Gross Profit Margin Formula, Example, and Interpretation

A positive gross profit ratio shows that you’re successfully covering your operating costs and generating a profit. New companies should expect their gross profits to be several percentage points lower than established companies in the same industry. The more important metric is how your company’s gross profit margin changes. You should aim for steady growth in your gross profit margin as your business gradually expands and you establish your customer base. Gross profit measures the amount of profit that a business generates after subtracting the costs of production or rendering services. Understanding gross profit is important for assessing a company’s production efficiency and tracking its growth and profitability.

Real-World Considerations in Gross Profit Percentage Calculations

The two techniques combined work together to improve your gross profit % and $. Gross Profit percentage is a measure of profitability that shows your percentage of earnings AFTER you subtract the cost of “producing” those products or services. However, that percentage is BEFORE you pay for other company costs and taxes. If the cost of producing a product is too high compared to the price customers are willing to pay, the company may not earn enough to cover future expansion. Revenue is the total money your company makes from its products and services before taking any taxes, debt, or other business expenses into account.

Interpreting the Gross Profit Margin

However, always be mindful of the quality of the materials when purchasing them at a cheaper price. Raw material costs can also be decreased by purchasing materials from a supplier that gives a much cheaper rate. Proceeds from the sale of equipment that are no longer used for profit are also considered income. For instance, a shoe manufacturer produced 10,000 shoes in one quarter, and the company paid $10,000 in rent for the building. Under absorption costing, $1 in cost would be assigned to each shoe produced.

Comprehensive Guide to Inventory Accounting

- You can use this information to pinpoint elements of your sales that are going well or to cut ineffective practices.

- For gross profit, he would ignore the administrative costs and salary costs on his company’s income statement.

- If you know what to look for in a company’s financial reports, it’s very simple and straightforward to compute the gross profit percentage.

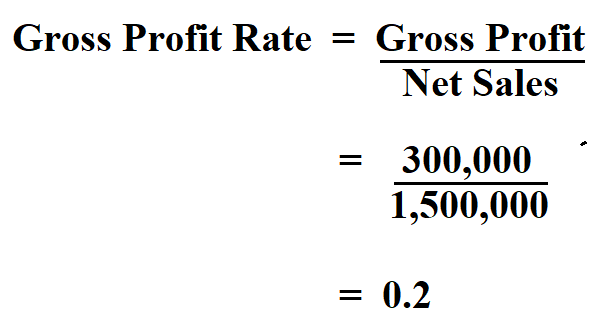

- Gross margin is calculated by dividing gross profit by sales revenue and multiplying the result by 100.

- A healthy net profit demonstrates that the business is operating profitably.

- Gross profit margin is a financial metric analysts use to assess a company’s financial health.

Net profit margin is a key financial metric indicating a company’s financial health. Also known as net margin, it shows the profit generated as a percentage of the company’s revenue. Simply put, net profit margin is the ratio of its net profit to its revenues.

The gross profit percentage could be negative, and the net income could be coming from other one-time operations. The company could be losing money on every product they produce, but staying a float because of a one-time insurance payout. In the world of business finance, few metrics are as important as gross profit percentage. This key indicator offers invaluable insights into a company’s financial health, operational efficiency, and competitive position.

Gross Profit and Gross Profit Margin – Definition, Calculations

As the ratio determines the profits from selling the inventories, it also estimates the percentage of sales that one can use to help fund other business parts. Some businesses that have higher fixed costs (or indirect costs) need to have a greater gross profit margin to cover these costs. Gross profit percentage impacts pricing strategies by helping you determine if your pricing covers production costs and desired profit margins. When reviewing your company’s gross profit, cash flow management will also inevitably come into play. An increase or decrease in your gross profit is an indicator of your business’s performance.

However, you must get ready by compiling the data required by the gross profit ratio formula. Here are 5 simple actions you can take to quickly start figuring out your gross profit percentage. Cost of goods sold (COGS) is subtracted from total receipts to determine how to prevent a tax hit when selling a rental property gross profit. It’s a method that financial analysts, business owners, and investors frequently use to gauge a company’s profitability. Knowing this number can also assist you compare your company to rivals and monitor your financial health over time.

This means if she wants to be profitable for the year, all of her other costs must be less than $650,000. Conversely, Monica can also view the $650,000 as the amount of money that can be put toward other business expenses or expansion into new markets. This means that for every dollar of sales Monica generates, she earns 65 cents in profits before other business expenses are paid. Or, the company might have low gross profit because its products are priced too low. The expenses that factor into gross profit are also more controllable than all the other expenses a company would incur in its overall operations.

Gross profit margin is a financial metric analysts use to assess a company’s financial health. It is the profit remaining after subtracting the cost of goods sold (COGS). Monica can also compute this ratio in a percentage using the gross profit margin formula. Simply divide the $650,000 GP that we already computed by the $1,000,000 of total sales.

The COGS margin would then be multiplied by the corresponding revenue amount. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team’s administrative workload. It’s a good indication that the company’s financial situation has improved if it rose.

Leave a Reply