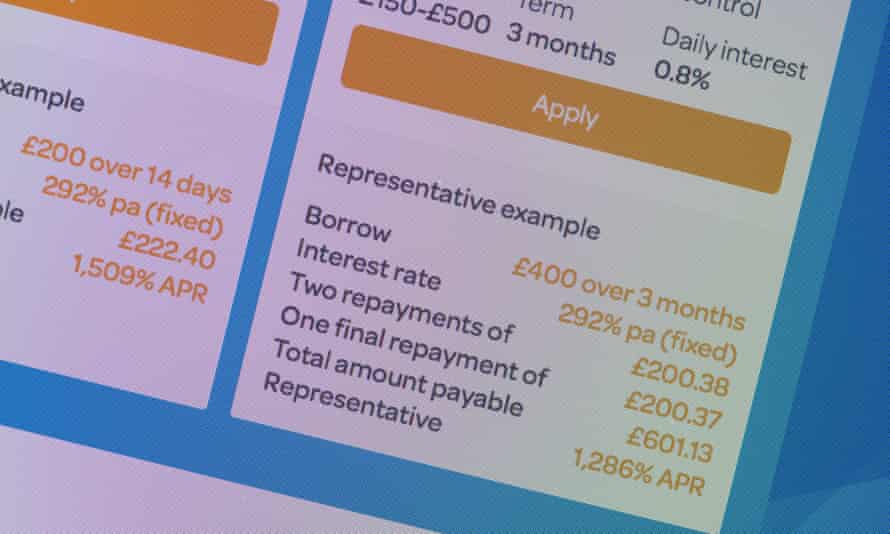

step 3. interest levels and you will conditions: Rates of interest and you will financing words can notably impact the total cost away from borrowing. Design loan cards usually have variable interest levels, that will be advantageous if rates disappear inside framework months. Yet not, nevertheless they pose the possibility of prices ascending, potentially boosting your monthly premiums. Domestic security funds routinely have fixed interest rates, getting balances and you can predictability in your payment plan. Additionally, financing terms and conditions to own design mortgage notes are usually faster, ranging from you to 36 months, while domestic collateral loans routinely have expanded words, making it possible for more affordable monthly obligations.

Yet not, for people who require a larger loan amount https://paydayloansconnecticut.com/madison-center/, a housing loan mention may be the better option

4. repayment options: Repayment options differ between construction loan notes and home equity loans. Construction loan notes typically require interest-only payments during the construction period, with the principal balance due upon completion. Once construction is finished, you can either pay off the loan in full or refinance into a long-term mortgage. Home equity loans, on the other hand, require both principal and interest payments from the start. This may be preferable if you want to start repaying the loan immediately and avoid a lump sum payment at the end.

5. Certification Requirements: Being qualified having often alternative depends on numerous points, as well as credit score, income balance, additionally the appraised property value your property. Structure mortgage cards will often have stricter qualification criteria because they include financial support a construction endeavor. Household equity funds can be more obtainable when you have sufficient security of your house and a good credit history. It is essential to see the money you owe and you may talk to loan providers to choose which financing solution you are prone to qualify for.

Considering such points, your best option eventually hinges on your unique activities and you may framework needs. When you yourself have substantial collateral of your home, property security mortgage may provide the necessary financing. However, for people who require a much bigger loan amount or prefer a flexible disbursement procedure, a construction financing mention will be more desirable. It is strongly recommended to check out loan providers and you will carefully contrast the newest terminology, interest rates, and you can installment alternatives of one another options to make the best decision that aligns along with your financial requirements and design conditions.

Leave a Reply