Repeat refinances were money that were refinanced several times inside an effective several-few days several months

A year ago was a busy seasons towards the financial industry. Because the cost savings was in credit crunch, listing lower home loan rates of interest triggered refinance passion reaching close number highs. Of many consumers saved thousands of dollars because of the reducing the financial rates using refinances. This research Notice highlights a few of the key style identifying re-finance home loan hobby in the 2020.

Re-finance regularity climbs

Even after an economy rocked of the COVID-19 pandemic, mortgage enhanced. Which have mortgage prices getting historical downs into the 2020, refinancing a mortgage craft achieved their high annual full given that 2003. There have been a projected $772 mil inside the inflation- adjusted 2020 cash in the single-household members very first lien refinances regarding the fourth one-fourth 2020. Getting full-season 2020, there were on the $2.6 trillion during the rising prices-modified refinance originations, more than double the regularity regarding the previous 12 months, yet still less than the brand new $step 3.nine trillion during the 2003. step one

Predicated on Freddie Mac’s Primary Field Financial Questionnaire, this new 29-season fixed rate financial speed averaged 3.1% when you look at the 2020, a decline of about 90 foundation activities from a year earlier. Also, inside the 2020 house pricing flower 11.6% towards the a-year-over-seasons foundation. Residents grabbed advantage of number reasonable home loan cost and enhanced resident equity to re-finance their services, cutting their monthly obligations and you may extracting equity as a result of dollars-away refinances.

Repeat refinances increased

Which have mortgage interest rates dropping easily all year long, i spotted a boost in repeat refinances. From inside the 2020, 10.1% from refinances were repeat refinances, up away from eight.8% in 2019, but below the brand new sixteen.6% when you look at the 2003.

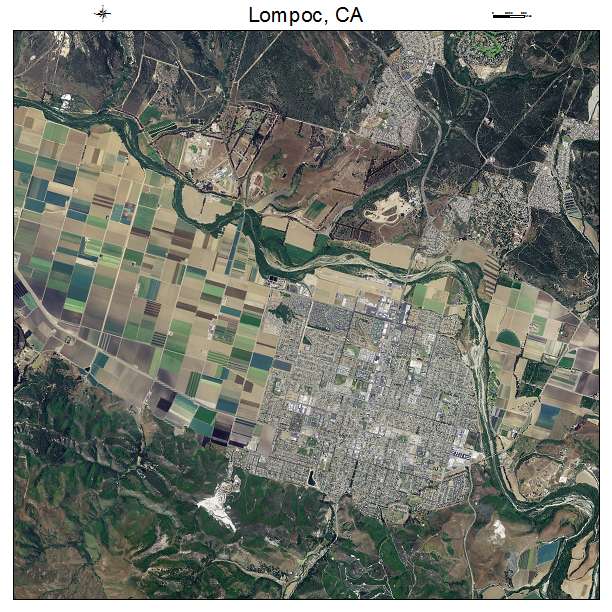

Repeat refinances was basically more prevalent inside large houses pricing urban area places that the average delinquent prominent balance off mortgages was large. During the 2020, almost 20% off old-fashioned refinances inside the Los angeles-Enough time Coastline Anaheim, Ca MSA was basically repeat refinances if you’re simply step 3.1% away from refinances from the Dallas-Fort Worth-Arlington, Texas MSA was recite refinances (Display step 3).

Borrower coupons regarding refinances

Typically, borrowers whom refinanced its very first lien mortgage in the next one-fourth regarding 2020 reduced their speed because of the more step one.25 payment activities, the biggest cures once the next one-fourth away from 2015. A-year earlier, re-finance consumers decreased its rate by in the 0.70 percentage factors, on average. Display cuatro compares the typical mortgage price of the dated refinanced financing against the average financial speed of the fresh new refinance funds each one-fourth from 1994 because of 2020.

An average of, individuals which refinanced its 30-season fixed speed financial to some other 31-12 months fixed rate home loan to reduce the home loan rates (non dollars-out refinancers) conserved more $dos,800 into the mortgage repayments (principal and attract) annually of the refinancing within the 2020. The common refinance mortgage into the 2020 try a loan for around $3 hundred,000 together with borrower reduced their speed away from cuatro.3% to 3.1%.

The amount conserved differed somewhat because of the area urban area; instance, consumers when you look at speedycashloan.net best sites for buy now pay later the La, North park, Bay area, Seattle, and you will Arizona DC urban area areas have spared over $3,500 per year when you look at the mortgage repayments while consumers for the St. Louis and you can Pittsburgh location section keeps spared regarding $2,000 (get a hold of Showcase 5).

On you to-4th away from refinance borrowers reduced their name

Regarding consumers who refinanced in the 1st quarter out-of 2020, on the 24% shortened their loan label, down off twenty-eight% on the previous quarter (look for Display 6). The difference between the 31-year and 15-12 months repaired speed funds averaged 0.52 fee circumstances. Consumers often re-finance toward reduced identity factors when the financial price difference in the newest lengthened and you will less-term factors was huge. Including, in the first quarter out of 2014, the essential difference between the 30-season and fifteen-season mortgage products is 0.96 percentage factors-causing over 37% away from individuals reducing their loan identity. With regards to unit distribution, more 98% off refinancing consumers picked a fixed-speed loan. Fixed-speed money had been popular in spite of how the first loan device had been.

Leave a Reply