Strategies for Purchasing a no Down Household when you look at the The state

Individual Financial Insurance (PMI)Getting low-Virtual assistant loans, people may be needed to fund Individual Mortgage Insurance (PMI), that’s an extra cost one handles the lending company in case you default to your loan. While you are Virtual assistant finance don’t require PMI, USDA money and other programs you’ll, leading to the monthly expenditures.

Highest Notice RatesZero advance payment mortgage loans go along with quite higher rates of interest versus traditional financing, as the loan providers was taking up so much more chance.

Over time, this may end up in spending a whole lot more appeal over the longevity of the mortgage

Long-Term AffordabilityWhile zero advance payment programs help you to get into the a beneficial household, it is very important check out the a lot of time-identity cost. High monthly installments, possible PMI, and you may increased rates adds up over the years, possibly making it more complicated in order to maintain the house economically.

Before deciding to the a no off mortgage, very carefully assess the money you owe, future money prospective, and you can much time-name desires. While these apps bring an amazing possibility to be a resident, however they need cautious cost management and you may planning make sure a lot of time-title victory.

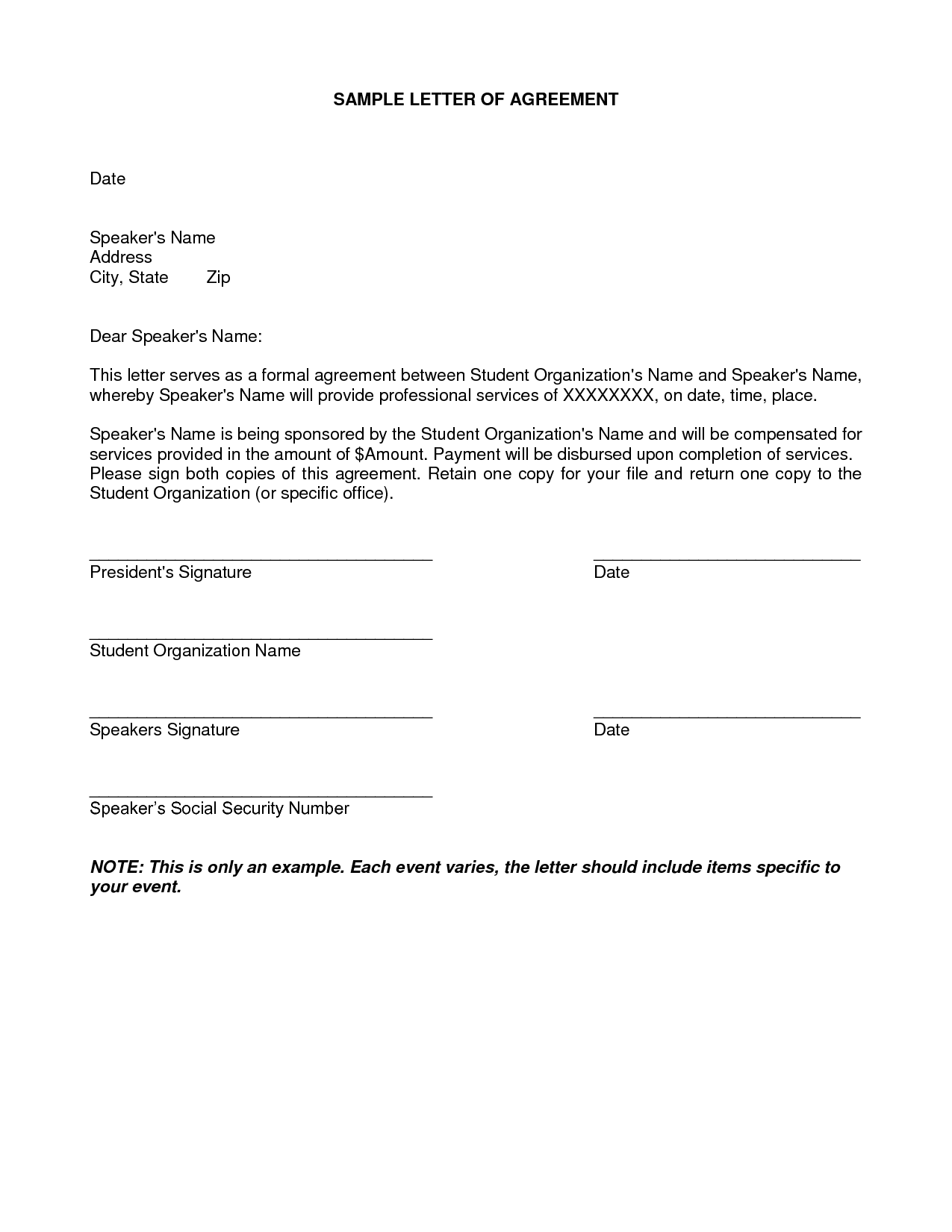

” data-large-file=”” tabindex=”0″ role=”button” width=”1024″ height=”574″ src=”” alt=”A drone shot of a home representing VA loans and Rural Development Loans in Hawaii” srcset=” 1456w, 300w, 1024w, 768w, 1060w, 600w, 1158w” sizes=”(max-width: 1024px) 100vw, 1024px” title=”zero down homes in hawaii ? The Papakea Collecton: Big Island Real Estate Team ? The Papakea Collecton: Big Island Real Estate Team” data-attachment-id=”14916″ data-permalink=”” data-orig-file=”” data-orig-size=”1456,816″ data-comments-opened=”1″ data-image-meta=”<"aperture":"0","credit":"","camera":"","caption":"","created_timestamp":"0","copyright":"","focal_length":"0","iso":"0","shutter_speed":"0","title":"","orientation":"0">” data-image-title=”zero down homes in hawaii” data-image-description=”

To order a zero off family for the Hawaii is a wonderful chance, nevertheless needs careful planning. To help installment loans in Wyoming you improve most readily useful choice, here are some crucial techniques for navigating the method effortlessly:

