Drawbacks of purchasing a beneficial fixer higher family

Often, home when you look at the a great communities that need plenty of improvements would not feel traveling from the markets quickly. That it has the benefit of customers which may well not otherwise have been in a position to afford to purchase a house in a much better society, the opportunity to accessibility a place with an easily affordable home and you will up coming renovate it.

six. Maintain handle

A separate benefit to to find a property that really needs improvements would be the fact you’ve got complete control over work that’s done. It is possible to make sure that all project is accomplished predicated on the standard of quality that you want, and like all of the element of the enterprise to help you line up towards the sight that you have toward house.

7. All the way down fees

Property taxation try computed with respect to the property value the house during the time of comparison along with the local assets income tax price. For example home having a lesser worth are going to have lower fees. This will just be ultimately before the enhancements were done, but it can lead to a massive preserving to own homeowners.

Prior to starting in search of a great fixer higher domestic, it’s important to take on the downfalls of approach since the well. While it should be profitable, you can find cons to be aware of that can impact the success of the strategy.

step one. Expensive house upgrades

Particular home renovation can cost you can be high, thus based on exactly what must be done, you are able to end expenses over your bargained to possess to your enhancements. The secret is not to find a house that requires repairs which could cost more than simply your allowance. Although not, since we’re going to outline lower than, this is simply not guaranteed since the unexpected will cost you can also be crop up, especially if you may be to get a half-done household.

dos. Unanticipated dilemmas

Fixer higher homes have a tendency to come with conditions that you might not find initially. Even if you get a house assessment, there might be most other solutions which can be called for, and they is going to be an extra expense. Unexpected issues can result in a lot more will cost you that can drive your over funds and you may resulted in enterprise charging many are shorter profitable. Old houses are extremely prone to issues that might not be picked up in the beginning inspection.

3. Unexpected costs

A lot more costs are one of the biggest drawbacks to purchasing house that require developments. Because of the nature out of unexpected trouble happening that have fixer top properties, these types of strategies are inclined to groing through funds.

Very, means a funds for those household upgrades is required, yet not be aware that although you to definitely funds is practical relies upon the other will set you back that appear along the way in which. Whether it is a water leak otherwise an electrical blame, extra repairs can cause major unexpected expenses.

4. Longterm investment

To shop for an effective fixer top family and renovating it is a venture that capture several months if you don’t ages, and this is not likely are a fast function. For traders that happen to be seeking a fast profit, this isn’t always the best choice given that fix programs might be biggest. To have homebuyers, and also this is generally problematic since surviving in a construction region isn’t necessarily feasible.

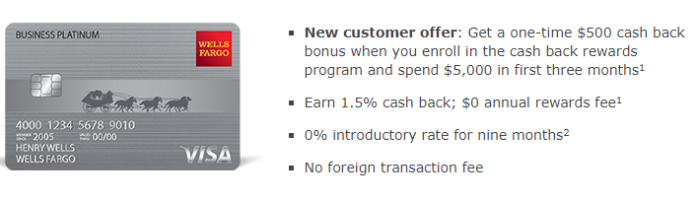

5. Limited investment choice

Getting financial support to possess a beneficial fixer top family buy and you may repair can also be be challenging due to the fact conventional mortgages would not coverage the home updates. Specific money can be used to protection household renovations, although not there are will constraints that version of home improvements and you will solutions you certainly can do.

This means that, simply exercise a monthly homeloan payment for this is not usually a choice. That is restricting for the opportunity, and leave your stuck rather than funding for some vital projects.

Leave a Reply