A step-by-Action Help guide to Navigating Mortgage Once Dying to have Family unit members

Shedding a loved one has never been easy, and it’s really much more challenging to browse the different economic and you can courtroom things that happen immediately following dying. One particular procedure is actually wisdom a dead loved your mortgage and you will what the results are in order to it after they die. Contained in this blogs, we will offer one step-by-step help guide to help you browse mortgage immediately following dying having a beneficial relative.

Collect Extremely important Data files

To start, you will have to gather the necessary data files, such as the dead loved your will, dying certificate, and home loan documentation. These data will help you comprehend the terms of the loan, the remaining balance, and you may any outstanding repayments that need to be made.

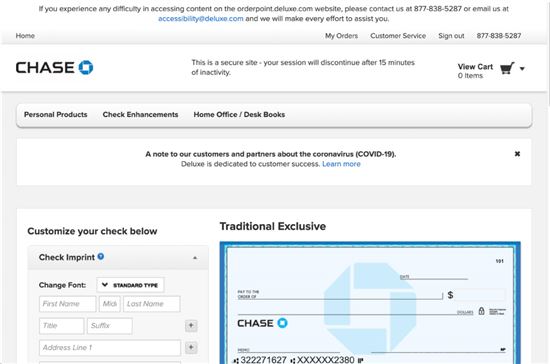

Get in touch with the lending company

After you have the required documentation, the next thing is to make contact with the lender. It is essential to tell them that the borrower has gone by aside and inquire about its home loan regulations just after dying. The financial institution may require additional documents or pointers, thus prepare yourself with all of requisite records.

Determine All of your current Selection

The choices count on if the mortgage-holder has actually called a recipient or if perhaps the house is part of the fresh new home. If the a beneficiary is called, they are able to to imagine the mortgage and remain making money. If your home is an element of the house, the latest executor otherwise administrator of the home may wish to offer the property to repay people the costs, such as the financial.

When you are This new Beneficiary:

- Think RefinancingIf you have enough money or possessions, imagine refinancing the loan so that it is paid off more readily otherwise from the a lesser rate of interest. This can clean out monthly installments to make it easier for surviving members of the family to handle its finances for the light on the changes within the affairs.

- Promote new PropertyMaybe refinancing isnt a choice, offering the house or property could be requisite in order to pay the remainder harmony on financing. Ahead of doing this, it is necessary to talk to a legal professional specializing in a home legislation understand the rights and you may financial obligation when attempting to sell a property shortly after individuals get a loan 500 transunion credit score passes away.

- Transfer OwnershipIn some instances, it can be possible for possession of the property is transferred from a single friend or recipient to another as opposed to going thanks to a formal marketing techniques. That is of use if the you can find multiple heirs who want entry to, or control off, a specific possessions but don’t are able to afford between the two every to settle its current mortgage equilibrium immediately.

- Consult Forbearance On LenderIf nothing ones choice have a look feasible, then it may be worth getting in touch with their bank actually and you will asking for forbearance on the region. In some cases, lenders commonly agree to pause costs for a few months while you are plans are increasingly being designed for the best way to cope with this situation. Although not, just remember that , attract have a tendency to nevertheless accrue during this period, so it is vital to weighing if so it service would actually save currency overall compared to anyone else in the above list.

Search Professional advice

Navigating the reasons of dealing with a home loan after the death of someone you care about will be overwhelming. Its imperative to get qualified advice off legal counsel, financial mentor, otherwise mortgage pro. They can offer custom information based on your unique state and you can help you make told behavior.

To summarize

Making reference to a liked your mortgage once its dying are daunting, but it’s essential to understand the options. By using these types of tips, get together the required papers, handling a lender and you can legal counsel, and looking economic counseling, you could potentially stay on the upper home loan and you can manage your own liked an individual’s legacy. Think about, you do not have to help you navigate this course of action alone, and you will advantages are around for help you in the process.

Are you having difficulties dealing with losing someone you care about and you will need advice on what direction to go through its house? Look no further than Strategic Financial Possibilities. Our company is here that will help you during the examining your options, off staying the home to refinancing. To find out more and for a totally free mortgage session, label 541-275-1148 or send us a message .

Leave a Reply