What’s the next Financial and exactly how Does it Performs?

You’ve been continuously settling your own mortgage when all of a sudden, you start delivering characters away from loan providers welcoming that sign up for one minute mortgage. “Create riches!” people say. “Pay for their degree! Renovate your house!”

Hold-up! One which just get an additional mortgage join, let’s take a closer look on next home loans and exactly why they aren’t worth it.

What is actually a second Mortgage Just?

An extra mortgage occurs when your lose your own home collateral (by turning they towards that loan) in return for a quicker means to fix repay almost every other expenses, over do it yourself ideas, or purchase something you didn’t or even afford.

But it is obligations. You need to pay it off. And since another financial was secure by the house, you are able to treat your residence or even pay it back. That’s specific frightening articles.

What is Family Security?

Until you repaid the financial, you never commercially very own the home. You own a share equivalent to extent you have paid off. House equity is that portion of your home that’s it is your.

Instance, say your property try respected within $250,one hundred thousand therefore are obligated to pay $150,000 on the home loan. To figure out the collateral, you’ll merely subtract $150,100000 off $250,000. Meaning your home loan place in Meadowbrook equity manage equal $100,100.

But that’s just in case the newest elizabeth. In most cases, the market worthy of varies, so your security have a tendency to as well, according to which method industry punches.

Why does Domestic Collateral Turn into one minute Financial?

Really, some tips about what goes: A citizen states, “Do you know what? You will find $a hundred,one hundred thousand within the guarantee. Why are unable to I turn one $one hundred,000 into the money I am able to used to pay off my pupil fund, upgrade the house, or continue vacation?”

Reduced and you can view, particular bank thinks that is a good idea and feedback, “You may have oneself a great deal!” The financial institution believes to provide the new citizen their equity in the event your resident intends to outlay cash back that have attention-or hand over their house whenever they you should never.

2nd Financial against. Refinancing: Just how Are they More?

Now take care not to mistake a second home loan having an excellent refinanced mortgage. The second home loan includes one minute payment along with your current payment.

At the same time, refinancing function you may be replacing your financial with a brand new home loan who may have a separate group of terms and conditions-and that means you stay glued to only 1 monthly payment.

That have a second home loan, your primary bank retains new lien (the fresh new legal rights to your residence)-if you prevent and then make payments (default), they are able to get back your residence (foreclosure).

Your second financial simply will get their money right back in case your primary bank will get all of their money back of auctioning from the house.

All this to express, the second lender was using up a higher chance and can probably ask you for increased rate of interest as a result compared so you can performing an excellent re-finance.

Was Second Mortgage Cost Highest?

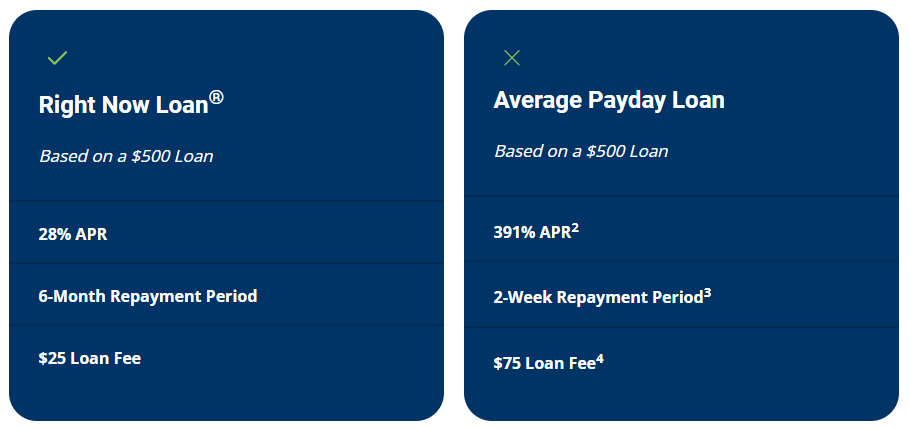

Do you hook you to definitely? Second financial pricing are infamously greater than those of a great refi-as well as an initial financial! To phrase it differently, second financial cost cost a lot and keep your with debt offered.

At the same time, you’re not (usually) heading then into the financial obligation which have a refi. Actually, for folks who re-finance in the correct manner for the ideal causes (a much better interest and you may a smaller label), it can save you tens of thousands when you look at the notice and you may pay the domestic ultimately.

Particular Second Mortgage loans

- Household equity loan. Having a home collateral mortgage, your bank gives you a stack of money based on the equity, and you pay back the lending company each month. Since it is a single-go out lump sum, house guarantee fund incorporate a predetermined interest, very monthly obligations try not to alter.

Leave a Reply