With its 324 branches, Navy Federal Borrowing Union (NFCU) ranks because the the ideal financial for inside-person assistance to have armed forces participants

Why we chose the firm: A mix of their 324 branches all over the country, together with complete within the-domestic servicing of its finance makes Navy Government Borrowing Connection our very own finest in-person bank having army users.

NFCU features each one of their mortgages in-family toward lifetime of brand new loans, and that is important for users seeking do business entirely along with their picked bank. Also, consumers you would like a lot fewer mortgage items to availability a low available cost.

Virtual assistant finance is regulators-backed, so they usually do not function an identical rate of interest all over lenders. Although not, consumers looking into financial circumstances thanks to NFCU can take advantage of its price financing fits. If you discover a far greater rates someplace else, NFCU will suits they otherwise dismiss $step one,000 from your own settlement costs.

First-big date applicants likewise have the means to access the newest Independence Secure function, that allows you to definitely secure a lower interest, if an individual gets offered. Individuals are allowed doing several locks that have the absolute minimum notice loss of 0.50%.

Navy Federal’s Homeowners Alternatives program is actually a standout choice regarding businesses distinctive line of lending products. It offers 100% investment, a predetermined interest rate, and you can a supplier contribution as much as 6%. This will make it a strong substitute for members of the newest armed forces who will be purchasing the basic family.

Good for Basic-go out Homebuyers: Guild Financial

The reason we chose the firm: Guild’s reduced credit rating requirements and you may deposit assistance programs create they an ideal choice having first-day homebuyers.

Guild Financial also provides regulators-recognized FHA, Virtual assistant, and USDA loans and software one focus on off-fee guidelines, and additionally connection money that may help you safer a new first quarters while you waiting to market your current house.

With respect to the Financial Lenders Association Report (MBA), Guild is just one of the nation’s most useful five lenders out-of FHA financing, so it is great for being qualified consumers with credit ratings only 540 (considering they put at the least ten% down).

Guild now offers an enthusiastic FHA No Down system to possess reasonable to moderate-earnings homebuyers with below-mediocre borrowing from the bank (essentially under 700) and who don’t have sufficient saved up having a downpayment.

Many FHA finance want at the least step three.5% off, Guild’s No Down program lets people which have credit ratings since the reasonable since 640 to acquire an enthusiastic FHA mortgage without the need having a down payment.

Guild can be originate loans for the Arizona D.C. and all of but a couple claims – Ny and you can Nj. On top of that, the firm is also totally romantic mortgages on the internet thru the digital program, MyMortgage, that provides additional shelter and can assist automate the newest closure process.

Most readily useful On line Lender to possess Armed forces Participants: Experts Joined

The reason we chosen the firm: Experts United’s powerful on line system and online borrowing from the bank guidance program generate they a good selection for effective-obligations armed forces players which may not have the time to check out an actual branch.

Veterans Joined focuses primarily on fund supported by the newest U.S. Department out of Pros Items, which will be a good selection for productive-duty solution people and you may reservists, in addition to experts in addition to their family.

VU also offers an online credit guidance program getting veterans and you may service users which have lowest credit scores called the Lighthouse System. A cards expert is assigned to for each customer to greatly help fix errors on credit file, map out a score improvement plan, and you can indicates this new debtor up to they visited the credit rating goal.

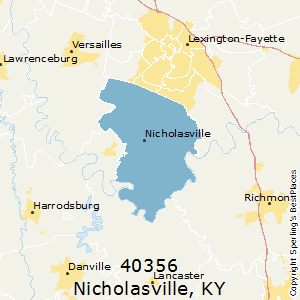

VU’s home loan software appear in https://availableloan.net/loans/1500-dollar-payday-loan/ all the 50 claims and you will Arizona DC. Yet not, understand that the lender has only actual branches in the the new states of Alabama, Alaska, Ca, Texas, Florida, Georgia, Hawaii, Idaho, Illinois, Kentucky, Nebraska, Vermont, Oklahoma, Sc, Tennessee, Texas, Virginia, Arizona.

Leave a Reply