The length of time can it get an underwriter in order to accept home financing inside Canada?

And make offers into the services that have been useful for any illegal intentions such as for instance build ops, or deficiencies in a healthy loans Bristow Cove AL and balanced equilibrium throughout the set-aside loans to have condos shortly after revealed normally terminate your own acceptance altogether. In this situation, you should analysis due diligence to find a great reputable and you will competent real estate professional which enjoys the opportunity to make certain that property which they assist you wasn’t used for illegal interest prior to now. Looking for an effective solicitor in early stages will provide all of them for you personally to remark this new set-aside money before you waive the conditions away from capital (known as a notification out-of satisfaction). In this situation, the criteria from financing are not only your funding and also the credit of the home.

Faqs

The borrowed funds underwriting procedure usually takes ranging from 24 to 72 period for the Canada, it will ultimately confidence the lender. However, if the you will find conditions linked to the acceptance for example a beneficial need to over a property check otherwise an assessment, you will find waits. Then delays will get happen in the event the recognition was re also-conditioned to present time for you to boost any problems with the new house one which just rating last recognition. The full approval in your financial will take regarding the 25 months in the event that conditions should be found or an appraisal is necessary.

Can be home financing fall due to through the underwriting?

Home loan recognition might be canceled following the reality for various reasons generally hinging on capacity, credit or guarantee. The best explanations are going to be losings otherwise change in your work. The fresh organization on your own credit bureau immediately after funded may take aside to fifty products from the credit score since these usually impact your capability also. Appraisals going back small in which you you should never compensate the real difference having a more impressive down payment from the deals, or perhaps the revelation of the home in past times used to possess unlawful activity will be the easiest way to get rid of away because of activities along with your collateral. It is informed that you get qualified advice regarding the property via your realtor; in addition to playing with a beneficial solicitor early in the latest phase in the event the you might be to get an apartment.

Conclusions

To conclude, underwriting is a serious step up the mortgage acceptance processes. Mortgage underwriters very carefully take a look at your financial situation additionally the property becoming funded to choose your qualifications for a financial loan. By understanding the underwriting processes and addressing any potential warning flags, you could potentially improve chances of a profitable financing approval. Think about, per financial possess certain underwriting guidelines, so it’s essential to performs directly with your mortgage mentor and you will offer all requisite records so you can facilitate new underwriting processes.

Prepared to start off?

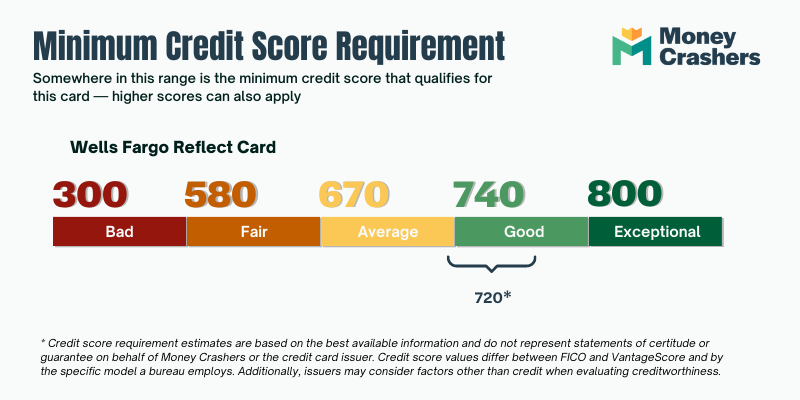

Charge card Application: A leading credit usage proportion, where their charge card balance try near the borrowing limit, otherwise overdraft payments is also adversely impression their creditworthiness, as it can imply into lender you are lifestyle significantly more than their setting. At exactly the same time, deficiencies in application is a problem; less than 2 rotating borrowing place means that their rating is actually simply according to one studio and can even get noticed because the a good exposure into financial.

Which are the step three Cs off Home loan Underwriting?

Cock & tubing wires, Kitec plumbing, otherwise a threshold that is not inside better than good condition are sure means into the financial so you’re able to recondition your acceptance to features this type of repaired ahead of a strong acceptance are given for your requirements. Making the effort to complete a house examination report having an excellent professional try a very beneficial do so because it provides so you’re able to white the costs employed in updating your house; along with mitigating the cost of your house in-line to your far-necessary fixes.

Leave a Reply