To acquire a home for the first time? How-to Browse Your purchase

If you would like make sure a first-time homebuyer loan is the best option for your, contact our financial masters. They have been willing to answr fully your questions, and also have the regional sense in order to recommend the best financing to have a problem.

Benefit from the totally free tools, useful blogs and much more. It is possible to be concerned less having the understand-the method that you have to with certainty reach finally your goal of homeownership.

Little could be more fun than buying your basic home! Once numerous years of saving and leasing, its eventually time to be the grasp of your domain. However, buying a home will likely be a whole lot more challenging than simply your you are going to read. The asking price of your house is the one bit of the newest picture as you navigate all this work-too-important get. Out of searching for a home loan in order to budgeting having unforeseen can cost you, we are going to walk you through every step of processes.

Getting Pre-Accepted getting a home loan

Do you want to house take a look, however they are wanting to know “Just how much financial can i manage?” Getting pre-acknowledged having a home loan can show providers that you’re a severe applicant and provide you with a feet abreast of almost every other consumers just who jump the gun by going to discover property without even once you understand its budget. In this industry, in which providers are receiving of numerous has the benefit of including bucks also provides, a pre-approval makes it possible to shine while the a purchaser. For those who have a reported pre-acceptance, the seller knows you’ll be able to to get the funding you are providing with the household and you will certainly be capable romantic more readily and easily.

Homebuying Procedure: 10 Biggest Stages in Purchasing property

The choice to pick a house should be one another fun and scary every meanwhile. Homeownership is what many of us shoot for-to be able to possess a home that individuals can call our own, plus a bona-fide house advantage we are able to use to generate our personal riches. Its an enormous action to take. Meanwhile, regardless of if, the process of to order a property are daunting. Understanding the step-by-step techniques during the to buy a property will help make the family-to find feel a positive one for you plus members of the family and certainly will reduce the additional stress that comes with larger requests in daily life.

HomeReady Financing

For some aspiring property owners, in search of an inexpensive way to homeownership can feel eg a faraway fantasy. HomeReady financing is yet another and flexible home loan option made to make this fantasy a real possibility to have a greater list of some body and you can parents. In this post, we delve into the realm of HomeReady money, demystifying the possess, pros, and qualification conditions.

Va loans compared to. old-fashioned funds

Veterans and you can services members of the Army in addition to their partners qualify for regulators-backed Va financing, and this vary from traditional mortgages in several ways. Both alternatives will help you buy a property, nonetheless they include more terms and conditions that may affect their conclusion. Find out about the advantages of an excellent Va financing vs. a normal loan to obtain the right choice for you and the ones you love.

Virtual assistant loan qualification requirements

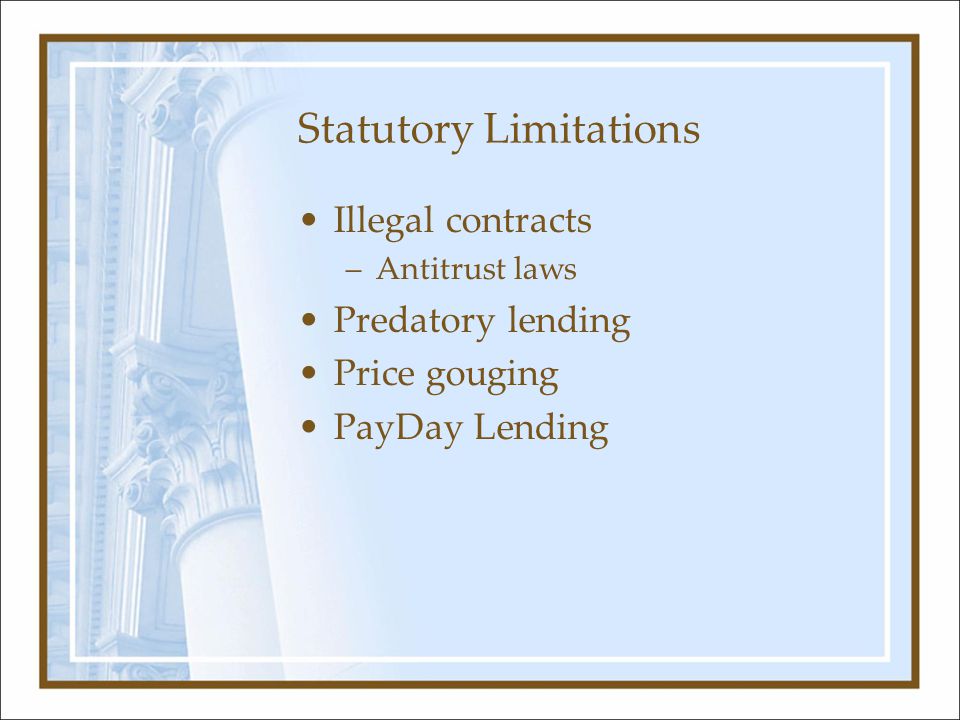

If you are a online payday loans in Thorsby military associate or experienced, your . Virtual assistant loans have all the way down qualifications conditions to assist services professionals in addition to their families be able to purchase a home even in the event it have little money in savings or a high credit history. Just be sure to be sure to satisfy all the Virtual assistant loan criteria to locate approved. Discover more about brand new Virtual assistant loan conditions to see if your qualify.

Leave a Reply