Home town Heroes Loan Program: Understand how to Wake up to help you a great $twenty-five,100000 Offer inside Orange State, Florida

What if you can acquire as much as $twenty five,100 for your house buy just as an initial responder, firefighter, police officer, or army teams? Really, anybody can! It would assist for those who found particular Hometown Heroes Financing System conditions. Including, your buying household must be for the Lime Condition, Fl.

Of several earliest-date homeowners do not think that they can be eligible for a loan themselves because they do not are able to afford secured for a down-payment or while they possess bad credit away from previous mistakes in daily life such getting into financial obligation or which have an effective bad credit report because of later repayments if you don’t bankruptcy issues. But you’ll find solutions so you’re able to basic-go out homebuyers that have earnings less than 80% AMI that will n’t have become experienced in past times as they think they’d be unable to be eligible for financing to your their.

Hometown Heroes Financing System

Do applying for a usda home loan you know regarding Home town Heroes Financing Program, a program for all those in the military and earliest responders, like cops and you can flames, medics, and even instructors? Good news! This loan system happens to be found in Main Fl.

The newest Home town Heroes Mortgage program is for people in the brand new military and very first responders, like cops and you may flame, medics, and even instructors. The fresh loans are intended to simply help these types of heroes buy belongings from inside the Central Fl.

You don’t need to spend hardly any money back if the app is approved! While it is really not acknowledged, there is no harm done – no credit rating is influenced by implementing.

But what if I am not saying qualified?

Sadly, it is not accessible to group: only those who are certified less than Term 38 can put on (and there are plenty of certificates).

Survivors using within this two years following the death of a life lover otherwise small man because of passing when you’re performing military solution financial obligation

Resigned provider people finding old-age shell out about 50% disability score otherwise similar fee reliant along solution rendered

- Medical professionals

- Nurses

- Teachers

$twenty five,000 to your house get

Brand new Hometown Heroes Basis can give very first responders, pros, and other hero benefits $twenty-five,one hundred thousand to order their houses. Oftentimes, zero downpayment is required. There are even no monthly payments or attention costs requisite into the loans. The actual only real specifications is that you are now living in our home having about 7 years once closure.

The application form functions such as this

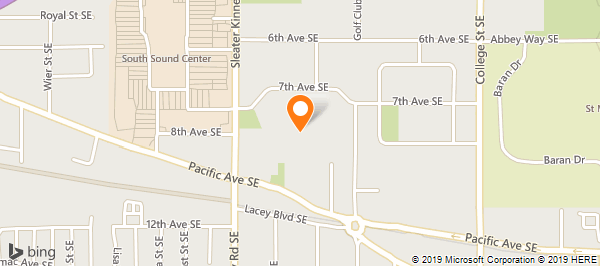

You can pick any house within the Fl that costs lower than the most number put so long as they suits HUD recommendations (see “Home town Heroes Program Requirements” below).

The Home town Heroes Base will provide you with an offer away from right up to $25k toward buying your new house. Guess the loan comes out in order to less than just what Hometown Heroes Base anticipates (it should be according to comparable conversion process analysis from inside 30 miles out of what your location is buying the property). In this case, they’ll increase their bring correctly up until the restriction amount might have been attained.

Thus regardless of if there isn’t sufficient guarantee left-over right after paying out of one liens resistant to the domestic just after to get it (in the event the you’ll find any), they’ll however give us adequate money for us lacking had anything come-out but really!

Genuine rebates

The fresh new Hometown Heroes program isnt financing. It is a primary bucks promotion and you may offers system that you can apply towards your household pick otherwise refinance closing costs.

Hometown Heroes try a national service provider away from a house services having married which have lots and lots of local real estate professionals inside pretty much every county and you can county along side You.S to include beneficial offers with the real estate charge.

Leave a Reply