Demystifying borrowing from the bank chance financial support requirements to own houses money

Addition

APRA’s remit should be to include depositors and give financial system stability it do because of the, around whatever else, requiring banking institutions to hang enough resource to resist shocks and you may ingest losings. A prevalent feature of your own money adequacy structure for banking institutions targets borrowing from the bank risk in the houses lending given the high intensity of homes financing inside the Australian banks’ portfolios. APRA it allows a couple fundamental solutions to figuring resource standards to possess borrowing risk: this new standardised approach together with interior recommendations-built (IRB) approach, the second from which happens to be recognized to be used from the half dozen of the biggest banks in australia.

- how does APRA guarantee that investment criteria for houses lending is actually enough to withstand losings through the duration; and

- why does APRA make sure the differences between IRB and you can standardised money conditions work, and maximum has an effect on toward battle about Australian bank operating system?

Knowing the money design having casing financing

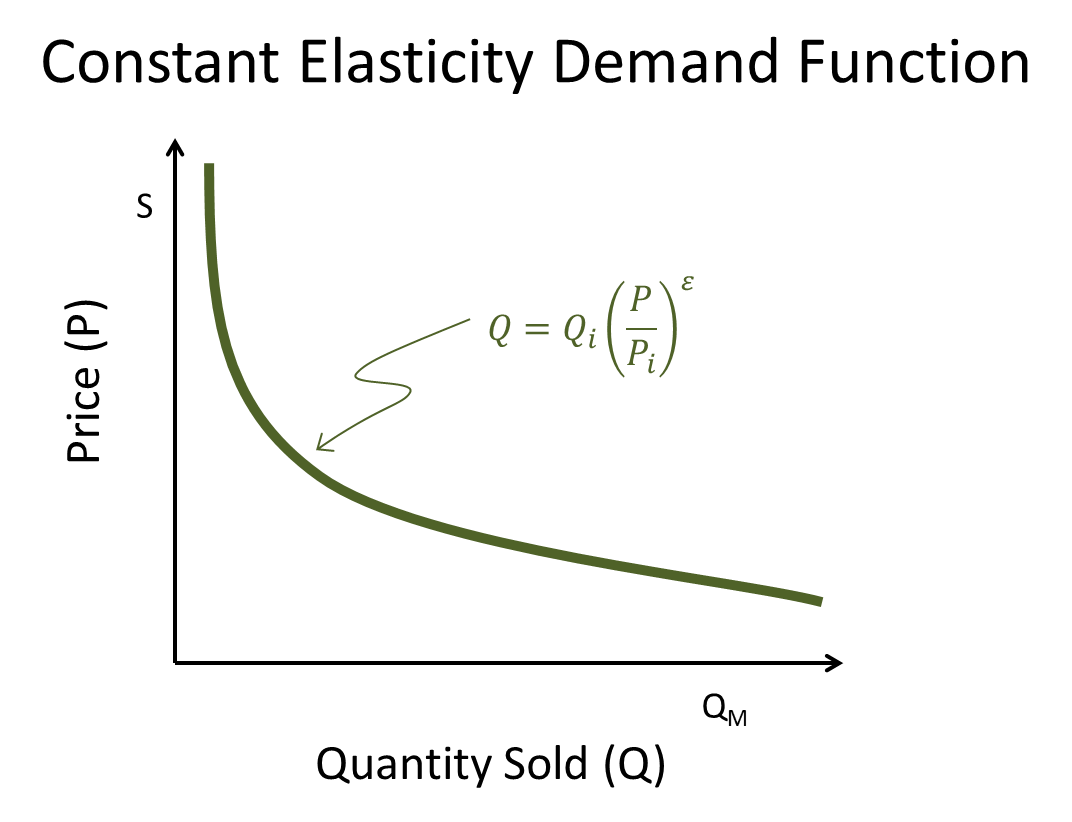

Investment requirements having borrowing from the bank chance are a purpose of credit chance-weights and lowest investment adequacy ratio. step 1 These requirements are mostly according to the around the world assented framework developed by the fresh new Basel Panel to your Financial Oversight with some adjustment having Australian affairs and you will dangers.

- the standardized approach, that’s effortless, conservative and you can caters for a variety of banks and portfolios; and

- the fresh IRB strategy, and that seeks to better line-up funding which have exposure by allowing banking institutions to utilize their internal chance models to help you determine financing conditions.

Standardized strategy

According to the loans Central City standardized method, financial support conditions for houses financing depend on a common lay of chance-weights prescribed from the APRA. Standardised risk-weights are calibrated on a traditional level because they’re reduced direct, connect with numerous banking institutions, and you will make an effort to make certain that standardised finance companies are effectively capitalised into a total base. If you find yourself exposure-weights are often a whole lot more traditional, there clearly was a lowered load into the standardised banks in terms of other supervisory standards including the handling of internal exposure models and you may analysis revealing.

IRB method

Underneath the IRB approach, financial institutions are permitted to make use of their internal habits since enters in order to determine the risk-loads for housing financing. Risk-weights within the IRB method is actually designed into the risks of a single bank and therefore are even more right than standardized risk-weights (which is, sensitive to a larger selection of borrower and you will collection risk functions). Thus, new IRB means contributes to much more right risk measurement, that allows a much better alignment away from funding so you’re able to chance.

To utilize the fresh new IRB approach, banking institutions should have sturdy historic investigation, a sophisticated chance dimensions framework and you may state-of-the-art internal modelling opportunities. Banking institutions should also proceed through a rigid analysis technique to end up being qualified because of the APRA. IRB banks try at the mercy of much more strict regulating standards plus intense constant oversight than simply standardized banking institutions.

In lieu of standardized banking institutions, IRB banking companies are also necessary to particularly keep funding to have desire rate exposure about financial publication (IRRBB), that’s expected to feel 5 to help you eight % of full exposure-adjusted possessions (depending on suggested alter for the prudential framework).

What are the trick drivers from capital standards having construction credit?

Within the standardised strategy, risk-loads to own housing financing are different in line with the mortgage-to-valuation ratio (LVR), if the financing try standard otherwise low-standard, 2 whether or not the financing is for holder-profession otherwise funding intentions, if or not financing costs try dominant-and-interest otherwise attention simply, and perhaps the loan enjoys lenders home loan insurance policies (LMI). Based these features, a construction loan may be chance-weighted within anywhere between 20 % and you will 150 %. step three

In IRB strategy, trick determinants of housing chance-weights will be banks’ prices regarding odds of default (PD, the risk of debtor standard), losses given default (LGD, losses because the a percentage of amount due at standard) and you will publicity at the default (EAD, the amount due from the standard), and a danger-lbs form recommended by APRA.

Leave a Reply