Stated Income otherwise Choice Earnings Verification Funds: Is it possible you Get a home loan Having One to?

Think about the creating group just like your Yoda, that have pro finance recommendations you can trust. MoneyTips teaches you basics simply, without special features otherwise formality, to help you live your very best financial existence.

Bringing a home loan demands a number of papers. When you apply for a vintage real estate loan, mortgage brokers usually check your credit history and financial obligation-to-money (DTI) ratio. They’ll also want to see evidence of income, just like your shell out stubs, W-2s and taxation statements.

Regrettably, you short-term installment loan cannot just tell a lender exactly how much you earn. Loan providers is actually obligated to assemble factual statements about your earnings, verify it and use it to choose the amount of money you’re competent to acquire and certainly will afford to pay off.

However,, when you are among the lots of people that are care about-employed, seasonally operating or get paid predicated on payment, delivering money confirmation is tricky. The good news is, specific finance make it easier to prove your revenue as they undertake option verification.

What happened toward Stated Money Mortgage?

In the first place, this type of finance had been intended for consumers whom would not be eligible for old-fashioned mortgage loans. That have said income loans, individuals didn’t must provide proof of earnings. They only must state its income to their applications (which the fresh loan’s identity).

As funds removed the cash confirmation challenge getting way too many borrowers, of numerous ended up taking out fully mortgages that would at some point getting unaffordable. Said income money finished into the failure of your own housing market and the Great Market meltdown.

Ever since then, higher control and you can transparency criteria make this type of funds unlawful to possess owner-occupied features (aka pri Dodd-Honest Wall Path Change and you will Consumer Protection Work produced the feeling-to-pay off code a key attention for mortgage lenders.

Just what are Option Confirmation Financing?

Like any almost every other home loan, option earnings confirmation fund (aka restricted files loans or financial report money) need proof of earnings and power to pay back the mortgage.

There are even no-money verification loans, which are arranged for real home investors and you may individuals having solution revenue source. The brand new vital difference between antique mortgage loans and you can choice with no-income verification fund is exactly what qualifies as the proof money.

How can you Qualify for a choice Money Confirmation Loan?

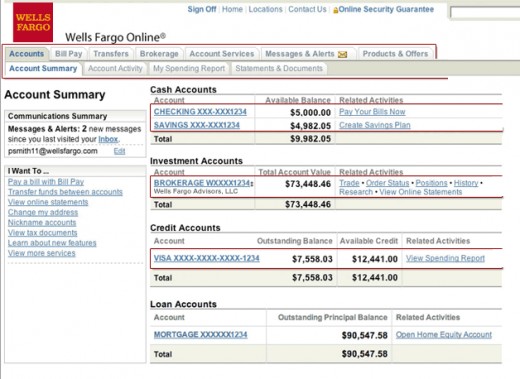

Old-fashioned financing usually wanted a borrower to incorporate the current pay stubs, tax statements and you may W-dos models. That have alternative income confirmation fund, borrowers try questioned to incorporate lender statements and other documents while the proof of income.

- More than mediocre credit scores (680+)

- Higher off payments (ranging from ten% and you may 29% down)

- Large cash reserves

Who will Make use of These types of Finance?

Not all of all of us are employed in antique, salary-established perform. Choice income confirmation financing would-be a much better selection for someone who work beyond your bounds off conventional nine-to-5s, including:

Self-operating or regular professionals

While a personal-operating debtor with your team otherwise behave as an independent builder, you may not be able to reveal consistent money since you:

- Get money from the venture: While paid to the a project-by-opportunity basis, you can acquire huge amounts of money from the certain times from the year and possess little money at other times.

- Work with a regular basis: Whenever you are a lawn specialist otherwise run a snow reduction team, you really have an active seasons and you may a much slower year.

- Is actually paid into the a percentage basis: While you are from inside the conversion process, you may make more income for folks who work at percentage. you may only get paid at the end of the few days otherwise quarter otherwise once you intimate on the a package.

To help you qualify for an option money confirmation mortgage if you are mind-working otherwise a seasonal staff member, you will have to deliver the bank that have facts that you’ve been in operation for over two years.

You’ll also need bring a business permit, a writeup on your profits and you may costs and you will a finalized page from your own CPA or other tax elite group verifying your company are effective.

Home flippers and a home traders

Whether your company is to find a property and you can flipping they to possess an income or you need it a residential property, you can find things once you may not have the money so you can buy the family downright.

To possess buyers who would like to purchase possessions rapidly, delivering a normal loan timely should be difficulty for people who cannot document your income or your earnings streams was difficult.

Choice or no-money verification finance are helpful since the borrowers is miss the intense money verification techniques when you look at the underwriting stage.

Nonworking earners

For people who earn your money as a result of expenditures (such as local rental attributes otherwise investing organizations), you will be doing well, however, find it difficult to reveal evidence of earnings. Otherwise, when you have multiple companies and you may file multiple taxation statements, it could be go out-drinking to possess lenders so you’re able to type all of them out.

An option or no-money confirmation mortgage could be the best bet for those who have enough cash supplies (hint: currency protected). You might obtain the money you desire without having to render an enthusiastic underwriter an in depth account off how you earn your bank account.

Try Alternative Earnings Verification Funds the most suitable choice?

If you aren’t typically operating or if you secure your income due to solution income avenues however, want it a property, alternative money confirmation fund was an alternative nonetheless is almost certainly not the only real option.

Don’t assume all bank offer a choice earnings verification mortgage. You might have to look for a lender which focuses on this particular financing. These types of certified loan providers can charge even more for the attention and you will charges given that the borrowed funds represents a top-chance financing.

Today, plenty of lenders whom provide old-fashioned fund understand that of several ambitious home buyers is making the revenue in many ways. To keep up with brand new specifics in our savings and also the job market, of a lot lenders have to give you traditional finance to help you nontraditional home buyers.

Yes, you will have a great deal more documents to include than a borrower just who is good salaried staff, however, you’d be in a position to gain benefit from the lower focus cost and credit score requirements out of a normal loan.

Leave a Reply