Is actually Rocket Financial Prices Below the group?

From that point, additionally be able to protected your own financial price therefore its secured. Upcoming simply done a great accomplish list because of the a particular time and you will certainly be all set.

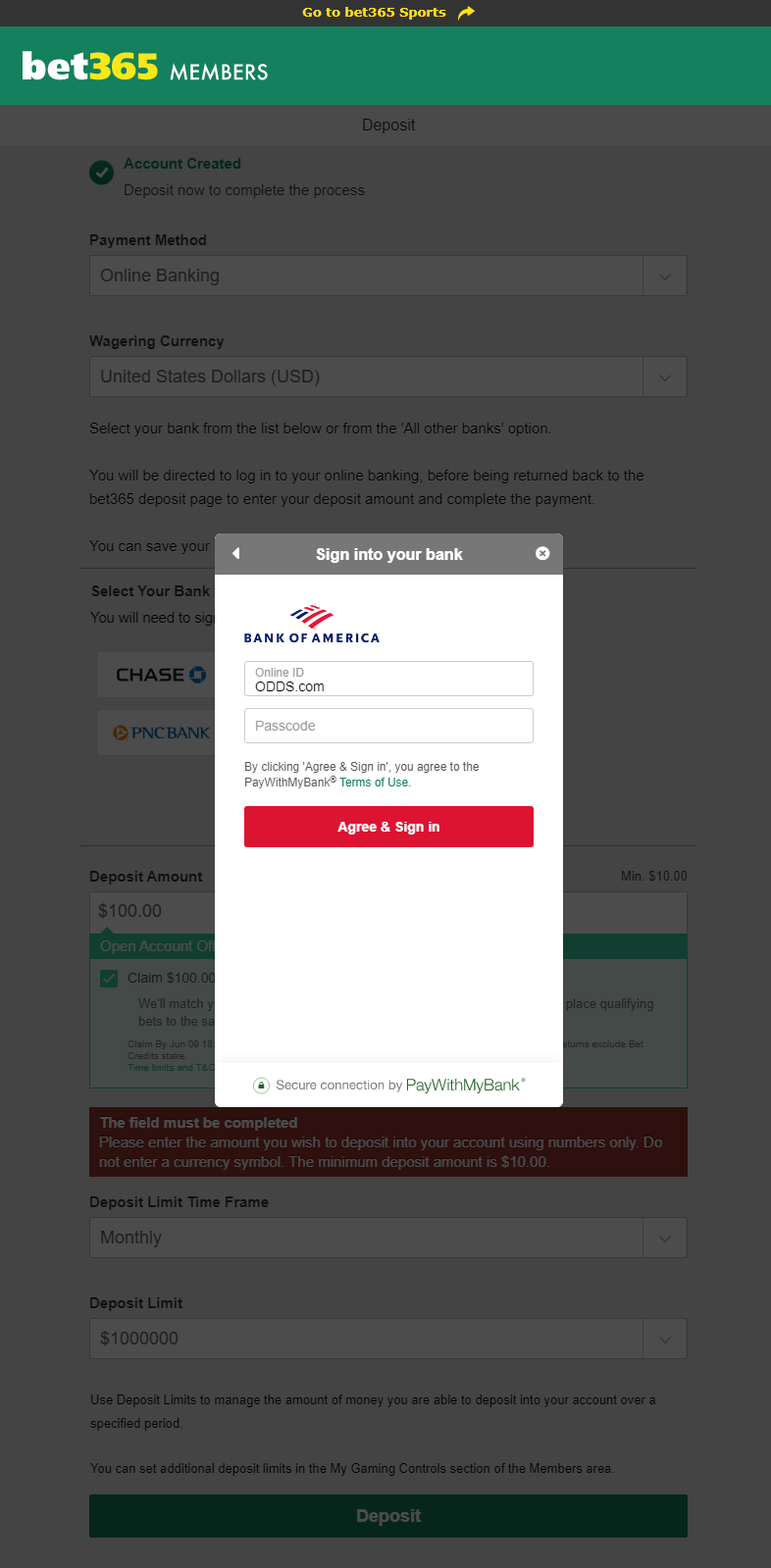

Rocket Home loan also allows you to transfer investment, money, and you can possessions advice on line due to numerous couples and you may databases about nation.

It sounds similar to Turbo Taxation where you are able to sign in to certain levels and also have the advice imported in to the borrowed funds application.

This would slow down the fears out of incomplete records and lost pages very often need to be re also-delivered more often than once.

You will be able to consider your entire loan details and you will documents on the internet otherwise in your smart phone to monitor how you’re progressing.

Financing Software Offered by Skyrocket Home loan

Including family get financing, re-finance money, and also property collateral loan. If you are a current owner, their money-out refinance also allows you to faucet their security.

If you are a prospective home customer, they will have antique and you will authorities mortgage available options, plus FHA money and you will Va finance.

Affordable Real estate Solutions

Into the , Skyrocket Mortgage launched Pick Plus, that provides as much as $7,five-hundred inside financial loans getting basic-day home buyers during the underserved groups.

It is in specific census tracts in the pursuing the half dozen metros Atlanta, Baltimore, Chi town, Detroit, Memphis and you may Philadelphia, and no conditions centered on city average earnings.

The credit includes a good $5,000 feet and additionally an extra financial borrowing around 1% of your own house’s price (up to $2,500).

Skyrocket offers the fresh new Detroit Financial+ giving a great $2,500 lender credit in the event you get a good prick and Highland Playground was excluded).

The BorrowS comes in 10 urban area areas, and Atlanta, Chi town, Detroit, Este Paso, Houston, McAllen, Memphis, Miami, Philadelphia, and you will St. Louis.

Buyers’ income ought not to surpass 140% of your own city median income (AMI) in addition they must satisfy any Freddie Mac computer underwriting guidelines.

Within the , it introduced One to+, which is a 1% advance payment program where team provides dos% thru a grant. It is a normal financing supported by Fannie mae.

People who have fun with a skyrocket Home partner broker to shop for a home is discover step one.5% financial borrowing from the bank while using Rocket Mortgage.

Alternatively, you can generate a 0.75% borrowing when known by the individual representative, or when doing a verified Acceptance otherwise an excellent RateShield letter.

While you are promoting a house, you can earn a 1% rebate of the conversion process speed while using the a rocket Home network agent. This is exactly also known as Promote+.

- Their home loan cost be seemingly just like almost every other high merchandising banking companies

- However might be using much more to have a brandname

- Less, lesser-identified loan providers can offer down pricing

- So take time to compare cost one of opposition

An effective concern. I’m not sure for sure, and it will surely always differ, so make sure you make sure to examine prices. The way to understand is to check around and you loans in Gulf Breeze may compare Quicken Money mortgage rates to people of other banking institutions and lenders.

We searched up Skyrocket home loan cost the other day and you can noticed these were giving a rate out of step three.875% to the a thirty-12 months repaired while Bank out of America got a said speed away from 4%.

So that they you will beat out of the almost every other big merchandising banking companies a little. However reduced direct mortgage brokers was basically giving costs once the low due to the fact step three.75% on a single go out. This means that, it is possible you could spend alot more towards brand.

So financial prices could well be high to compensate as opposed to a smaller sized financial that does not promote and enjoys over costs awesome reduced.

Leave a Reply