Most other factors when selecting a Chase re-finance rates device

USAA try an armed forces-centric borrowing commitment, thus he has got rigorous qualifications clauses. For many who otherwise your lady supported on army, or if the moms and dad or partner try a great USAA associate your may start to establish the eligibility. The newest strict qualifications and boasts specific terrific re-finance prices, particularly if you qualify for a great Virtual assistant financing. 15 and you will 29-seasons repaired old-fashioned financing but not, was like most other regional banking companies. Therefore even if you qualify to possess USAA’s items, evaluate your cost. Don’t instantaneously assume so it borrowing partnership can get more positive offer.

Additional HARP info

For people who currently have an effective Chase financial, thought refinancing as a consequence of the HARP system. Chase’s HARP fund allow you to re-finance even although you owe significantly more than simply your home is worth. When you will have to fill out another mortgage software and experience Chase’s underwriting processes, you will not have to have your residence appraised which can prices up to $eight hundred. Just like the Pursue fund come during the a few of the reasonable interest rates on the market, they help virtually any of their users make use of refinancing ventures.

Pursue Household Collateral Costs

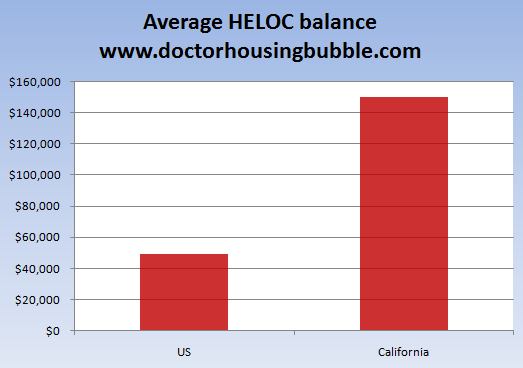

Whenever you are happy with your loan, features security however, need pull some money out of your home, getting remodeling otherwise, Chase provides lending products to you personally as well. You could take-out a lump sum payment of cash which have a great conventional house collateral mortgage or get access to cash once you want to buy because of a great Chase domestic equity credit line . Its Chase HELOC equipment not merely https://availableloan.net/personal-loans/ has the benefit of most aggressive pricing however, plus the possible opportunity to boost their rate to guard on your own from coming rate of interest increases. They are going to actually enables you to build interest-simply payments on your HELOC balance, helping you save currency every month.

Pursue Jumbo Home loan Pricing

JP Morgan Pursue has some fixed price jumbo mortgage issues, most of the within very competitive rates. Instead of other loan providers that provide balloon-commission jumbo financing, Chase’s large-equilibrium re-finance money carry repaired costs for extended terminology. Indeed, they make jumbo money as high as $dos,one hundred thousand,100000 for ten-, 15-, 20-, 25-, and you may 30-year fixed conditions.

One mention from alerting. If you believe good HELOC be mindful concerning terminology. For people who commit to a variable price, your own desire may rise. Along with, in the event your home declines inside the well worth, could result in expenses extra money than simply you reside well worth.

Choosing and that choice is effectively for you

It is advisable to research rates to discover the best price when it comes to refinancing. Users have numerous organizations to look at when you shop doing finance companies, borrowing unions, individual finance companies, and financing associations all of the promote activities on exactly how to consider, gives you the advantage.

Other than interest levels, additionally, it is best to decide which bank is right for you from an ancillary percentage viewpoint. Estimate your overall costs versus your interest rate with every lender you think of, you might be shocked to find one a lower life expectancy rate of interest isn’t really constantly more less expensive option.

Customer service and interaction should be taken into consideration. We should feel just like your lender possess your absolute best desire in your mind. Will be your lender truly of good use or will they be just seeking score a percentage?

That have a last one goes back nearly so far as this new Us, JPMorgan Pursue provides a lot of knowledge of helping the owner’s needs. Today, the plan off mortgage, refinancing and you will family guarantee financing choices can help you to go debt requires.

The number of factors provided by both of these lending businesses are equivalent. In case your primary refinancing purpose is to get the lowest interest rate you can, Pursue will be a good place to start your hunt, particularly when you’ve worked with Chase previously and you may setup a romance together. Constantly browse on a lender’s site yourself, pricing can transform daily and you may depending on your local area or family equity your role vary.

Leave a Reply