Domestic Depot Funding Possibilities: six Ways to Pay

Editorial Notice: The message regarding the blog post is founded on the brand new author’s viewpoints and pointers by yourself. It may not was in fact examined, commissioned otherwise endorsed because of the any of all of our system partners.

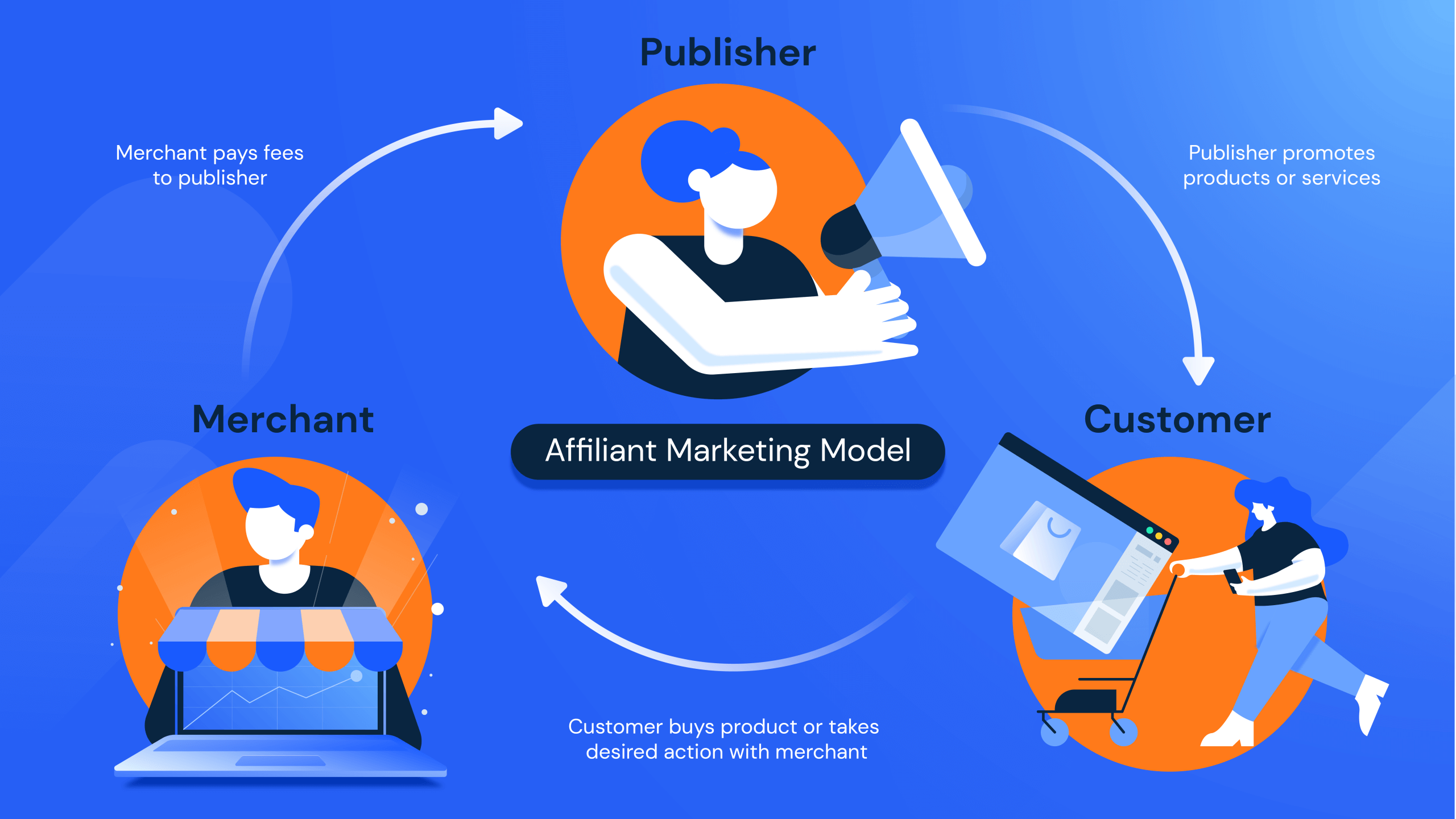

Whether you are trying to find property renovation or if you just want so you’re able to spruce up your garden, you really have some choices for resource your residence Depot purchase. A shop also offers one or two selection: the newest co-branded House Depot Consumer credit Credit and you can Household Depot Project Mortgage, you could as well as faucet conventional percentage solutions, like a zero-attract credit card or an unsecured loan.

- Home Depot Credit rating Cards

- House Depot Venture Loan

- 0% appeal credit card

- Unsecured loan

- Family collateral mortgage

- Home collateral line of credit

- Home Depot investment choices: The bottom line

- Household Depot investment choices: FAQ

The home Depot Consumer credit Card

The brand new co-labeled Household Depot Credit Cards out of Citi is an excellent choice for frequent buyers who wish to take advantage of special capital even offers.

You’ll be able to be eligible for 6 months off deferred-notice money to your requests from $299 or more. In the event your equilibrium are paid in complete inside investment months, you may not feel recharged focus. Yet not, the newest annual percentage rate (APR) is actually highest, whenever you never pay-off what you owe in the allocated several months, you will end up billed desire regarding purchase time.

In lieu of your own typical charge card, it cannot be studied in the most other areas. Although not, during the look for promotion symptoms, cardholders could possibly get up to two years off unique capital. Year-round, cardholders may benefit out of spinning even offers, particularly coupons to the strung fencing or shed instructions, and additionally see 1 year out of issues-free efficiency (fourfold longer than having non-cardholders).

The house Depot Credit rating Cards conditions*

Our home Depot Consumer credit Cards is a great solution if the your frequent the store and need unique capital otherwise want to access periodic discounts. The typical half a dozen-week resource several months is relatively quick, therefore you should become comfortable settling your balance inside that time to quit deferred interest.

As the credit has no yearly commission, there are not any perks sometimes, and your credit only functions home Depot. The regular Apr is highest, therefore you should usually try to lower your debts easily to get rid of large deferred-desire fees. When you’re drawn to looking in the competing retailers or scarcely you need special resource, the newest cards may not be worthwhile.

Home Depot Enterprise Mortgage

Home Depot’s Opportunity Loan will be always loans major home improvements. It works including a line of credit, having a threshold of up to $55,100000, and it also includes a branded credit that will just be used at home Depot.

While you are recognized having holiday loans australia a job Mortgage, you should have a six-day window to find products and you can product yourself Depot, available otherwise on the web. Afterwards, possible pay down what you owe in the fixed installment payments more 66 to help you 114 days.

Additional payment times incorporate different words. Enterprise Funds do not have prepayment penalties, so you can generate additional repayments to keep towards focus, plus pay in full as soon as you for example.

Brand new Annual percentage rate, that’s only eight.42%, makes it financial support alternative cheaper than the user Credit card if you can’t enjoy the card’s six-few days unique capital give.

Family Depot Investment Mortgage words*

For those who have a massive do it yourself endeavor and you may relatively a borrowing from the bank, and also you plan to make the most your purchases within Home Depot, the home Depot Endeavor Mortgage are a beneficial capital option. With a high credit limit and you can a relatively low limitation Annual percentage rate, your panels Loan was quite affordable, specifically compared to Consumer credit Credit.

Leave a Reply