Knowledge mortgages immediately after advancing years: Heres what you should see

You.S. Lender Real estate loan Officers Susan Brown and you will Melany Hannibal share its suggestions to let since you imagine a mortgage shortly after old age.

Old age will provide you with the latest freedom to change your life, together with moving to your perfect family. But how do you help make your specifications reality if you want to move and don’t have enough security or coupons to pay for the price of a different household?

Perhaps you will be an empty nester and require to downsize to a beneficial reduced place. Perchance you must disperse nearer to nearest and dearest, loved ones or even yet another city when planning on taking advantage of specific amenities-believe beach area, mountain cabin or a good swanky loft apartment on your favourite downtown metropolis.

Or perhaps you are seeking downsize, utilizing the guarantee in your home to purchase a smaller property and save yourself the surplus money to other expenditures when you look at the advancing years. This is basically the prime possible opportunity to move from a-two-facts where you can find a-one-height ranch. Here are a few points to consider just before obtaining a home loan once retirement.

Start with the basic principles: How come home financing just after senior years functions?

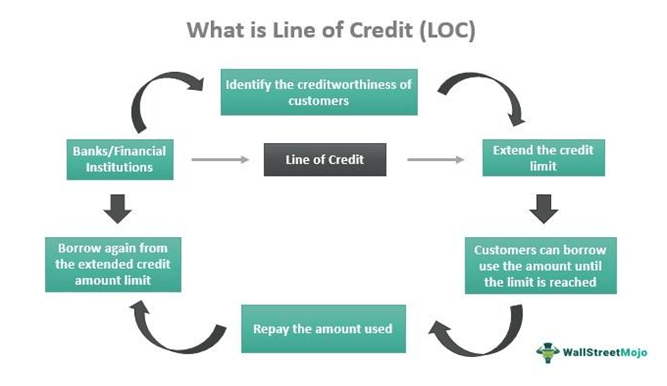

You can easily observe mortgages just after old age are like any other house loans; it is a type of loan that is taken out by the a good retiree to get a home or any other a house. The mortgage is typically secured of the assets being bought, meaning that if the mortgage isnt paid down, the lending company takes fingers of the home. The newest terms of the loan differ according to bank, however, typically the mortgage is actually paid off during a period of many years and requirements normal repayments.

Decide if this is much of your household

Because the a resigned person, you likely have more autonomy to reside no matter where you want. not, there are factors to remember whenever deciding in the event that might alive within property regular loan places Breckenridge otherwise in your free time. Such, you’re browsing buy a beach condominium to leave cold winters and you may return to much of your home to purchase summer seasons together with your grandchildren.

After you get a mortgage, the type of property top family, second household otherwise money spent you happen to be resource often impact the rate of interest providing, says Susan Brownish, You.S. Mortgage Maker NMLS 222940. Usually, rates of interest try lower to have no. 1 home occupancy models and certainly will render coupons with the lifetime of the borrowed funds.

Together with, your own occupancy designation influences this new deposit conditions, that have a first residence requiring a reduced advance payment demands than just a moment domestic otherwise money spent.

Look at your credit score

Brown states maintaining a leading credit rating is also more critical up on retirement because you probably have smaller constant money than whenever you had been doing work full-time. The higher your score, the greater number of optimal the interest rate providing was.

When trying to get an interest rate, the financial institution commonly comment your credit rating and borrowing from the bank character so you’re able to know if financial funding would be approved. Because this is a button reason for your capability are recognized, you ought to display your borrowing from the bank character when preparing to own making an application for mortgage pre-acceptance.

There are many different an approach to increase rating, letting you have the best resource terms available. You need to keep in touch with a mortgage loan mentor to assess your own borrowing from the bank reputation. If you’d like to become knowledgeable ahead of talking to a beneficial top-notch, new You.S. Regulators brings info to help you customers such as this device.

Think about your money and you can obligations-to-income ratio

Melany Hannibal, U.S. Bank Real estate loan and you will Money Financial Banker, NMLS 502019 states lenders want to be sure you’ve got money to reside past merely paying the financial. The debt-to-income ratio (DTI) is the percentage of their monthly income one to goes toward spending your financial situation.

To determine just how much you really can afford, the lending company often consider your income, personal debt and expenditures, level of discounts readily available and you may credit character. Really loan providers inquire about proof of income over the past two many years, as well as retirement and you may Personal Defense money together with one investment returns otherwise acquired appeal.

Just be able to pay for things like resources, an auto payment, energy, market, dresses and you can recreation, Hannibal said. Maximum personal debt-to-income proportion to have loan apps try 50% of full earnings received. This consists of borrowing from the bank, mortgage payments, taxation, insurance and homeowner relationship (HOA) dues.

The amount of money when considering your debt stream assists a loan provider determine how far you can obtain. The financial institution analysis the fresh financial profile, like the DTI, of your own borrower to decide if they do the fresh new costs and you may pay the loan.

On the other hand, to order property that meets comfortably to your budget might help make certain way of living here and you can maintaining our home is sustainable no matter exactly what life throws the right path. If you are curious about what you could afford before you fulfill with an expert, it product makes it possible to imagine a rough amount.

What other items should i thought using my lender?

Are resigned, you really have money present your lender have a tendency to believe such as since the societal shelter, pension, later years withdrawals, investment income, annuity, spousal positives and your assets whenever deciding whether your qualifications to possess a mortgage.

Each borrower’s income and you may personal debt has an effect on its to shop for stamina and you may eligibility, Hannibal said. Together with, the financing score of every person can change the pace the couple gets. Their home loan elite group can assist support getting an effective preapproval to possess an effective loan before you start considering belongings with a representative and you can planning the desired savings and money reserves.

Just why is it crucial that you score a preapproval just before interviewing a realtor?

It helps you have got realistic hopes of what you could manage, Hannibal told you. I would recommend making an application for a preapproval 3 months sooner than we should pick. Borrowing from the bank is made for 120 weeks if you remove a beneficial report fundamentally, it will expire.

Just what options create I have if I’m not able to rating an excellent old-fashioned mortgage loan?

Of many borrowers usually takes aside an excellent margin mortgage on their assets, Brownish told you. If this is things you’re interested in exploring, you can examine along with your monetary coach and you can home mortgage pro for the current cost and your capability to borrow.

If retirement within the yet another household awaits, get in touch with a mortgage officer near you to aid make it.

Leave a Reply