How do i Score a mortgage without Credit rating?

A credit score indicating a flawless payment track is vital to get financing of lenders. Good cost song can make a lender convinced of your feature to pay fees promptly. Nevertheless when you are considering bringing a home loan, the necessity of credit score reduces to an extent. Simply because home financing are a guaranteed financing supplied against an equitable home loan of the property you want to purchase. If you default to have 6-eight weeks consecutively, the financial institution is also grab the property and market it in the market to get well the bucks borrowed for you. Very, even if you don’t possess a credit rating, you can aquire home financing away from several banking institutions and you may casing finance companies (HFCs). Check this out blog post next to learn the standards about what your own financial acceptance depends.

Things that Loan providers Envision In advance of Approving a home loan

Whenever you don’t need to a credit history, your property financing qualifications could well be analyzed on the money, many years, and also the property you’re looking to acquire.

Earnings

Earnings is the the very first thing one a lender monitors to evaluate the newest cost possible away from a candidate. A greater income gets individuals significantly more extent to have settling a property financing compared to individuals that have less earnings. New quantum of income will assist choose the mortgage your financial will disburse toward debtor. Although not, the most quantum are subject to the mortgage to help you Really worth (LTV) ratio since lay by bank. Typically, fund upto INR 31 lakh, over INR 30 lakh-75 lakh and you may above INR 75 lakh are paid from the upto 90%, 80% and you will 75% of the home pricing, correspondingly.

Applicant’s Age

The age of this new applicant is even taken into consideration of the bank when you find yourself giving a mortgage or ount. The younger youre significantly more would be the chances of home loan recognition and you may greater loan disbursals compared to the while drawing near to old age. The reason being the job prospects be much more when you are young.

Co-applicants

If your earnings isnt adequate to score a loan amount that is required to shop for a home from the seller, incorporating making co-individuals may help!. New co-applicant can be your immediate family members. However the restriction financing quantum might be limited to the fresh new LTV ratio, which is in the list above.

Work Experience

One another salaried and you may notice-functioning meet the requirements to try to get a home loan. Loan providers would like you to have some many years of really works feel prior to providing a loan.

The kind of Assets You’re looking to order

You can either purchase a below-design property otherwise a ready-to-disperse unit having a home loan. The borrowed funds having a less than-build assets comes in phase, and you will through to the time the building isnt accomplished, the interest appropriate with the period could well be deducted courtesy equated monthly premiums (EMIs). Whereas, the mortgage to possess a ready-to-circulate property comes in you to definitely stack and the EMI applicable because of it is sold with the principal and attention.

The region of the home

It is also one of several tactics you Cortez loans to definitely loan providers imagine prior to approving home financing. In the event your house is situated in a reduced-character urban area, not too many lenders gives you that loan. Very, on the application for the loan becoming accepted without any problem, the house or property might be located in a beneficial area filled with services.

The latest Reputation for the home Designer

It also hinges on the house or property designer that have whom you is transacting. To have a hassle-free home loan disbursal, the house or property developer have to be a respected one to as well as have come authorized by the concerned financial.

What is the Rate of interest into the Home loans Given to Some one without Credit score?

A credit score may not hold much advantages in terms so you can opening home loans, but it is very important so far as rates are involved. The fresh new costs for folks no credit history is highest as compared to ones which have a great CIBIL get , but less than the individuals that have a detrimental get. Even when really lenders try not to disclose the interest rate for these lacking a credit score, discover Financial regarding Baroda (BoB) and Financial out of Asia (BOI) that tell you an identical. BoB brings a home loan to individuals without credit rating within mortgage loan away from seven.10% per year. In addition, BOI has different rates of interest considering its occupation. Salaried consumers get home financing from the 7.00% (women candidates) and seven.05% (almost every other people). Whereas, self-functioning will get the mortgage during the eight.10% (women candidates) and you may 7.15% (other applicants).

What if You a credit score and is A?

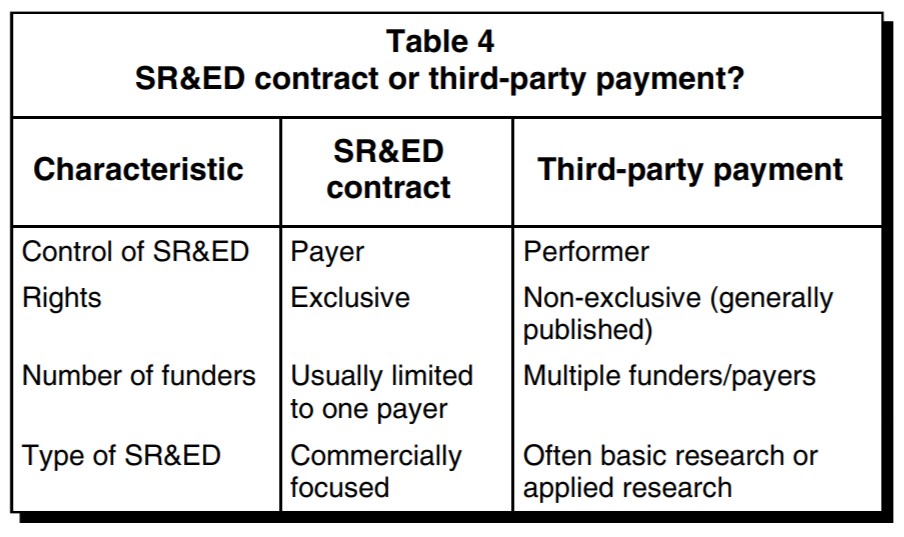

It actually was hinted more than that individuals which have a credit history try compensated that have glamorous rates. Anyone can can comprehend the special rate for all of us with a decent credit history. Let’s check out the dining table less than knowing the same.

Leave a Reply