Everything you need to Find out about Home loans for Self employed

From inside the India, anyone aspires in order to homes a great job, earn a paycheck, or initiate their unique business and you can fulfil brand new lifelong think of getting a resident. Yet ,, towards rising price of property and you may assets, home ownership is a lot easier told you than simply complete. For folks who focus on a respected corporation and just have good annual salary plan, you might effortlessly get a home loan without much stress. But what about people that are mind-employed?

Better, mortgage brokers for thinking-functioning are since financially rewarding for salaried advantages. Yet , most people are at night regarding knowing the qualification standards, brand new documents expected or any other variations in the house finance to have the 2. Worry maybe not, just like the we are here to clear all of your dilemma and doubts.

Mortgage Qualification to have Worry about-Working

Of many worry about-employed somebody care about how much cash analysis they’ve to face once the home loan people. At all, they may n’t have a steady stream of cash for example salaried individuals. You’ll be willing to remember that the house loan qualifications to have care about-operating is extremely casual in the modern go out. Like all people, its mortgage application’s profits will mostly rely on many factors:

- Ages When you have many years on your side, you can generate a whole lot more favorable financial terms from your financial. Therefore, young mind-operating candidates has actually better qualifications and will get on their own away from a good extended period also.

- Income To possess notice-operating people, proof of regular earnings affairs greatly in the home mortgage qualification criteria . Typically, your financial will demand tax returns regarding the early in the day step 3 age and you may earnings, losings and you may balance statements of your providers.

- Providers continuity Proof of business lifetime and its success in addition to weigh heavily in the homes mortgage qualifications. An extended-running, green, and you may profitable business is an indication of good mortgage installment abilities.

- Creditworthiness The lending company including decides if you really have other present funds, costs, or defaulted money before signing out of towards mortgage. Your credit rating is an excellent indication of creditworthiness.

Mortgage Data files for Worry about-Employed

Regardless if you are a candidate or co-candidate, the following list out-of mortgage files to own mind-operating is available in useful while applying for a beneficial housing mortgage:

- Address Proof Aadhar card, Passport paydayloanalabama.com/susan-moore, Operating License, Phone Bill, Ration Cards, Election Credit, and other certificate of legal authority,

- Age Evidence Bowl Credit, Passport, or any other associated certification off a statutory authority

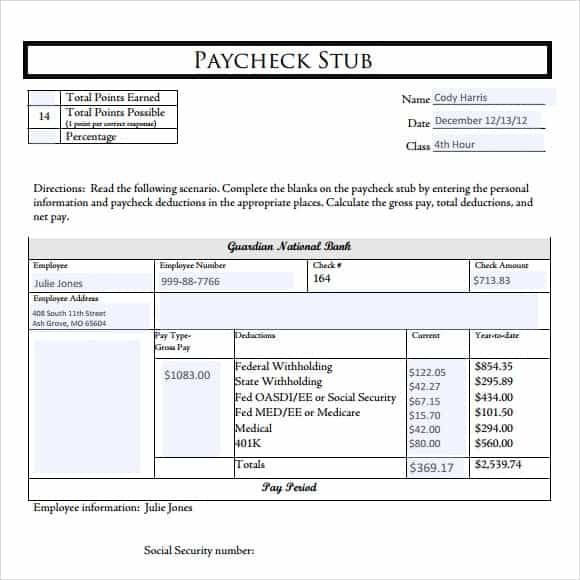

- Income Evidence Proof of company lifestyle, last 36 months income tax returns, accountant-official harmony sheets, and you will last 12 months family savings report

- Property Records A copy of agreement to possess assets purchase

- Academic Official certification Evidence of certification otherwise studies To understand much more about new data files expected, click .

Mortgage Rates to own Notice-Operating

Before you go in the future and implement for a houses mortgage to have self-employed, you should know you to financial interest levels to possess mind-employed applicants differ a bit out-of those to own salaried somebody. The cause of this might be simple: there can be a somewhat higher risk towards the financial whether or not it involves the former.

Bear in mind though these particular rates of interest go from date so you can day. As a self-functioning candidate, you also have the substitute for select from a drifting attention speed and you may a predetermined interest . Although not, repaired rates was highest and you will rarely readily available than floating rates of interest. The rate of interest was modified if you have a movement throughout the PLR speed.

The remainder stipulations, for instance the mortgage tenure and quantity of family mortgage one to a personal-employed applicant can put on to have was according to community norms:

Achievement

Before applying for home financing due to the fact a personal-operating individual, ensure that all your valuable documents is up-to-day and you will ready, especially tax returns and you can company ledgers. A lot of fun to try to get a home loan is when you do really on your business, lack significant expense and have a credit score 750+. It’s also possible to get an effective salaried co-applicant to increase the possibility.

Leave a Reply