Immediately after half a year, Varying HELOC Price only

Family Security Financing otherwise Credit line

Regardless if you are planning an aspiration vacation, upgrading the floor otherwise paying for university, you will need a source to fund you to mission. Your property guarantee will be the service for any plans you are considering.

How do you Use your Security to fund Your position?

Equity is the difference in their residence’s most recent really worth along with your financial equilibrium. You can make use of that it value to invest in certain home improvement methods otherwise financing nice sales. In the Inventory Yards Financial, we offer two options to help you use the currency you have invested into the domestic:

- House Guarantee Mortgage: A house security mortgage allows residents so you can borrow money against its security. Since debtor, you will get the cash in one single lump sum and you may repay it when you look at the monthly obligations. They generally feature repaired interest rates and money, carrying out a predictable schedule getting property owners, which you can influence playing with all of payday loans Warrior Alabama our on line funds hand calculators.

- Family Guarantee Line of credit (HELOC): Property collateral personal line of credit acts similarly to a credit card, providing a repeating personal line of credit to use as you wish. Such financing are available owing to various methods, in addition to on the internet import, inspections or an actual cards – commonly available for 10 years. You pay varying notice on the just the loans you use, and when you’ve repaid the financing, the financing feel usable again, causing them to perfect for problems.

Exactly why you Normally Rely on Stock Yards Financial

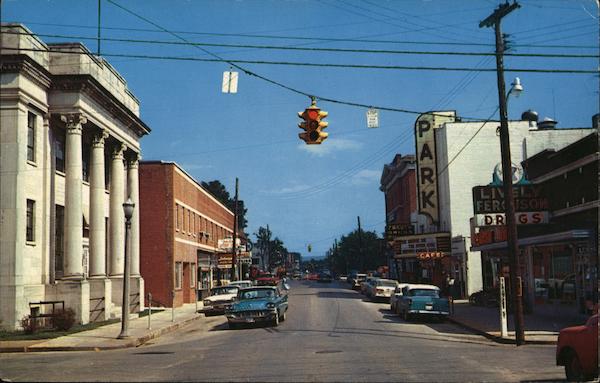

Inventory Meters Lender has been a dependable spouse while the 1904, providing individualized methods to assist residents reach its ambitions. We provide household security lines of credit and you can domestic security fund inside Kentucky, Indiana, and you will Ohio, helping you tap into an invaluable capital too good to pass through up. Our educated mortgage officials allows you to choose which choice is most effective for you courtesy our very own individualized characteristics. With us to your benefit, you can be assured understanding that you’re in a great give. Inventory Meters Lender will allow you to: Make use of flexible cost selection Conveniently supply your account and make repayments courtesy all of our effortless-to-use online program. Work with a devoted selection of positives invested in working out for you on the techniques. Retrieve finance thanks to inspections or transfer these to your bank account having fun with the on the web banking. Take pleasure in a flaccid and you may smooth online application techniques.

Sign up for Your house Guarantee Mortgage otherwise Line of credit Now

Take the pounds regarding their shoulders and you will let your family would the brand new heavy lifting. Having a property equity financing or household guarantee personal line of credit during the Kentucky, Indiana, and Kansas you are able to make use of funds you do not realized you’d. Start the latest quick software techniques online and e mail us having any issues you really have!

*Domestic Security Credit line: Varying Apr (APR) is dependent on The fresh new Wall surface Highway Record Prime Rates (Prime) wrote day-after-day, (8.00% ). Introductory Annual percentage rate (APR) can be found to the Family Collateral Credit line having an 80% loan-to-well worth (LTV) or quicker. Inside 6-month introductory period the Annual percentage rate could well be Finest without step one.00%. If the Best expands or minimizes during this time period the new Annual percentage rate often together with change. Provide is changed otherwise abandoned at any time.

**Pursuing the six-few days Basic Several months, brand new Annual percentage rate will be your recognized variable speed. Your own speed and you will corresponding ount, and Inventory Meters Bank’s credit formula. Speed try variable and certainly will fluctuate based on change on the Primary Price (Index Rate) due to the fact wrote about Wall surface Highway Record. Their Apr doesn’t exceed % in the Kentucky, and won’t exceed % within the Indiana and you can Ohio. The brand new Apr cannot wade less than 4.00% (flooring rate). At the mercy of credit approval to your an inventory Meters Financial & Believe Domestic Equity Personal line of credit on proprietor occupied belongings having a keen 80% otherwise shorter financing-to-really worth proportion. Range number start around $15,000 so you can $250,. Yearly payment out-of $50 might be recharged within first anniversary of the bundle each year thereafter. Early termination fees will get use in the event that credit line try finalized in this three years. Unavailable in order to re-finance present Home Security Financing. Possessions insurance is requisite and, if the applicable, flooding insurance coverage are needed. This financing isnt designed for the purchase out-of an initial house. Almost every other limits get pertain. Consult your tax mentor out-of attract deductibility. A great 1098 might possibly be approved as required by-law.

Warning: You are Leaving The site.

You are about to follow a relationship to [Link] . In order to go ahead, mouse click ‘continue’ below. To stay on this site, mouse click ‘cancel’ less than.

Leave a Reply