What is the Obligations-to-Earnings Proportion to the a Jumbo Home loan?

Thus, if you’re trying to good jumbo mortgage, the lender will probably want to find a premier credit history (usually 700-720 or more).

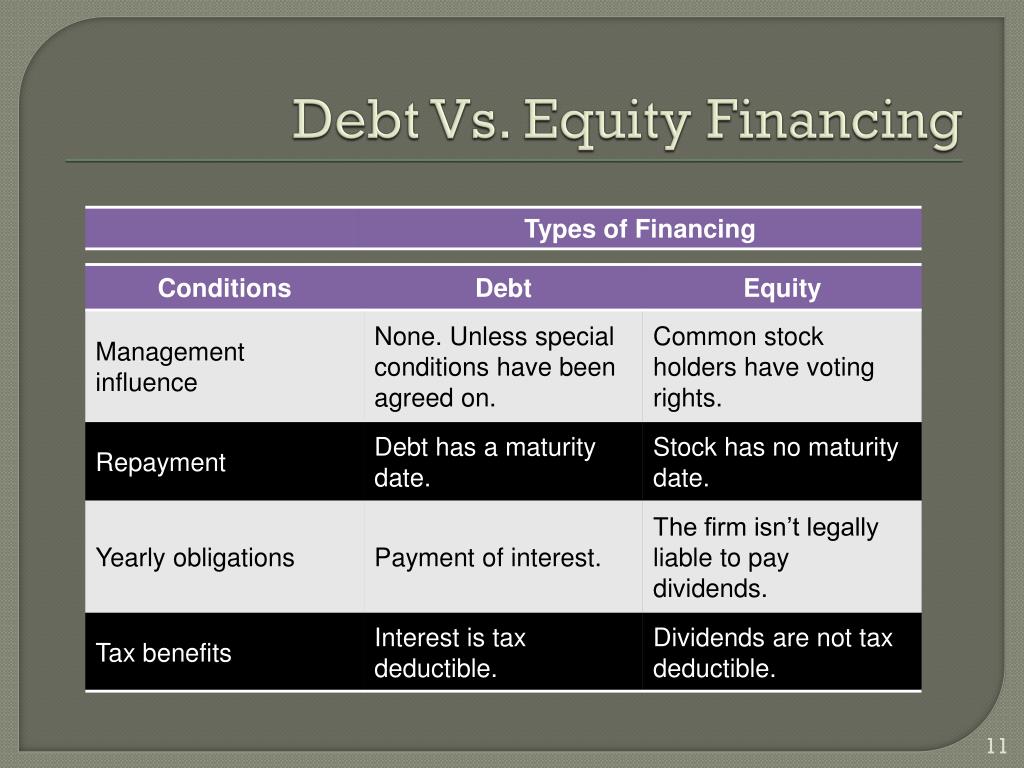

A debt-to-money proportion was a strategy getting loan providers to decide for individuals who meet the requirements to possess a mortgage. The debt-to-money ratio says to the lender simply how much of one’s income try heading on the one current costs and what section of your revenue remains to suit your home loan.

This new DTI try split up into two-fold – the leading and you will back end. Leading end is the housing will cost you, additionally the back end relates to all other monthly expense (playing cards, auto loans).

How Loan providers Assess Financial obligation so you’re able to Income Proportion

Whenever obtaining an excellent Jumbo home loan, really loan providers look at a few different DTI ratios: Back end & Front-Stop DTI Ratios.

Usually, lenders don’t like DTIs more than 36%, but this may will vary dependent on additional factors such as for instance credit records & resource reserves.

Jumbo Financing Restriction – Ought i Get approved to own a high Count Than just I wanted?

Nope. Unfortuitously, you can not add more your own jumbo loan to keep a little more money in to your pocket.

You’re going to be acknowledged to possess what you want and nothing far more. That is certainly one of only a small number of times when your should not become approved for over you desire!

In the event the domestic appraisal returns more than everything decided for the provider, well, then there is very good news! But that’s not a thing you to loan providers does to you.

Personal Mortgage Insurance policies (PMI) on an excellent Jumbo Home loan

Personal mortgage insurance coverage covers lenders against standard on your own financing, you get they terminated when you have 20% equity home.

The cost of that it protection are steep-$step 1,five-hundred in order to $dos,000 a-year- however it is worth every penny to have buyers having quick off repayments. It can cost you about one percent of overall amount you owe monthly.

Just how much try PMI to own jumbo funds?

For those who have a traditional home loan however, only put down ten% otherwise shorter, you will need to spend personal mortgage insurance (PMI) until the loan-to-worthy of (LTV) proportion drops to help you 80%.

Once you arrive at 80% LTV, your own financial try forced to Modesto installment loan bad credit no bank account terminate PMI on date whenever the dominating equilibrium is set to arrive 78%.

Sadly, it’s not just as possible for jumbo fund. There isn’t any industry practical getting PMI cost into jumbo funds, so you will most likely spend more than a conventional mortgage.

You to reduces in order to throughout the $4 each $100 regarding payment worth. On a $750,000 mortgage that have good 5% down payment (we.elizabeth., a keen LTV of 95%), this would emerge so you can on the $308 30 days for the a lot more advanced payments.

You’ve seen you to absolutely nothing flyer in the mail from time to time, offering you a teaser price off 3.99% in your mortgage payment. You will be not knowing ways to use they because it’s inside the small printing and you will doesn’t add up.

Thus, you place they on the recycling cleanup bin, however you remove tabs on it. (Who doesn’t eliminate track of something which short?) The other day, almost thirty days later, your unlock their mailbox, and there is a letter out of your bank proclaiming that you have failed while making five money.

Your credit rating is already lower. The lending company can begin delivering sees in the event the a whole lot more repayments is later-however, performs this indicate that given that all your valuable costs are past due, the bank can be lawfully foreclose?

Is it possible so they are able bring your home from you? Or even worse – What the results are if you standard on the loan completely?

Leave a Reply