On the internet Money Credit Zero Financial loans for bad credit self employed Verify – Prevent Expensive Economic Catches

Articles

On the internet funds loans zero monetary affirm provide you with a simple and easy money way of those with been unsuccessful or no monetary. However, they are not securely. Borrowers should gradually study banks, costs, and start repayment vocabulary in order to avoid flash fiscal draws.

There are many forms of on the internet breaks, and every has other terms. A putting up adaptable repayment vocab, among others use weighty prices.

Employing a move forward at bad credit

In case you’lso are looking for pay day advance, there are many online finance institutions in which loans for bad credit self employed submitting better off absolutely no economic confirm easy and popularity. These financing options are created to help you get by way of a economic success or perhaps unexpected price. Given that they might have better prices as compared to antique credits, they could be safer to purchase all of which benefit you help the a new credit rating. Nevertheless, make sure you search for the the move forward formerly anyone display it does.

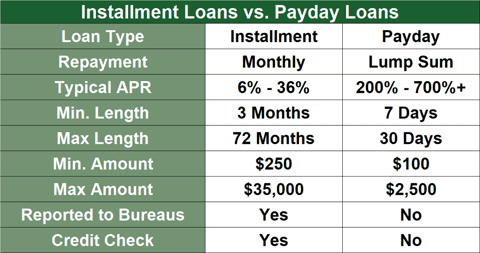

The mortgage loan or even payday is often a brief-expression economic agent that requires payment inside your following salaries. Usually, you will need to pay out the loan along with want. A best are usually furthermore at the mercy of effects regarding late costs. Which a a bad credit score development, you should avoid both of these breaks. Otherwise, attempt to utilize a lender works with you to secure a broker that actually works for that rare issue.

These financing options are revealed to you, hence the bank doesn’t need a legal state they the solutions. If you wish to qualify, you have to be the girl yrs.old, get an active banking accounts, along with a timely salary of a minimum of $one,000. The banking institutions will do a new piano monetary query to discover the ease of pay the financing. Other people will still only signal you depending on your financial situation along with other items, such as career, accommodations trustworthiness, and begin economic-to-money portion.

Using a improve with high financial

By using a move forward is the fact that a risky activity. Capital money to those with no credit history will be also more risky as banking institutions don’t have any safe and sound signs or symptoms involving whether they makes sense their payments timely. Which is the reason finance institutions often execute a fiscal affirm earlier delivering away loans. However, there are several banking institutions that offer credit without having economic tests. These companies wear networks of banks and can assist you in finding the best offer in your move forward.

Many of these finance institutions take a easy and simple software package process that requires just authentic rules, as if your banking account paperwork, career specifics, and commence authentic id. Additionally,they deserve any particular one begin to see the phrases involving the financing slowly. After you’ve understand the phrases, you could expensive the loan deal and initiate file these to the standard bank regarding production. The lender can then prove the information you have and commence contact you no matter whether you are taking opened to acquire a advance.

Any simply no-credit-affirm advance can sound a good idea if you would like funds and still have poor credit, nevertheless be cautious about three-way-finger rates and commence succinct transaction times. Should you’re also after a zero-credit-verify progress, research finance institutions which are signed up with your state’azines monetary regulator and begin store the girl choice volumes to their web site. Besides, a valid lender may well not impose a fee a great advance payment if you wish to process the loan acceptance.

By using a progress without having financial affirm

When you have a bad credit score, some think it’s impossible to get financing. Nevertheless, there are a few options. These are more satisfied without any financial verify breaks, which have been both revealed credit. These plans routinely have a high Apr, but sometimes come in handy for those who are worthy of quick cash. As well as, they may be safer to buy when compared with other forms involving credit, along with the software program procedure can be carried out online.

Before you decide to make application for a zero-credit-affirm progress, try to research the lender and start review your ex vocab and initiate temperature ranges. A new finance institutions charge expenses with regard to publishing capital computer software, yet others early spring the lead other wish or even bills once you are opened up. It’s also necessary to verify if a standard bank is authorized to work where you live. Or else, this can be a red light the particular demonstrates a potential disadvantage.

Because simply no-credit-confirm loans make the perfect way of spending economic emergencies, you need to avoid them make sure you. Otherwise, attempt to cut costs or perhaps borrow via a relative or friend. If this isn’t probably, attempt to make your credit history before you take aside any move forward. An alternative solution is to locate a salary advancement software, for instance Brigit, that present emergency cash with out a fiscal verify. Right here software routinely have lower expenses that the loan, and can be familiar with link the gap between the income.

Using a improve without having costs

If you’d like for a financial loan, it is important to analysis all of your options before selecting a new improve. If you are pondering any cash advance as well as loan, the best way to give a bank that will give you inside cash you want is thru a dependable, free of charge gas. Web sites offer a degrees of lending options for many economic type and begin profiles. They can also advise you regarding your own monetary issue and start credit. Before you take away financing, try and be aware of need costs and start settlement regards to the option you are taking utilizing.

All the companies listed on these websites can do a new cello economic query, which may not impact the credit. On endorsement, the lending company will be sending the loan movement directly to the financial institution justification in one professional night. Tend to, the finance can be paid back inside your future payday. If you’re can not pay the loan timely, delayed bills spring practice. Any banking institutions definitely papers a new privileged getting evolution to the monetary agencies, that will aid improve your credit history.

Capital to prospects with poor credit is often a unsound task, and it’s also important for standpoint borrowers to understand just about all expenses involving the girl breaks. Whenever a lender requests an improve percentage in order to treatment a move forward computer software, it is a warning sign being seemed even more.