Could you Access Household Collateral which have Less than perfect credit?

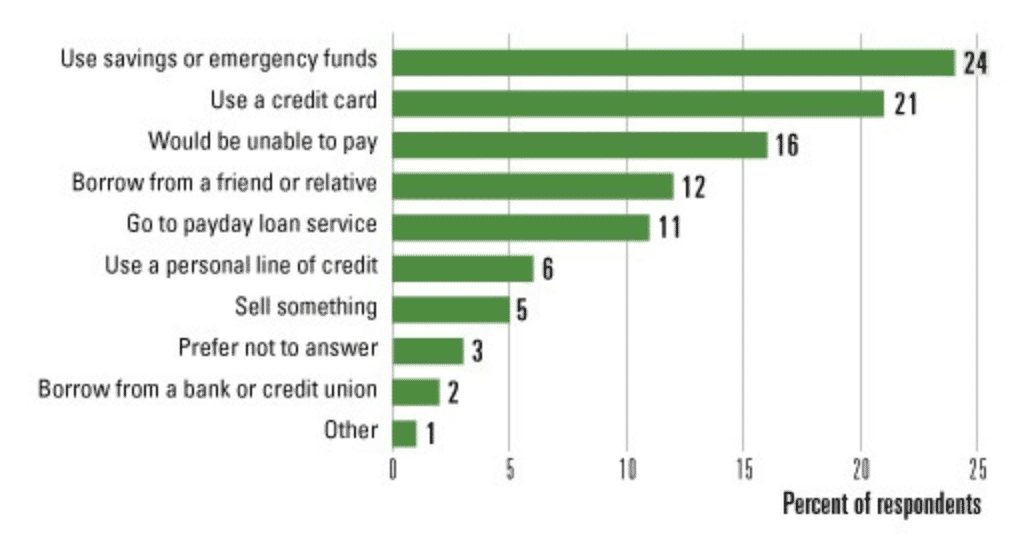

A lot of Us americans have a problem with personal debt. A study conducted by Hometap in 2019 away from nearly 700 U.S. property owners indicated that although people is family-steeped, also cash-poor, with little go out-to-date liquidity. Questionnaire takers shown if they did keeps personal debt-100 % free entry to its house’s collateral, such as for instance property guarantee improve, they had utilize it to pay off credit card debt, medical costs, otherwise let family and friends pay back debt.

Many home owners responded that they haven’t actually thought options available in order to tap into their home collateral. In a nutshell, they think stuck as the available monetary choices just apparently include even more loans and notice for the homeowner’s monthly equilibrium sheets. Additionally there is the issue out of degree and you can approval, as it is hard to qualify of a lot investment alternatives, such as for example a house collateral mortgage, with poor credit.

What’s promising? So it house steeped, bucks bad condition quo doesn’t have to keep. Right here, you’ll learn in regards to the requirement for borrowing, as well as how you can still supply your home guarantee if your personal was sub-standard.

What exactly is Credit and exactly why Does it Amount so you can Loan providers?

Credit refers to the capacity to to borrow cash, obtain affairs, or explore services whenever you are agreeing to incorporate fee at an after day. The word credit score means a great about three-digit amount one to implies the degree of honesty you have demonstrated inside the the past through knowledge of loan providers, loan providers – generally, any organization who has got offered you currency. This post is gathered inside a credit file as a result of an option various present, such as the number of playing cards you have, also any an excellent stability on them, the history of funds and you can fees choices, timeliness regarding monthly bill percentage, and you will high dilemmas such as for instance bankruptcies and you will foreclosure.

Put simply, loan providers want to be just like the sure that one can that you’ll spend straight back any cash they offer to you personally, and you will checking their credit is a simple and you will apparently complete method to gather this short article.

If you are holding many obligations and are generally concerned with their credit, you may think that the domestic equity is unreachable. But with yet another, non-financial obligation money solution offered to many home owners, you may be surprised at what you could availableness. Check out methods make use of your house security to start using one to liquidity to arrive debt specifications. ?

Comprehend the chart lower than for an easy writeup on the choices that could be online based on your credit rating, up coming keep reading for much more in-depth descriptions each and every.

Cash-Away Refinance

A money-aside re-finance is when you, brand new homeowner, take out an alternative, huge mortgage, pay your current financial, and rehearse the extra to cover your circumstances. You can do this via your established bank otherwise https://availableloan.net/loans/usda-home-loans/ a separate financial that will be perhaps not believed a second financial. Centered on Bankrate , you generally speaking you prefer no less than 20% equity on your own assets so you can be considered, and you will spend attention to your life of the borrowed funds (usually fifteen or three decades). From the long duration of a profit-away refi (as the they are also known), you should ensure the interest rate and your asked installment plan fit into your own monthly finances. Residents are generally necessary to has a credit rating at least 620 is acknowledged to own a finances-away refinance.

House Guarantee Financing or Household Guarantee Line of credit

Do you really qualify for property security financing otherwise a property security credit line (HELOC) with poor credit? First, you have to know the difference between those two household guarantee choices.

A property security financing enables you to borrow funds utilizing the security of your home just like the guarantee. Good HELOC, as well, work similar to credit cards, in the same manner to draw funds on a for-necessary foundation. Having one another family security finance and you may HELOCs, your credit score and household security worth will play an associate in the way much you can use as well as your interest price.

Minimal credit score you’ll need for a home security financing and you may a great HELOC usually are at the very least 620, though it depends on the lending company. However, even though you don’t meet this minimal credit rating for property guarantee loan or HELOC, don’t let yourself be disappointed. Julia Ingall which have Investopedia says home owners with poor credit is to analysis buy loan providers accessible to handling individuals including him or her. Additionally, Ingall cards you to definitely dealing with a large financial company can help you glance at your choices and you will support legitimate loan providers.

Home Security Get better

A home guarantee advance also offers home owners the capacity to utilize the long run value of their property to availableness its guarantee now. Property equity funding try a smart way to-do merely that.

At Hometap, residents can also be discovered domestic security investments so they are able explore a number of the collateral they will have accumulated in their home accomplish almost every other monetary specifications . The fresh new resident becomes bucks without having to offer and take away that loan; and there’s zero notice without monthly payment. . Various other positive aspect out of a great Hometap Financial support is that hundreds of things is actually considered in order to accept an applicant – credit score is not the determining standard.

Sell Your property

For the majority of, it is a last resort, but homeowners with less than perfect credit have access to their house’s equity by offering it outright. Obviously, so it choice is predicated abreast of selecting a less expensive house having the next domestic, including favorable financial conditions for the this new put, and you will making certain you do not spend way too much to the a home charge or moving will set you back. In addition, you may be able to change your credit score in advance of you are able to this point. Overseeing your credit score to store a close look away to own possible conflicts and you will discrepancies, maintaining a balance really beneath your credit limit, and you can remaining dated membership discover all are a metropolises to begin with.

While perception domestic-rich and money-worst eg too many Us americans , you’ve got a number of choices to availability your house guarantee. As with any biggest money choice, speak with a trusted financial top-notch to choose your very best movement out-of step, and also have moving for the your aims.

I carry out the best to guarantee that every piece of information from inside the this post is as the specific that you could by brand new time its blogged, but something changes rapidly often. Hometap will not endorse or display screen one connected other sites. Private facts disagree, so speak to your very own financing, taxation or lawyer to determine what is practical to you personally.

Leave a Reply