Aspects of To buy a property Versus a partner in australia

Home loan Conditions

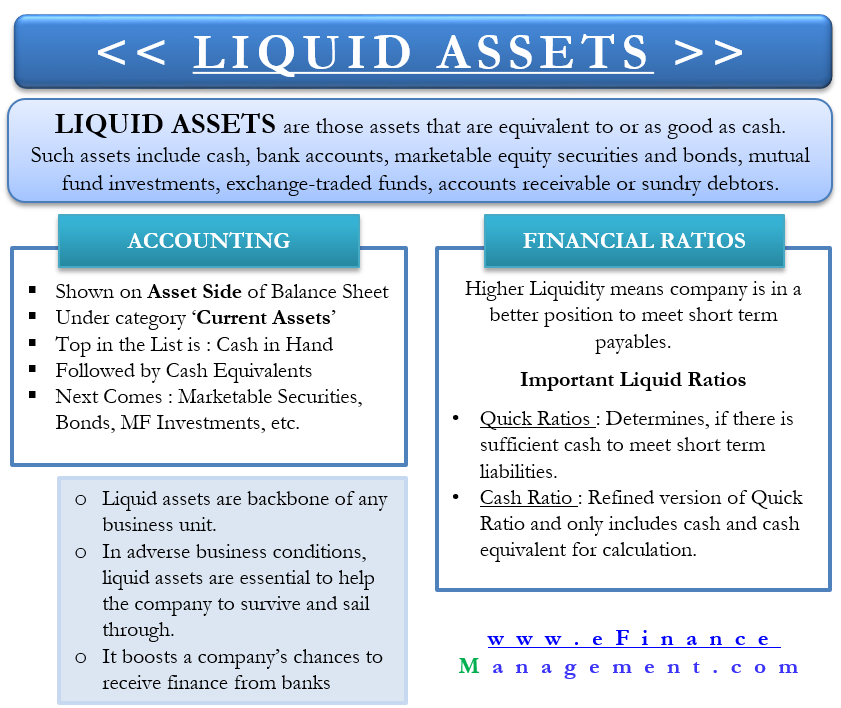

Financial requirements for someone application can be much more stringent, requiring an effective personal financial reputation. To help you acquire a mortgage around australia, a deposit off 10-20% will become necessary, with at least put out-of 20% needed to avoid paying lender’s home loan insurance coverage (LMI).

Being aware of the loan conditions and you can making certain your fulfill all of them is important when buying a home in place of a spouse.

Search qualified advice regarding financial coordinators, home loans such as for instance Soho Mortgage brokers, and you can legal professionals to understand the latest ramifications additionally the means of to shop for property in place of a wife.

Potential Enough time-Label Consequences

- The possibility of a decrease in the value of the property

- The bad credit loan Dunnavant chance of a decrease in the borrower’s credit history

- The opportunity of a reduction in the latest borrower’s capability to acquire upcoming capital

- Relationship property, plus assets obtained in the place of a partner, is generally at the mercy of assets department in the eventuality of separation otherwise divorce proceedings.

From the offered this type of prospective enough time-name outcomes and and make the best decision, you might most useful cover their hobbies and make certain a profitable assets order.

De- Facto Relationship and you can Property Ownership

De facto relationship and you can possessions control in australia involve particular definitions and possessions legal rights. Insights these types of issues might help protect the appeal and ensure a good effortless property purchase processes in the event of a de- facto matchmaking.

Definition of De- Facto Relationships

A de facto relationship is described as one or two solitary anyone life style to each other for the a wedding-for example matchmaking, aside from gender. It’s important to see the concept of the word de facto relationship’.

Possessions Rights during the De- Facto Relationship

Possessions liberties within the de- facto relationships are state-of-the-art, with low-getting people possibly that have a state they a percentage of the assets dependent on individuals products, instance financial contributions together with Friends Law Work.

This new requirements to possess an excellent de- facto companion to have a state in order to possessions payment, including a property, under the Family Rules Work was in depth as follows:

- Having lived to each other to possess a critical several months (essentially couple of years or higher)

- Having a bona fide residential relationship

- That have monetary and you will/or youngster-relevant things as fixed.

When breaking up property in the an excellent de facto relationships, it is necessary in order to first select and you can evaluate the property and you can obligations each and every party. At the same time, another circumstances would be taken into account:

- Monetary contributions

- Non-economic contributions

Of the understanding property rights for the de- facto matchmaking, you might top manage your own hobbies and ensure a fair property department in the event of break up or divorce proceedings.

There are numerous reason why one may want to purchase property versus its companion in australia. These could become a woeful credit rating, overwhelming debt, or an aspire to care for separate profit.

It is required to know these reasons and exactly how they may effect the choice to find a home without your lady.

Chart The right path: Taking up the home field unicamente? The report about to find a property since the an individual woman in Australia will bring advice, info, and you can help to suit your excursion.

Less than perfect credit Score

A wife or husband’s bad credit get might have a bad influence on a combined home loan software, leading to large interest rates if not getting rejected.

Should your mate enjoys a reputation personal bankruptcy otherwise property foreclosure, otherwise a massive personal debt that impacts the creditworthiness, loan providers may refuse their mutual application for the loan.

In addition, a non-existent credit rating can be considered a risk because of the financial institutions, increasing the probability of the home loan app becoming denied. Which, making an application for a home loan truly can be a far greater option when the you to definitely companion have the lowest credit history.

Leave a Reply