Using your Family Equity for a divorce or separation Payment

- The way you use house guarantee

- Display otherwise offer

- Refinancing and you can home collateral finance

More 70% from elderly Americans think their property probably the most worthwhile asset it very own. For the majority of younger People in the us, the house means a great deal of ventures. Throughout the a breakup, you must decide what to do with one to assets.

Your home equity means exacltly what the house is worth versus just what you owe in the financing, plus each other mortgage loans and you will household guarantee fund. That it shape would-be a fundamental piece of their divorce case conversations along with your spouse.

Utilizing house collateral throughout the a splitting up settlement

A number of claims, also Ca, situations purchased during the wedding are believed public, definition they must be separated into the divorce case until each other parties reach a different equitable arrangement. For many individuals, house equity is the prominent investment to split.

- Sell our house and you may split up the earnings evenly.

- Pick out your mate and maintain the house.

- Trade almost every other worthwhile possessions with your partner to keep our house.

For every alternative boasts benefits and drawbacks. Such, you might feel dissapointed about attempting to sell a house if you live in good tight sector that have not any other choice. But this is not a decision you could potentially stop. In your divorce or separation, you ought to know very well what to do with so it most rewarding advantage.

Knowing just how your property guarantee can be put on your own divorce, you desire study. Realize these tips to decide just what path suits you.

1. Get an enthusiastic appraiser

Professional appraisers walk through your residence and you can property, explaining this pros and cons in your home because is right now. The content you earn off an appraiser is more direct than the domestic worthy of you notice into the possessions taxation statements. Appraisers think simply how much your house could well be well worth for individuals who were to sell it nowadays.

An appraisal could cost as low as $313 to have one-family home. You and your partner you’ll express this costs, or you might bring it towards individually to get recommendations getting the divorce case settlement plan.

dos. Determine your own genuine guarantee

Remember that your home collateral ‘s the difference in exacltly what the house is really worth and your balance. An appraisal offers only 1 / 2 of so it formula.

Start with your home loan. The common American consumer possess more $200,000 inside the financial loans, even though your personal could differ. Influence your debts, and inquire the company regarding very early cancellation fees. If you would get slapped which have a fine to own paying the balance during your divorce case, you to definitely number is always to go into their computations.

People have fun with home equity finance otherwise domestic security lines of credit (HELOCs) to pay for repairs, getaways, and much more. A beneficial HELOC lets people to use to 85% of one’s home’s worthy of. These items surged in the prominence inside 2022.

A leading financial harmony and you will significant HELOC could indicate your residence will probably be worth little or no on your payment. However, you may be surprised at this new influence you have on your breakup using this that extremely worthwhile house.

step three. Evaluate debt balances

To keep a beneficial mortgaged home, you should get a hold of somebody willing to pay the existing unit and provide you with a separate one in the label only. Have a tendency to your credit rating last in order to scrutiny? Is it possible you create an unicamente homeloan payment?

4. Assess your own market

If you possibly could buy your home because the an unicamente manager, want to stay static in it? A property your shared with your ex lover could well be full of bland thoughts you prefer to forget about. Doing fresh you are going to leave you a resume, however it you can expect to include transferring to a different sort of area or condition.

Get in touch with a representative you trust, or take a peek at a number of attributes for sale in the newest opportunities. If you can’t look for something appropriate, being set was smart.

Refinancing and you will house security money

You’ve talked together with your lover, and you will you’ve chosen to stay in the house your once mutual. Preciselywhat are your options?

- Repay your own dated mortgage

- Give you a separate home loan on the name

- Create an identify the difference between the 2 money

That last take a look at means their payout towards the lover during the divorce payment. You walk off with a brand new mortgage on your own label and you may independence from your own companion.

Should your have a look at is small, it click here to investigate is possible to make within the variation by giving your partner one thing regarding equivalent well worth, such as the family members vehicle, boat, or vacation domestic.

Some individuals consider HELOCs or family security financing and also make within the difference between a divorce proceedings settlement. Unfortuitously, this option does not treat him/her in the residence’s specialized label. You’re both on hook up getting home loan repayments and you may HELOC money. If you want a flush break inside the divorce case, it is not an educated route for you.

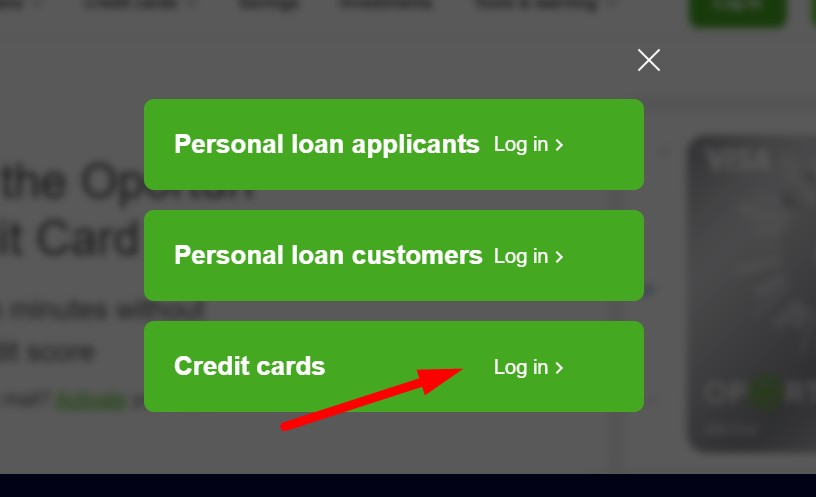

Wanting a mortgage companion might be not too difficult, particularly if you have a good credit history. Nonbanks, such as Skyrocket Home loan and you will LoanDepot, focus on points designed for home owners, plus they approved more a couple-thirds of all of the mortgages into the 2020. A company similar to this you certainly will issue a good preapproval for a loan in minutes, enabling you to keep told discussions with your spouse.

Zero choice is naturally correct otherwise incorrect. You and your spouse can decide if the keeping your house was better or if perhaps offering is most beneficial for all inside it.

It’s a decision you will have to arrive at to each other, that have or without having any assistance of additional recommendations. A split up intermediary helps you come to a choice more quickly and you may affordably than simply if you hired a lawyer.

Leave a Reply