Is others use your income to help you be eligible for home financing?

The newest quick answer to your question is that somebody more usually do not make use of earnings to enable them to qualify for home financing. There are many suggests, although not, that you may have the ability to assist them to get approved for the mortgage, and this i outline below.

After you get a home loan, lenders require you to be sure the a career and you may money with data including spend stubs, W-2s and you will tax statements. The newest documents need to be on the term with the financial so you’re able to are the money on your loan application.

This means that, unless you secure the cash then you definitely usually do not play with they so you’re able to be eligible for a mortgage not as much as extremely issues. Even in the event your revenue are placed towards the same family savings because person who can be applied into the home loan, the lending company will not consider the earnings when the person applies into the financing.

Loan providers want to use long lasting, steady income to determine the financial your be eligible for which makes counting on someone else’s income is not possible. You’ve got the means to access one money now however, points may changes and not need those funds for the the long run.

Now that you appreciate this someone else usually do not use your money when they apply for home financing we would also like to review methods for you to assist them to become approved.

When you need to use your earnings to simply help somebody qualify having a home loan then you can end up being an effective co-borrower to the financing. Contained in this condition you’re on the loan as well as your money and you will monthly obligations payments are part of the application.

If you have an effective money and relatively reduced financial obligation costs, are good co-borrower is allow you plus the other applicant so you can be eligible for a higher home loan amount.

The fresh new downside to getting a good co-borrower for the someone else’s mortgage is the fact that the payment is actually found in the debt-to-income proportion once you submit an application for financing later on.

At exactly the same time, while toward mortgage, in the event that things negative goes including an overlooked payment, standard otherwise foreclosures, your credit score are adversely influenced. Basically, you need to understand the responsibility and you can connection working in becoming a good co-borrower.

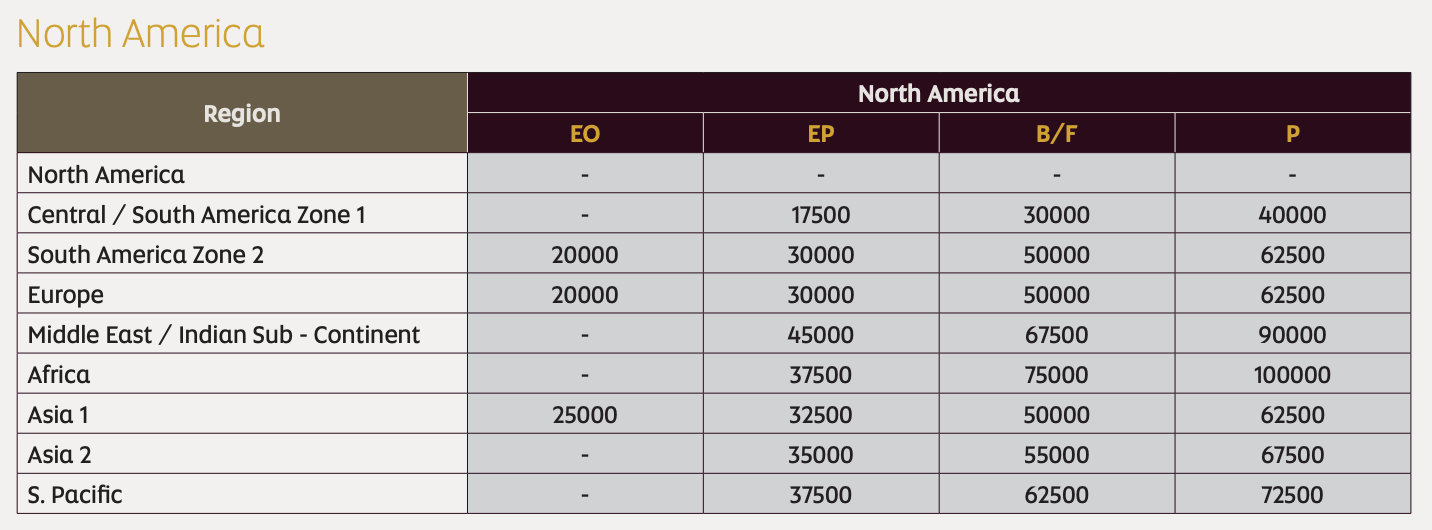

The brand new table less than reveals home loan cost and you will charges for best loan providers towards you. We recommend that you shop numerous lenders to ensure their degree conditions in order to find the best mortgage conditions.

This may allow more difficult on how best to access borrowing from the bank otherwise be eligible for the financial

If you intend to live on on their behalf trying to get the fresh mortgage he then or she and use you due to the fact a low-debtor house representative. Contained in this situation, you are not a great co-borrower on the financial your income is used once the a good help factor to greatly help them be considered.

Please be aware that bank also assesses your credit rating and you can a career records when they comment the mortgage software

Instance, if the an applicant is actually borderline when it comes to being qualified to have a specific mortgage number https://paydayloansconnecticut.com/trumbull-center, after that earnings out-of a non-borrower household is going to be a positive foundation. Instead of are a great co-borrower, your earnings is not set in the latest applicant’s money nonetheless it can invariably offer a helpful nudge.

Great things about this method include not including the fresh new monthly mortgage payment on your own debt-to-earnings ratio, making it easier for the so you can qualify for home financing in the future. Including, the borrowing from the bank is not opened when the things happens to the mortgage.

The brand new bad of being a low-debtor household user is the fact that candidate likely qualifies getting an effective less mortgage matter than he or she would when you’re a good co-debtor. The brand new candidate must be eligible for brand new HomeReady Program and the borrowed funds on their own once the a best debtor, which is another important idea.

One other way you could potentially help somebody qualify for a home loan are to include a down-payment provide. In such a case, the present will get enable the person to afford to pick an effective costly property or meet up with the minimum down payment requirements.

Making at the very least a 20% down-payment makes you be eligible for brand new lender’s greatest financial terms while stop using personal home loan insurance policies (PMI). These two reduce your monthly payment and you can probably improve the mortgage you really can afford.

Take note that in the event that you render somebody a down-payment current, it ought to it is be a present and never that loan that must be reduced. Additionally, loan providers implement particular advice to have down-payment gifts and you’re usually expected to render a letter one lines the reason out of financing towards provide. In a few however most of the cases lenders in addition to consult financial data on current provider.

In closing, even if someone else don’t use your earnings when they get a mortgage, you’ll find several methods help them qualify for the newest loan. Definitely understand the positives and negatives of each and every alternative being get the approach that is correct to have you.

Leave a Reply