Affordable Home loan Choice You Didnt Understand You could Qualify for

Homeownership regarding You.S. has been tied to the fresh Western dream-beautiful yard, white picket fence, and all of the newest accouterments regarding comfy lifestyle someone you will ever wanted. Unfortunately, that is an idea that is difficult to to obtain to own an enormous part of the inhabitants.

For people living in a reduced-money family, it’s difficult not to ever feel you may be completely valued off brand new housing market. But by way of specific societal and personal reduced-income mortgage options, brand new dream of homeownership does not need to become because the from arrive at as it may take a look. Continue reading for more information on which alternatives of becoming a homeowner.

Key Takeaways

- People with lower earnings tend to believe they can’t go their dreams of homeownership on account of bank and you can down payment conditions.

- Providers such as for instance HUD plus the FHA has actually homeownership software designed for low-income houses.

- Your household earnings peak find whether or not you could qualify for these types of fund.

- Together with national apps, county and you will U.S. territory software are available you to give finance in the place of a giant down payment.

- It certainly is best if you learn whether or not your meet the requirements given that low income before applying your state otherwise government homeownership apps.

Government-Backed Mortgage brokers

The us government is the prominent vendor out of fund, has, or other kinds of guidance in the country, ultimately causing a total finances off nearly $six.8 trillion with the 2021 fiscal season. It’s from the government’s welfare to store as many out of its owners housed you could to keep a pleasurable and you may healthy staff. Because of this businesses like the You.S. Department away from Homes and Metropolitan Invention (HUD) together with Federal Property Administration (FHA) possess software geared towards helping down-earnings house afford homes.

Individuals you to meet particular conditions is also find to get government-backed mortgage loans with varying requirements, downpayment minimums, and perks from the following apps. Because of the fact that these are typically supported by the latest You.S. government, lenders often see these software due to the fact a reduced-chance money, ultimately causing ideal terminology and you will probably more affordable prices.

FHA Funds

Having fundamentally less strict requirements than many other government-supported software, the newest FHA loan program is designed to let very first-date low-earnings people go into the housing industry.

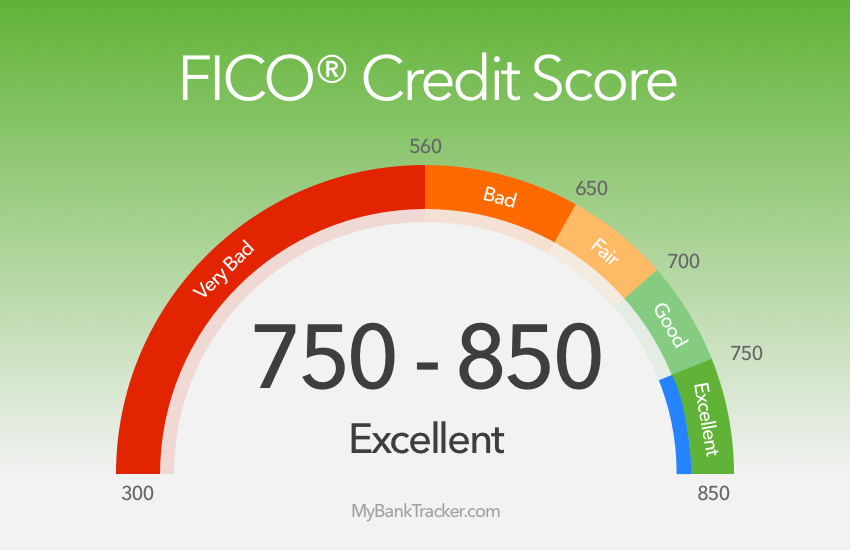

So you’re able to be eligible for the applying, individuals must have an average credit score from 580 and stay capable pay for no less than good step three.5% down-payment into domestic. You could determine their FHA financing restrict-that can believe brand new condition for which americash loans Mccalla you anticipate and then make you buy-by the consulting brand new HUD website.

Aside from your credit score and readily available downpayment, every consumers must pay the settlement costs. These types of can cost you, in addition to bank costs, third-team fees, and you will one prepaid service products, can’t be financed. Borrowers are on the hook for yearly financial insurance fees.

Good neighbor Across the street System

It is sorry to say, however, many somebody involved in public-service jobs do not build as the much money because the you’ll imagine. Such, a highschool teacher’s foot yearly paycheck will start around $38,000 in addition to average income to own firefighters simply over $forty eight,000. All of people numbers carry out home all of them from the lowest-money group, considering really standards.

Eligible public service group can purchase a home during the 50% of from the Good-neighbor Nearby program, that’s provided by HUD. All the that you need is you are presently being employed as a great full-date

- Pre-K as a result of twelfth-amounts teacher

- Disaster medical technician

- Firefighter

- The authorities manager

Its also wise to want to pick a house inside the an effective HUD-designated revitalization urban area and are also ready to invest in surviving in one to domestic for around 3 years.

Leave a Reply