In the event the financial receives it find, the original document gets invalid should your title have not currently started used

The state of Alabama requires name loan companies getting registered, which means that he is becoming managed of the county to guard your, an individual, up against things like scam. Which also implies that regarding the unlikely event one thing go wrong, otherwise a lender will not stick to the legislation set forth of the the official, you can take legal action. For example, for people who had a loan out of a loan provider that has been not securely authorized then mortgage could well be sensed emptiness.

Loan providers is actually managed in the same way one to pawnbrokers is, therefore have to be no less than 19 years old to get a subject loan. The state is served by discussed specific, usually predatory practices, and therefore lenders commonly permitted to do, and additionally getting into untrue marketing promoting or charging you when it comes down to form of insurance policies. How much cash you could potentially borrow would-be to new lender’s discernment however, are based no less than partially with the your income together with property value the vehicle youre offering since collateral.

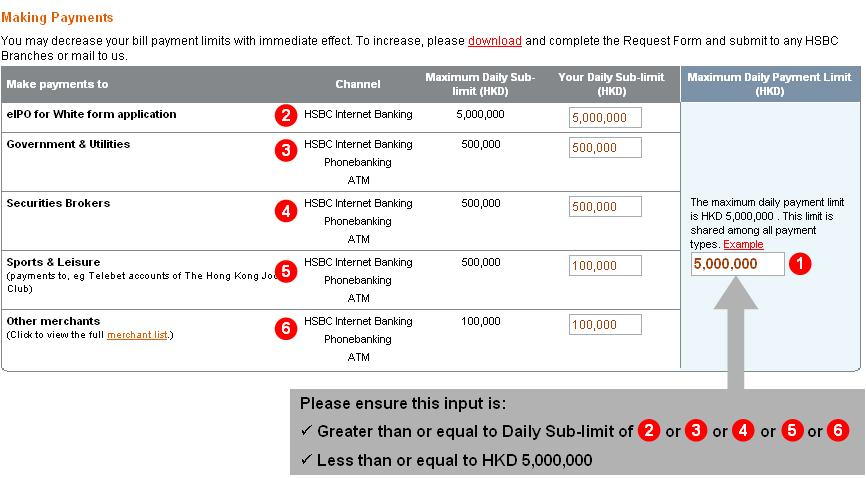

Price Standards

- A precise dysfunction of your auto (create, model, year, etcetera.)

- The label, address, and you will date of birth

- Big date of your loan

- Kind of ID and you can ID matter shown by you

- The malfunction, plus calculate level, sex, and you can battle

- Level of the borrowed funds

- The brand new decideded upon cost go out of one’s mortgage as well as the number due

- The month-to-month rate and charge

Mortgage Process & Cost

Of the or until the concurred repayment date you really need to pay the financial a complete number because decided, and therefore the total amount lent in addition to agreed upon attract. You and your lender get invest in a fee in place of interest, however, that it charges dont meet or exceed twenty five% of your own loan per month. Legally, a lender is not eligible to get any money that surpass the new twenty-five%, so if your loan is for $3,one hundred thousand, the other charges can not be greater than $750 ($3750 overall).

The lender usually takes hands of your title of your own vehicles until the loan are repaid, nevertheless still have full use of the vehicle. The financial institution gets a good lien up against the label of one’s vehicle towards the balance due (amount borrowed and attention/fees) before financing is reduced. Together with, to the time of the mortgage you, while alone, have the straight to get the loan property (your car or truck term). So on arranged fees period you don’t need to to bother with someone else stating their name by paying the fresh harmony of the mortgage otherwise using another arrangement.

Forgotten, Stolen, or Destroyed Contracts

At the time the mortgage agreement is made it should are all the lawfully expected specifications and you will arranged terminology, and get signed because of the both parties. If any time the fresh new agreement document you were offered was lost, missing, otherwise stolen you should quickly allow the financial discover, written down.

Prior to getting the newest title otherwise issuing an alternate document, the lending company will require that create an authored statement from the loss, exhaustion, or theft of one’s citation. Which declaration might be closed from the bank or his personnel, in which he/the woman is eligible to located a charge out-of just about $5 concerning for every forgotten, broken, otherwise taken mortgage document and you can relevant report.

Exactly how You may be Protected against Repossession

Should your mortgage isnt repaid from the conformed repayment day, the lending company shall secure the identity to own an installment loans in Miami MO extra a month. Throughout that 31-big date months, you can even receive their title by paying the new to start with decided rates (level of financing along with attention or costs) and you will an additional fees equal to the first you to.

If the no payment, if any full payment, consists to that big date then you will keeps a supplementary thirty day period to expend the balance and you may receive your term, but you’ll have to pay the attention charges off $750 once again. Making the overall due $4500 ($step three,000 loan + $750 attention fees + $750 fees to have shed this new percentage due date). When you yourself have made money toward the balance before this time, they will certainly be also mirrored on the balance.

In other says, automobile ounts, definition business proceeds are accustomed to cover your debt therefore have earned the surplus. Throughout the condition off Alabama failure to repay a subject financing contained in this thirty day period of your installment day leads to automatic and done forfeiture of auto. You are not permitted any deals continues. It indicates failure to expend the balance of a beneficial $step three,100 loan may cause repossession out-of a car, whether or not it is worth lots more than you to.

Regional Ordinances

All of the laws and regulations and procedures explained here apply to the whole condition out of Alabama. However, private counties otherwise municipalities is also enact ordinances which can be different on the county. Ergo, to have a better idea of most of the legislation of name fund that will apply to your, you can also need certainly to research in the event your condition otherwise local government has one certain statutes. Yet not, no state or municipality may make ordinances which might be more strict than just those people exhibited right here.

Leave a Reply