Provided Borrowing from the bank from the 401K? Accomplish that instead

Both the fresh unexpected happen. If you’re wanting instant investment, many mans earliest thoughts are of using their 401Ks to help you obtain money. That money is merely sitting there, right? Surely it assists. Completely wrong. Even though the effect in order to use out of your 401K is reasonable, it will incorporate an array of bad outcomes. This type of cons tend to somewhat provide more benefits than advantages when borrowing up against your 401k. Instead, gain benefit from the collateral you have and make use of your fine jewelry otherwise luxury observe locate a jewelry-supported loan out-of Diamond Banc.

Because 2008 housing drama, progressively more Americans was looking at its 401Ks as that loan origin. Domestic security financing are no longer an option for we and private funds are difficult otherwise impractical to get. This leaving many people who require money to have a crisis that have couples choices. But not, with your 401k so you can borrow funds will be undoubtedly prevented.

step one. It will place your own next back in retirement needs

. An estimated twenty-two% of Us citizens just have $5,000 spared due to their senior years. Folks are currently loan places Central not as much as-protecting to possess later years. Credit up against your own 401K just compounds this problem. A good 401K retirement finance allows the attention from the discounts to material over time. On a basic, that is mostly the point of good 401k. By taking the money out for a loan, so it effortlessly prevents the material attract out-of accruing.

dos. With your 401K to borrow cash may cause your bank account so you’re able to clean out value

Because you repay the loan you will be re-purchasing the offers you in earlier times sold, usually at the a high rate. For example you dump the majority of the equity you’ve got achieved on your own membership.

step three. Look at the fees that accompany borrowing out of your 401k

Even if you was merely credit regarding yourself you can find charges of this obtaining financing, constantly a control percentage you to definitely would go to brand new officer.

4. Using your 401k so you can borrow funds can indicate you will have faster discounts in the long run

According to the 401K plan, you’ll be able to eliminate the capability to sign up for new fund if you are you have got a great mortgage facing it. Specific fund can take many years to pay back, meaning that years of zero contributions from you or perhaps the suits contribution from your boss. As ideal routine getting old-age profile is generally to keep as much as you could as quickly as possible, given the role away from compounding desire, this may enjoys a beneficial snowball effect on your general deals. Effectively cutting your coupons off exponentially after you reach the age regarding old-age.

5. Borrowing from the bank from your 401k can indicate all the way down earnings when you require money very

Very 401K loan installment arrangements want that payments to the loan feel subtracted instantly out of your salary, which means that your bring-family spend commonly disappear. In addition to the fee actually income tax deferred, you will be taxed in it. It indicates you can owe more than requested by the point taxation already been due.

six. Taxes Fees Taxation.

You are taxed on the same money twice. You are settling the loan that have money which had been taxed assuming you withdraw from your 401K through your retirement you can easily be taxed involved once more.

seven. Borrowing from the bank from your 401K can indicate lower levels away from defense

For many who prevent or was discharged away from you employment, you need to pay back the borrowed funds within this sixty so you’re able to ninety days, based your bundle. When you find yourself unable to pay the financing straight back for the installment period, then your Internal revenue service takes into account the loan a distribution. The amount you owe has grown to become confronted with taxation, also an effective ten% punishment when you’re 59.five years old or young.

Rating an accessories-recognized loan in lieu of borrowing from the 401K.

Usually do not slide victim into pitfall regarding credit out of your 401K whenever there are top choice. Making use of your accessories while the guarantee to help you borrow cash is a wonderful solution to keep the 401K intact, borrow cash in the place of negatively affecting your credit history, and have money quickly.

Diamond Banc focuses primarily on bringing financing to prospects who have great expensive jewelry and you will engagement groups, high-stop luxury observe and you will precious jewelry of better designers for example Cartier, Bulgari, Tiffany & Co. and more. These items can be used just like the guarantee in order to hold the mortgage. The borrowed funds amount relies on new liquid general market value of your own goods. Because mortgage is actually installment, the thing is actually kept in all of our safer vault. Once you’ve paid back the borrowed funds, we’re going to get back the thing for your requirements. For folks who default towards the loan, we contain the product and sell it to recuperate the total amount you borrowed.

Diamond Banc’s book mortgage procedure

As amount borrowed depends on new h2o property value the object are sworn, we do not run any credit monitors, a job verification otherwise wanted a repayment guarantee. I including dont report the loan in order to a card bureau; this does not apply at your credit score, even though you default toward mortgage.

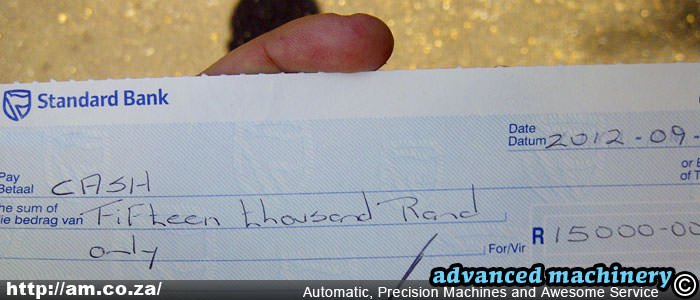

The borrowed funds process with Diamond Banc is fast and simple. We can normally have fund on the account in as little since the two days. Just fill out a zero exposure, no responsibility financing quotation setting into all of our website. Within 24 hours out-of choosing your own submission we’ll send you all of our initial offer. While the very first give is actually decideded upon, we shall give you a shipment name and recommendations, you can also bring it with the venue nearby you. As soon as we discovered your own plan we shall make certain their items. After you deal with the latest render and you can terminology, we’re going to cable transfer loans to your account otherwise mail your an excellent evaluate instantaneously.

Look at the Diamond Banc website for more information and fill in a online forms. Or, go to one of the towns here.

Leave a Reply