Latest Mortgage and you may Refinance Rates during the Utah

Holly Johnson try a self-employed contributor in order to Newsweek’s private loans people with a watch handmade cards and advantages, financial products and you can travel. Johnson have invested more ten years level economic and you may travel information and resides in Indiana along with her partner and two students.

Mariah is actually a freelance contributor to help you Newsweek’s personal loans group. Just after putting by herself through college or university, age looking playing with private money to achieve monetary liberty-if this means settling personal debt or using mastercard things when deciding to take a dream travel. This woman is composed and you may edited numerous content concerning the procedure and you can feels warmly on providing almost every other millennial and Gen Z women live their finest life.

Their work could have been searched regarding Ny Times, Brand new Now Let you know, The brand new Wall Street Record, Business Insider and more most readily useful media sites.

Utah is one of the top ten fastest-growing claims in the united kingdom, according to 2023 Census data. If you’re www.cashadvancecompass.com/payday-loans-al/hamilton looking to acquire or refinance a property, you can ponder how that it progress affects latest financial costs during the Utah.

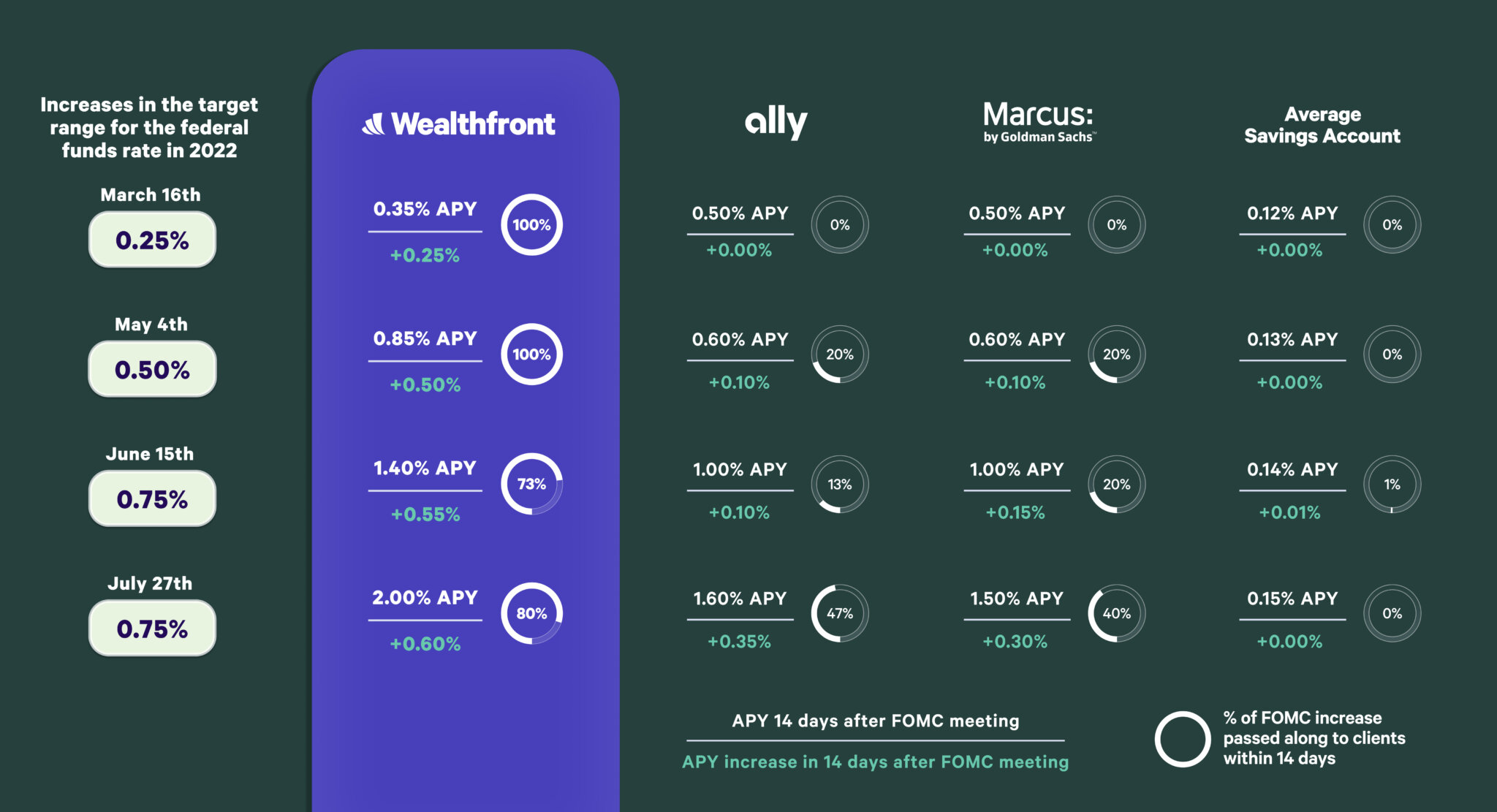

Loan providers try able to put her home loan prices, as well as are normally taken for every now and then and you will state to state. Whenever form the eye costs, lenders account for numerous situations like the Federal Set aside cost, most recent monetary styles, the local housing industry and you may borrower certification.

Our very own studies are made to present an extensive knowledge regarding personal funds services and products you to definitely work best with your circumstances. To help you in the choice-to make procedure, our specialist contributors contrast popular choice and you will possible aches circumstances, eg value, usage of, and you will dependability.

Most recent Rates of interest into the Utah

According to Zillow studies, the common financial rates to possess a 30-season fixed-rates loan when you look at the Utah are 6.55%. Which is in the towards par to the federal average home loan price, that’s 6.68%.

Having one another home values and you will rates inside the Utah skyrocketing once the the newest COVID-19 pandemic, homes affordability are a premier question to own owners. New average domestic speed is continuing to grow more 60% given that 2019, predicated on Redfin investigation-regarding $339K during the .

These fashion, regardless of if unfortunate, are not novel in order to Utah; of a lot metropolises all over the country is wrestling that have soaring financial costs and family cost. Still, houses locations during the Utah are extremely productive. Redfin plus unearthed that, by , more than 25% out of belongings in the industry ended up selling over the list rates-facts one to, despite issues about pricing, people are energetic. Brand new places for the fastest-expanding home values for the Utah include Hurricane, Western Retreat and North Ogden.

Re-finance Rates during the Utah

In a nutshell, mortgage refinancing mode substitution that financial with an alternative. Refinancing mortgage is sensible whenever rates of interest possess diminished as you got your home loan; securing a lowered speed can frequently mean a reduced percentage. You’ll be able to have fun with refinancing to switch others regards to the financial, particularly changing from an excellent fifteen-12 months fixed to help you a thirty-12 months fixed otherwise going of an adjustable speed so you can a predetermined rate-which may equivalent less month-to-month mortgage repayment.

Refinance cost in Utah are very different from the bank and you will financing particular but generally speaking stick to the exact same fashion just like the antique financial cost: Cost have skyrocketed since the 2022, however, they have been dropping very somewhat lately. According to Zillow studies, the present day mediocre 29-season repaired refinance price during the Utah was 6.65%, lower than brand new national mediocre off seven.87%.

Vault’s Opinion: Utah Financial Rates Fashion within the 2024

Utah’s growth will not seem to be slowing down. To greatly help treat the fresh new construction shortage, Utah Governor Spencer Cox enjoys pledged to construct thirty five,000 sensible beginner property by the 2028. This increase off average house rates directory might possibly be helpful to owners struggling to qualify for most recent home loan costs inside the Utah.

Leave a Reply