Sensible Mortgage Solutions You Didnt Know You could potentially Qualify for

Homeownership in the You.S. happens to be linked with brand new American dream-gorgeous grass, light picket wall, and all of the newest accouterments out of safe life some one could previously need. Unfortuitously, which is a concept that is difficult to getting to own a giant piece of populace.

For people located in a reduced-money house, it’s difficult not to ever feel like you are entirely priced out of the brand new housing marketplace. However, by way of some public and private reasonable-income mortgage alternatives, the brand new imagine homeownership does not need to feel due to the fact away from reach as it can seem. Read on to learn more about what choice of becoming a resident.

Key Takeaways

- People with low earnings commonly think payday loans that they can not go its hopes for homeownership because of financial and you may deposit requirements.

- Enterprises including HUD plus the FHA features homeownership software readily available for low-income domiciles.

- Your family money level find if you might qualify for this type of money.

- Plus national applications, state and You.S. area programs arrive one to give finance versus an enormous down fee.

- It’s always smart to discover if your meet the requirements as low income before you apply for the county otherwise federal homeownership apps.

Government-Recognized Home loans

The us government ‘s the largest supplier out of fund, offers, and other different recommendations in the united kingdom, ultimately causing a whole budget away from nearly $6.8 trillion towards the 2021 financial season. It is in the government’s welfare to store as many out of their owners situated that one can to maintain a happy and you may match employees. For this reason firms such as the U.S. Agencies from Construction and Metropolitan Innovation (HUD) therefore the Government Construction Management (FHA) features software aimed at providing lower-income property pay for property.

Consumers that see specific conditions is look for and get government-recognized mortgages that have differing criteria, advance payment minimums, and you may benefits from after the apps. Due to the proven fact that these include supported by the brand new You.S. regulators, loan providers could see such programs as a low-chance money, causing better terms and conditions and you can possibly less expensive pricing.

FHA Financing

With fundamentally less strict requirements than many other bodies-supported apps, the fresh FHA loan system is designed to help very first-day low-income people enter the housing industry.

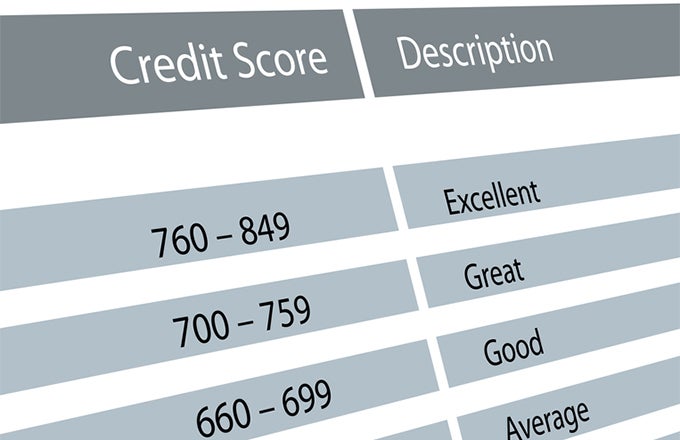

So you can qualify for the program, borrowers need to have an average credit history of 580 and stay capable manage about a beneficial step 3.5% down payment to the house. You can influence the FHA mortgage limit-which will believe new state in which you thinking about and come up with you buy-by the consulting the new HUD web site.

Despite your credit score and you may offered downpayment, the individuals have to pay the settlement costs. These can cost you, as well as financial costs, third-team costs, and you may people prepaid service things, cannot be financed. Consumers also are on the connect for yearly financial insurance fees.

Good-neighbor Next-door Program

It’s sorry to say, but some somebody employed in public service work do not generate since much money while the you’ll consider. Instance, a senior high school teacher’s ft annual salary can begin as much as $38,000 together with mediocre income to possess firefighters is simply more than $48,000. All of those people figures create house them regarding the reasonable-earnings group, according to extremely conditions.

Eligible public-service personnel can find a home during the 50% out-of through the Good neighbor Nearby system, that’s provided with HUD. All the that’s needed is you are currently working as a great full-date

- Pre-K using 12th-degrees educator

- Disaster scientific technician

- Firefighter

- The authorities officer

It’s also wise to propose to pick a house from inside the a great HUD-designated revitalization area and are also happy to agree to staying in one to house for at least 3 years.

Leave a Reply