In the first year immediately after closure, a debtor cannot availability more 60 percent of available loan continues

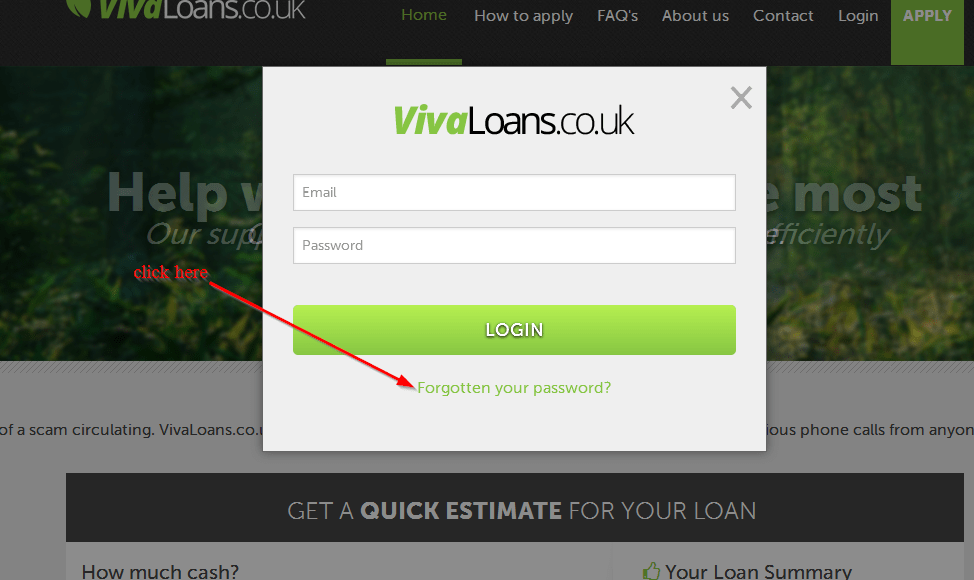

Q: Preciselywhat are My personal Fee Plan Options? A: You could love to have the funds from a face-to-face mortgage in one go given that a lump sum payment, repaired monthly premiums often having an appartment term or because the enough time as you live-in the house, as a line of credit, otherwise a variety of these types of. To find out more, click on this link.

Number of Continues

Q: How much cash Should i Get? A: The degree of funds youre eligible to receive hinges on your age (or the ages of the fresh youngest partner if there is a great couple), appraised household really worth, interest rates, along with the actual situation of one’s bodies system, the FHA financing restrict, that’s currently $1,149,825. If for example the residence is worth a whole lot more, then your number of finance you will be qualified to receive tend to be in accordance with the $step one,149,825 loan restrict. As a whole, the fresh more mature you are and more vital your property (and shorter you owe on your family), more currency you can purchase.

For the week thirteen, a debtor can access as much otherwise very little of one’s leftover finance when he otherwise she wishes.

You can find exceptions into sixty percent signal. When you have an existing financial, you can even repay it or take an extra ten percent of your offered financing, even if the overall matter made use of exceeds sixty percent.

Access to Continues

Q: How to use the proceeds from a contrary mortgage? A: The fresh proceeds from an other mortgage can be used for one thing, if or not their in order to complement later years income to cover day to day living expenditures, repair or customize your residence (i.age., widening places otherwise setting-up an excellent ramp), buy health care, pay-off established expenses, shelter assets taxation, otherwise prevent foreclosure.

Interest

Q: How does the eye work with an opposite financial? A: That have an other home loan, youre charged attract merely towards continues you will get. Both repaired and you will varying interest levels come. Costs was linked with a directory, for instance the You.S. Lingering Readiness Speed, also an excellent margin you to generally contributes an additional one to three fee facts onto the rates you’re billed. Desire is not paid of the readily available mortgage proceeds, but rather compounds over the longevity of the borrowed funds up to repayment occurs.

Increases Feature

Q: My wisdom is that the empty equilibrium from the HECM Line away from Borrowing Alternative have a growth feature. Does which means that I am generating desire? A: Zero, you aren’t generating desire like you create which have a savings account. Following very first week of HECM mortgage, the main limitation develops monthly afterwards at a rate equal to one-twelfth of mortgage interest essentially during the time, and another-twelfth from month-to-month home loan premium rates. Which progress is highly recommended a much deeper extension regarding borrowing from the bank alternatively than an accrual of interest.

Loan Closing Date

Q: What’s the financing closing date? An effective : The mortgage Closure Go out for everybody HECMs is understood to be this new big date on which your (the new borrower) signal the fresh new mention on the contrary financial. So it time need to arrive, and get identified, due to the fact financing closing go out in Cut-off step 1 for the Page hands down the Means HUD-step 1 Settlement Statement, which you are loans Albertville to located at your mortgage closure.

Correct of Rescission

Q: What’s the Best of Rescission? A: Regulation Z of one’s government Information Inside the Credit Work provides you (this new debtor) with a right from rescission, or straight to cancel the loan, for a few working days once your loan closure. Loan providers is banned regarding charging notice with the financing that are stored in your case in the three day rescission several months. Focus need start to accrue on the day after the disbursement is created. According to Control Z criteria, you should be provided by a duplicate of Observe of just the right out-of Rescission at your closure. It observe informs you of your straight to rescind new package inside around three (3) times of loan closure. The brand new see should be signed and you can old from you to point the fresh new time your received the fresh notice. If you choose to rescind your contract, you must alert the financial in the three (3) days of the loan closing, with regards to the instructions considering in your Notice of your Right of Rescission.

Leave a Reply