Was Virtual assistant Finance an option for Mobile otherwise Are created House?

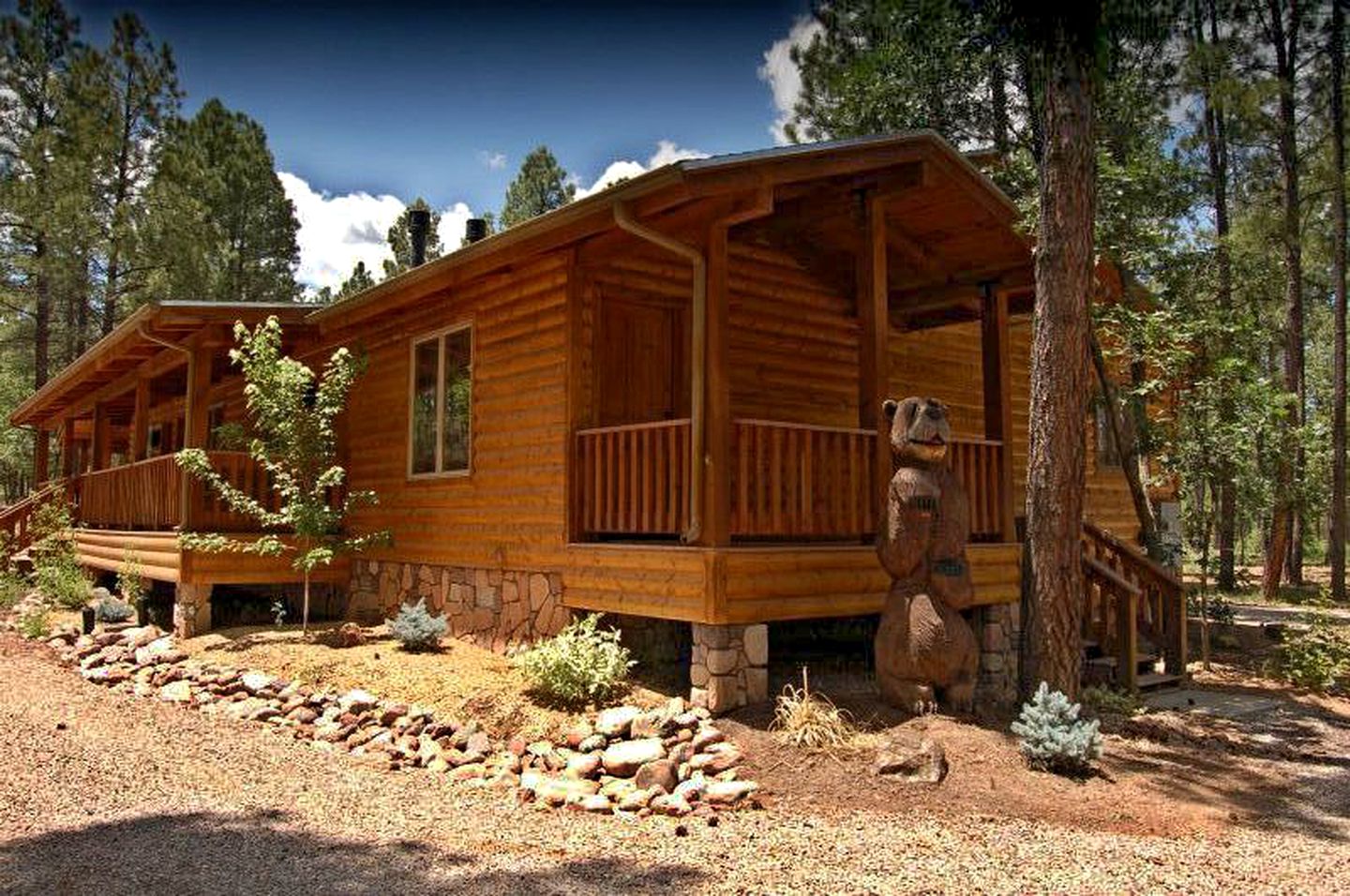

Which have costs which can be either half as costly due to the fact traditional webpages-built property, are designed property present a more accessible road to homeownership. It is brand new Virtual assistant loan a good fit to own a mobile home pick, or perhaps is the applying also restrictive weighed against most other financing programs?

The usa is actually experience among top construction places in its history, and the powerful request along with really low inventory in a lot of markets is actually riding home prices for the list territory.

The condition of the business are pushing of numerous potential homeowners so you’re able to pivot and you may imagine are produced otherwise standard land. Fortunately, people who be eligible for the new Va home loan program may use it to purchase a produced otherwise standard family, but there are certain fine print unique to these dwellings you to a buyer should be aware of first.

What are Cellular and you can Were created Homes?

The initial step would be to get to know some terms and conditions and you can classifications for these formations, such as while they relate solely to the fresh new Va home loan processes. While you are trailer and cellular family is colloquial and also greater conditions to own describing prefabricated homes situated in a factory to your a frame and later transmitted in order to a good web site, people terminology also are very dated.

With regards to the laws, one thing are built ahead of Summer fifteen, 1976, is recognized as a cellular house. Formations depending up coming time need to adhere to the fresh new stricter advice of the Were created Household Design and you will Coverage Conditions, statutes established and you may implemented because of the Department off Construction and you will Metropolitan Innovation (HUD). Belongings you to fulfill these guidelines are known as are manufactured homes. A 3rd classification, modular property, differs from cellular home and you will were created property because these structures don’t need to fulfill HUD conditions and are made to a comparable strengthening codes and conditions given that site-depending house.

Differences between Mobile and Were created Home

The latest Virtual assistant mortgage system possesses its own look at the structures, and you will takes into account mobile and manufactured structures in general and the exact same. The Va classifies a cellular or are produced home because one house that’s built in a factory on the a permanent figure otherwise frame. However, a standard residence is manufactured in sections within the a from-website factory and soon after transferred to the next where it is make towards a foundation.

Utilizing the Virtual assistant loan system is achievable towards the acquisition of a mobile or are built domestic, but there are specific direction that are available. First, remember that brand new Virtual assistant does not lend the money – they merely pledges the borrowed funds. A good Virtual assistant-acknowledged lender will have their standards, and never are typical happy to question fund with the are formulated or mobile land. Next, before fulfilling any specific bank conditions, one property would have to adhere to the fresh new VA’s criteria.

Virtual assistant Financing Requirements to have Are available Home

Before you submit a deal, make sure to understand the specific conditions you to definitely were created residential property must satisfy to be qualified to receive this new Virtual assistant household financing system.

- Long lasting foundation: The new Virtual assistant features a broad policy that the family have to be connected so you’re able to a permanent base, although it are you can easily that have recognition about Virtual loan places Indian Field assistant to help you safer financing to your a home that is not permanently connected.

- Classification: The dwelling need certainly to hold which have appropriate building and you can zoning regulations. It ought to be also categorized and taxed once the property and you may titled to the residential property it sits up on. (A difference can be offered if your financial becomes approval.)

- Construction: The house have to have a great HUD level, a metal identification dish discovered beyond your framework certifying which has been examined and you will fits build criteria certain to are made property. Indeed there should also be a document plate when you look at the home, usually located inside a case otherwise drawer, one directories factual statements about our house.

Leave a Reply