Accounting Rate of Return Calculator ARR Calculator

It is a quick method of calculating the rate of return of a project – ignoring the time value of money. A good return on investment is generally considered to be about 7% per year, which is also the average when are credits negative in accounting chron com annual return of the S&P 500, adjusting for inflation. Assume, for example, a company is considering the purchase of a new piece of equipment for $10,000, and the firm uses a discount rate of 5%.

What Are Some Drawbacks of RoR?

The initial cost of the project shall be $100 million comprising $60 million for capital expenditure and $40 million for working capital requirements. However, it is preferable to evaluate investments based on theoretically superior appraisal methods such as NPV and IRR due to the limitations of ARR discussed below. Evaluating the pros and cons of ARR enables stakeholders to arrive at informed decisions about its acceptability in some investment circumstances and adjust their approach to analysis accordingly.

What is the approximate value of your cash savings and other investments?

Next we need to convert this profit for the whole project into an average figure, so dividing by five years gives us $8,000 ($40,000/5). Note that the value of investment assets at the end of 5th year (i.e. $50m) is the sum of scrap value ($10 m) and working capital ($40 m). Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting. In this blog, we delve into the intricacies of ARR using examples, understand the key components of the ARR formula, investigate its pros and cons, and highlight its importance in financial decision-making. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

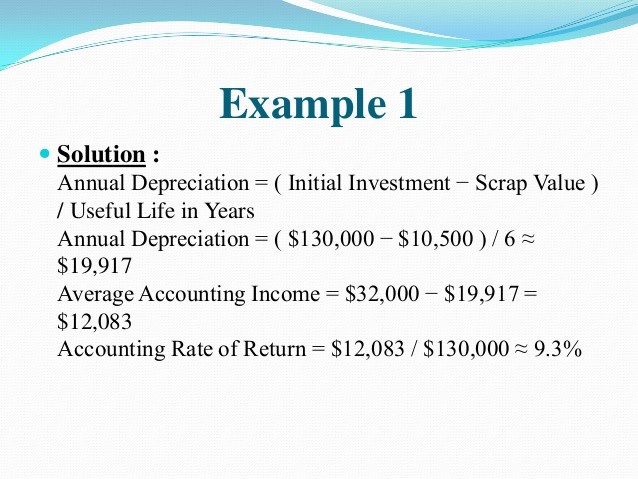

Calculating ARR

For example, say that an investor purchased a short-term bond, such as a US Treasury Bill, for $950 and redeemed it for its face value of $1000 at maturity. So, in this example, for every pound that your company invests, it will receive a return of 20.71p. That’s relatively good, and if it’s better than the company’s other options, it may convince them to go ahead with the investment.

ARR illustrates the impact of a proposed investment on the accounting profitability which is the primary means through which stakeholders assess the performance of an enterprise. Accept the project only if its ARR is equal to or greater than the required accounting rate of return. Based on the below information, you are required to calculate the accounting rate of return, assuming a 20% tax rate. The rate of return can be calculated for any investment, dealing with any kind of asset. Let’s take the example of purchasing a home as a basic example for understanding how to calculate the RoR.

This is a solid tool for evaluating financial performance and it can be applied across multiple industries and businesses that take on projects with varying degrees of risk. The accounting rate of return is one of the most common tools used to determine an investment’s profitability. Accounting rates are used in tons of different locations, from analyzing investments to determining the profitability of different investments. The accounting rate of return is a simple calculation that does not require complex math and allows managers to compare ARR to the desired minimum required return. For example, if the minimum required return of a project is 12% and ARR is 9%, a manager will know not to proceed with the project.

- It’s important to understand these differences for the value one is able to leverage out of ARR into financial analysis and decision-making.

- Let’s take the example of purchasing a home as a basic example for understanding how to calculate the RoR.

- A rate of return (RoR) can be applied to any investment vehicle, from real estate to bonds, stocks, and fine art.

- For example, if the minimum required return of a project is 12% and ARR is 9%, a manager will know not to proceed with the project.

- The rate of return can be calculated for any investment, dealing with any kind of asset.

- Here we are not given annual revenue directly either directly yearly expenses and hence we shall calculate them per the below table.

If the investor sells the bond for $1,100 in premium value and earns $100 in total interest, the investor’s rate of return is the $100 gain on the sale, plus $100 interest income divided by the $1,000 initial cost, or 20%. Accounting Rate of Return (ARR) is a formula used to calculate the net income expected from an investment or asset compared to the initial cost of investment. If you’re making a long-term investment in an asset or project, it’s important to keep a close eye on your plans and budgets.

Remember that you may need to change these details depending on the specifics of your project. Overall, however, this is a simple and efficient method for anyone who wants to learn how to calculate Accounting Rate of Return in Excel. If you’re not comfortable working this out for yourself, you can use an ARR calculator online to be extra sure that your figures are correct. EasyCalculation offers a simple tool for working out your ARR, although there are many different ARR calculators online to explore.

The Accounting Rate of Return (ARR) provides firms with a straight-forward way to evaluate an investment’s profitability over time. A firm understanding of ARR is critical for financial decision-makers as it demonstrates the potential return on investment and is instrumental in strategic planning. Investment evaluation, capital budgeting, and financial analysis are all areas where ARR has a strong foundation. Its adaptability makes it useful for a wide range of applications, including assessing the economic profitability of projects, benchmarking performance, and improving resource allocation. The accounting rate of return (ARR) formula divides an asset’s average revenue by the company’s initial investment to derive the ratio or return generated from the net income of the proposed capital investment.

Investments are assessed based, in part, on past rates of return, which can be compared against assets of the same type to determine which investments are the most attractive. Many investors like to pick a required rate of return before making an investment choice. A rate of return (RoR) is the net gain or loss of an investment over a specified time period, expressed as a percentage of the investment’s initial cost.

Say that you buy a house for $250,000 (for simplicity let’s assume you pay 100% cash). The simple rate of return is considered a nominal rate of return since it does not account for the effect of inflation over time. Inflation reduces the purchasing power of money, and so $335,000 six years from now is not the same as $335,000 today.

Leave a Reply