All you need to Learn about To find a great Fixer-Upper House

This post discusses all you need to realize about purchasing good fixer-higher house. Homeowners can purchase holder-occupant top fixer-higher renovation funds having FHA, Va, USDA, and you will conventional fund. Of several homebuyers thinking of buying, rehabilitation, or renovate their homes . FHA 203k financing was for manager-renter property only. FHA 203k loans make an effort to support people in their operate so you’re able to renew the areas.

FHA 203k money try to have homeowners wanting home trying to find solutions or updates. Its a blended order and framework financing which have an excellent 3.5% down-payment of the improved well worth.

FHA 203k finance have become common funds getting homeowners to acquire an excellent fixer-higher home. not, FHA 203k money are merely getting manager-renter homes and never financing services. New continues can be used for the purchase and you can treatment financing amounts. FHA 203(k) loans are for individuals who should re-finance their houses and purchase repairs. Capable re-finance the existing home loan and also more substantial mortgage that includes the building can cost you. In this posting, we’ll shelter to get a beneficial fixer-upper house with FHA 203k loans.

Advantages of To get an effective Fixer-Upper Home

To invest in an effective fixer-top house is quite popular certainly a property dealers and you can a good rewarding investment, but it addittionally includes pressures. In this posting, we’re going to talk about particular measures to look at if you’re considering to acquire good fixer-upper home. Influence the purchase prices plus restoration finances.

Get prices estimates. Obtain multiple rates out of designers and tradespeople with the performs you want to perform. This will help you finances way more accurately and give a wide berth to unforeseen expenses.

Before deciding on fixer-higher belongings, dictate the purchase and you may restoration will set you back. Definitely reason for the purchase price therefore the costs away from repairs and you will renovations. Decide what we wish to achieve to the fixer-upper. Are you looking for a home to live in, flip having money, otherwise rent? Your aims will influence the way of home improvements plus the funds you lay.

Getting Pre-Acknowledged To purchase an effective Fixer-Top Home

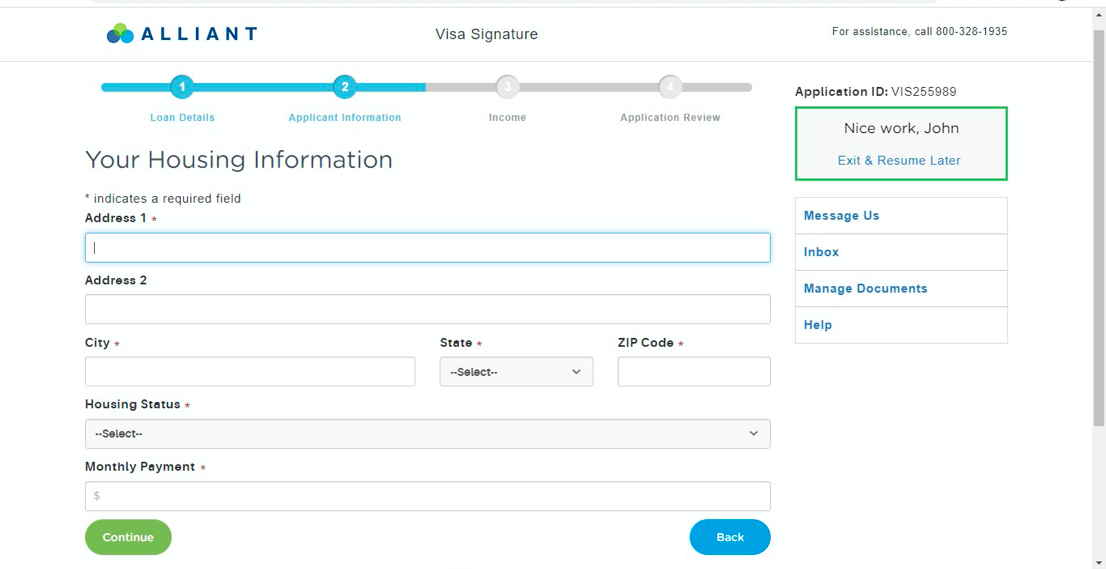

Providing pre-acknowledged getting home financing ‘s the 1st step into the to get a beneficial fixer-upper domestic. What sort of fixer-upper household are you currently to acquire? Would it be an owner-occupant home? Can it be an investment domestic? Can it be a remedy-and-flip house?

There are numerous options for capital a fixer-higher family. If you intend to invest in the purchase, score pre-recognized having a home loan which means you understand how far you could potentially use.

This will help you restrict the choices making way more advised choices. Remember that buying a beneficial fixer-upper would be work-intensive and economically demanding, making it crucial to become well-prepared and also a definite plan. If you wish to be more experienced in house home improvements, imagine choosing advantages otherwise asking advantages to assist show you.

Look Area To buy a beneficial Fixer-Top Domestic

Check out the real estate market where you need it. Glance at possessions thinking, people style, as well as the potential for loans in Southern Ute future really love. Work on an agent experienced in to order fixer-uppers. Real estate professionals will help buyers pick functions, discuss business, and gives the best place for a knowledgeable potential enjoy. You don’t want to invest a lot of towards the house and encounter renovation overruns.

Cause for contingencies whenever looking to buy a beneficial fixer-top household. Arranged a contingency money for unexpected products during the repair. It is prominent for unforeseen troubles to increase all round cost.

Get a professional household inspector to assess the fixer-top. Discover architectural, electrical, and you will plumbing system issues and other significant issues. This new assessment statement allows you to estimate resolve will cost you a whole lot more correctly. Discuss the purchase price: In accordance with the assessment along with your repair package, negotiate the cost on the vendor. They are happy to lessen the rates otherwise give concessions in order to account fully for called for fixes.

Leave a Reply