step 1. Find the right NeighborhoodHawaii’s areas is diverse, regarding the calm country in order to active urban areas. Whether you are interested in the fresh new shores away from Kailua-Kona or the luxurious landscapes from Hilo, venue things. Having a no advance payment alternative, shopping for a city that meets your life style and finances is a must.

2. Get ready for Hidden CostsEven with no upfront fee, additional will cost you normally arise, such as for instance closing charges, all about home inspections, and you will maintenance expenditures. Also, long-label can cost you instance possessions taxes and you will homeowners insurance have to be factored in the budget. Planning these invisible costs helps to ensure you will be financially ready towards the obligations out-of homeownership.

step three. Change your Borrowing ScoreAlthough no down-payment apps are made to let people as opposed to a large cash reserve, improving your credit score can result in ideal loan terms and you may straight down interest levels. Actually brief transform, eg paying off obligations otherwise guaranteeing into the-go out payments, helps make a positive change on your home loan promote.

Make sure to search section one meet your own standards, so if you’re provided a USDA loan, make sure your desired venue qualifies just like the rural with the USDA’s possessions qualification chart

cuatro. Manage a skilled A house AgentNavigating Hawaii’s competitive home markets, especially with a zero off choice, is much simpler with the pointers out-of an informed a residential property representative. In the Papakea Range A home People, i are experts in helping customers get a hold of zero down homes during the Their state, making certain the procedure is because easy and you can fret-totally free to. Having strong expertise in Hawaii’s book property land and knowledge of financial applications, we are working along with you to find the prime family and you may discuss the best deal. Regardless if you are a first-date customer otherwise a skilled resident, we will become with you, helping you make use of all the readily available options. Call us right now to talk about the choices.

5. Negotiate to discover the best DealEven if you find yourself making use of a no off fee system, there is certainly still-room so you can discuss. We on Papakea Collection will allow you to keep the lowest price, demand requisite repairs, and possibly also discuss on vendor to fund some of the latest closing costs. Obtaining the correct people on your side implies that you create an audio financing while keeping extra cash in your wallet.

Leave a Reply