Do i need to score a keen FHA or Antique Home loan?

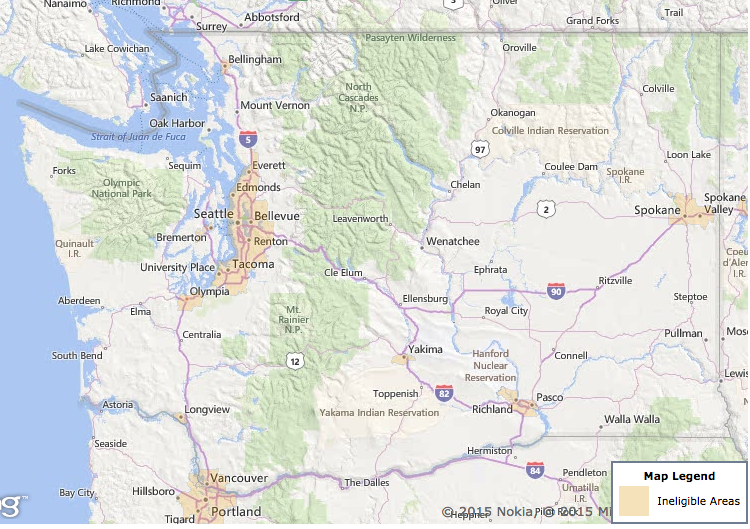

Nowadays, cuatro version of mortgages are available: Conventional, FHA, Virtual assistant, and you can USDA. Of 4 financial systems, FHA and you may Traditional money are definitely the most frequent, thus we are going to cover those individuals. Va mortgages are merely open to United states Veterans, and you may USDA mortgage loans only apply to certain property within the USDA-approved zip rules).

To make it simpler to comprehend the differences between FHA and you can Conventional let’s view it from 4 C’s from home loan underwriting criteria:

- Borrowing from the bank Credit rating and you will FICO/credit rating as it’s claimed because of the 3 borrowing enterprises, Trans Partnership, Equifax, and Experian.

- Capabilities The ability to pay off the home loan.

- Financial support The amount of loans protected to possess deposit and you can supplies.

- Guarantee The significance and marketability of one’s topic property.

During the a higher rate FHA finance operate better to have basic-day home buyers that have less than-mediocre or troubled borrowing. FHA finance are also ideal for those with restricted financial support to own a deposit. FHA fund can be a little more challenging to locate from inside the parts aside from credit. Discover alot more red tape that have an FHA financing, while the prices are a small higher.

Antique is most beneficial if you have high fico scores and/otherwise more than-average financing. Considering the stamina of your own borrowing from the bank off a normal debtor, there was reduced red tape. Antique financing get the best financial cost and so are simpler on the this new collateral.

Framing brand new FHA vs Traditional Direction

So you’re able to speak within the higher detail, you want to talk about Pc Underwriter (DO) and you will Financing Prospector (LP). These represent the computer system database you to underwrite the new loans so you can FHA or traditional guidelines. Federal national mortgage association and you can Freddie Mac computer could be the agencies which make and you will insure a lot of antique funds in america.

FHA, Fannie mae, and you may Freddie Mac computer set forth advice to which financial bankers like Homestead Economic Financial underwrite. So, quite simply, they lay the guidelines of your own game, and then we enjoy of the all of them.

Antique Mortgage loans

The federal government Backed Enterprises (GSE) Federal national mortgage association and Freddie Mac computer dominate the regular mortgage sector. An excellent GSE try an entity developed by government entities with specific advantages supplied from the government. The GSE’s masters are acclimatized to support the well-known good. In cases like this, the hidden objective should be to offer home ownership also so you’re able to feel successful.

Credit:

Credit have to be over mediocre (700) if for example the Financing to help you Well worth is over 80%. There clearly was zero biggest later repayments over the last 2 many years. Bankruptcies have to be more than 4 years of age, and you will property foreclosure have to be higher than seven many years.

Capabilities (Income):

Money must be https://paydayloanalabama.com/macedonia/ steady into the earlier in the day two years and looking pass. The job background big date can include getting an entire-big date college student, provided the brand new tasks are in the area of analysis.

This new month-to-month income is placed to the denominator to start the new formula of front and back financial obligation-to-earnings percentages. This new monthly payment from prominent, notice, fees, insurance coverage, and you can financial insurance (PITIMI) will then be put in the newest numerator. The fresh new fee is called leading-avoid proportion.

Almost every other payments into the credit file try put into PITIMI to discover the right back-prevent ratio.The debt-to-income underwriting simple to own conventional loan approvals has been 28%-36%. Although not, i are not come across approvals which have a beneficial backend proportion a lot more than 45%.

Capital:

If for example the score are less than 700, just be looking to place 20% upon your purchase. If you don’t have 20% guarantee, your own score most likely has to be more than 700, and you will have to expect to pay Financial Insurance coverage. Personal Home loan Insurance rates (PMI) can be canceled on a traditional financing after you have paid off earlier a specific amount on the loan. PMI is actually driven because of the credit rating, and it also actually starts to rating high priced less than 700. Getting fifteen% isn’t dreadful, in the event at that time, you happen to be best off going with FHA.

Leave a Reply