Personal loans are prominent because of their versatility

There are many reasons exactly why you may want to get a beneficial parcel even though you aren’t ready to generate into it right away.

Have you ever discovered the ideal location for property or vacation location, therefore must set-aside they for the future. Or maybe you’ve receive an only-best package throughout the woods to flee so you’re able to on your own freshly up-to-date Camper .

When you need to move forward with your bundle, you will probably you want financial support to really make the get. What kind of loan you ought to get to acquire homes usually depend on the expense of the fresh new residential property, the method that you intend to put it to use, and how higher a downpayment you can make.

Continue reading knowing how a personal bank loan for selecting belongings even compares to getting an area mortgage, together with other available choices you could consider to aid financing an area purchase.

What exactly is an unsecured loan?

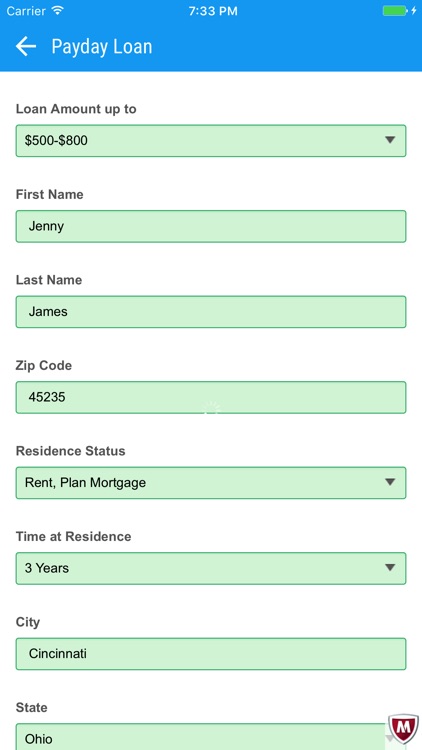

A personal loan makes you get a lump sum payment out of currency to fund expenses, whether it is credit card debt, a healthcare costs, otherwise a dream vacation. Then chances are you pay back that cash (including interest) through the years. You can borrow a giant or bit, depending on your needs and you can credit score, and you can usually explore an unsecured loan for nearly all you particularly.

Really signature loans is unsecured loans , for example they will not require you to right up equity (such as your domestic, car, or any other asset). Unsecured unsecured loans have large interest levels than finance one to are safeguarded while the, instead security, loan providers tend to consider all of them as the riskier.

For many who apply for a consumer loan online and the loan is eligible, you could potentially typically anticipate to get currency smaller than just that have some other version of resource. You are getting the bucks in a single lump sum – and you will be likely to pay off your debt inside fixed monthly repayments inside a predetermined time.

One of many great things about a consumer loan for choosing property would be the fact borrowers is also generally use this sorts of loan for nearly any personal purpose, out of settling existing personal debt ( high bank card balances , including, otherwise a big medical statement) in order to capital a giant buy-and therefore has to shop for land.

Signature loans may also keeps a lot fewer initial will set you back than other models away from finance for selecting belongings, because the individuals may not have to fund appraisals, studies, title hunt, or other settlement costs. But not, rates of interest private financing have left upwards in the last year by discount.

If or not a consumer loan try a suitable solutions, however, can get rely on simply how much you will have to acquire buying the latest parcel of land you need of course you can get approved for a financial loan that will not bring high https://paydayloanalabama.com/sterrett/ notice.

Instead, loan providers will in the good borrower’s credit to determine when they qualified to receive these types of mortgage and precisely what the terminology commonly end up being

How much you can borrow is vital. Unsecured loan wide variety generally may include $1,000 so you can $fifty,000, according to your revenue, existing obligations, credit score, therefore the lender. One of several some thing and only unsecured loans is the currency appear easily.

If you’re not in almost any hurry to create into the property, even if, or if you anticipate to lay a property or second family on parcel soon, you will probably need to take aside an extra financing. Therefore, you may be considering settling two financing on the other hand: the private financing to the residential property pick and you can whatever particular resource you determine to have fun with when you begin framework.

Therefore seeking a personal loan to possess belongings? Personal loans possess some positives that can make certain they are a great option for to invest in property. However, there are even some drawbacks. Let me reveal an instant realization:

Leave a Reply