Preciselywhat are Level 2 Visa or Competent Personnel Charge Mortgage loans?

Whenever a level dos visa try nearing their termination, a charge holder would need to apply for an experienced employee visa so you can offer its stay inside United kingdom.

This new charge method is an information-dependent design that requires an applicant requiring 70 points to be qualified to receive a skilled personnel visa.

This informative guide usually talk about brand new mortgages available to overseas nationals working in the united kingdom significantly less than possibly a tier 2 visa or good skilled functioning visa.

A familiar myth would be the fact overseas nationals can’t get home financing the help of its visa updates this really is perhaps not the outcome. Mortgage brokers tend to evaluate a loan application mainly into the common credit monitors and you may affordability standards.

not, lenders may also be seeking along big date new applicant possess resided within the British while the length of time leftover on their latest visa.

For every lender’s conditions vary however generally speaking lenders manage anticipate one financial applications will have been a resident in United kingdom an excellent minimum of couple of years prior to making a loan application so you’re able to build a card profile when you look at the Uk.

Some lenders is actually so much more strict and can require a great about three-seasons residence in addition to an effective British bank and you will family savings, however in get back, particularly loan providers may offer far more favorable conditions.

Can i Obtain a tier dos Visa or Competent Employee Visa Home loan having a poor credit History?

A track record of bad credit could possibly get feeling any home loan application however the degree of determine is dependent on the seriousness of brand new financial hardships.

Reputation of Condition Courtroom Judgments (CCJs), non-payments, bankruptcy otherwise Individual Volunteer Preparations (IVAs) perform show a greater chance so you can a lender than just a small offence.

not, loan providers could be selecting the length of day who’s got passed as the sleep credit number are signed on the an applicant’s credit score.

Although it would not be impractical to obtain a home loan which have a negative credit score, consolidating it foundation with a visa-related reputation may restrict your options.

In this circumstance, it might be recommended that the applicant aims separate monetary pointers prior to and work out a mortgage software in order for all the almost every other personal circumstances have more positive status in advance of approaching a loan provider.

A professional coach may advise and that loan providers might possibly be most compatible, get the best monetary equipment on criteria and you will gauge the probability of a software getting recognized.

Mortgage Lender’s Factors Whenever Assessing a tier dos Visa otherwise Skilled Personnel Charge Home loan Application

Like with a fundamental mortgage software, lenders will accept an evaluation technique to review the complete individual and you will finances of your own applicant(s) to help make a choice on lending.

- Decades Loan providers get a maximum age that they loans in Graham are happy to give to

- Duration of home when you look at the United kingdom Just like the discussed loan providers will get at least dependence on just how long an application have to have stayed in the British ahead of a keen software becoming generated

- Length of time in the most recent address

- A position condition and date that have an employer

- Quantity of dependants

- Affordability Lenders have a tendency to for every has their cost conditions which include looking at the amount of expense one a candidate have and way to obtain borrowing and month-to-month expense and you can degrees of throw away income

- Credit rating & Credit history A loan provider perform feedback both an applicant’s most recent credit score once the really while the intricate credit score declaration in addition to information on facts regarding the prior borrowing instance loans, handmade cards, home debts and certainly will description the success of typical payments because really because the outlining people later otherwise overlooked instalments or other things.

If you have people significant situations with the a credit rating including due to the fact Condition Court Judgments (CCJs), non-payments, bankruptcy proceeding or Personal Volunteer Plans (IVAs) with regards to the products, it can be advisable to wait until the newest events drop-off a credit history just after six many years.

When you yourself have a reputation any such situations, it is strongly suggested one recommendations are tried out-of either an enthusiastic independent economic advisor or large financial company just before and make a home loan application who will assess all activities involved and you will suggest the probability of an application becoming acknowledged.

Foreign National Mortgage loans

Level 2 visas or Competent Staff Visas are not the only version of immigration statuses that could be appropriate for a mortgage in the united kingdom. Almost every other performs it allows or statuses tends to be thought to be long as the fresh new candidate match the next key conditions:

- Existed in Uk getting at least two years

- Enjoys a long-term a position contract set up

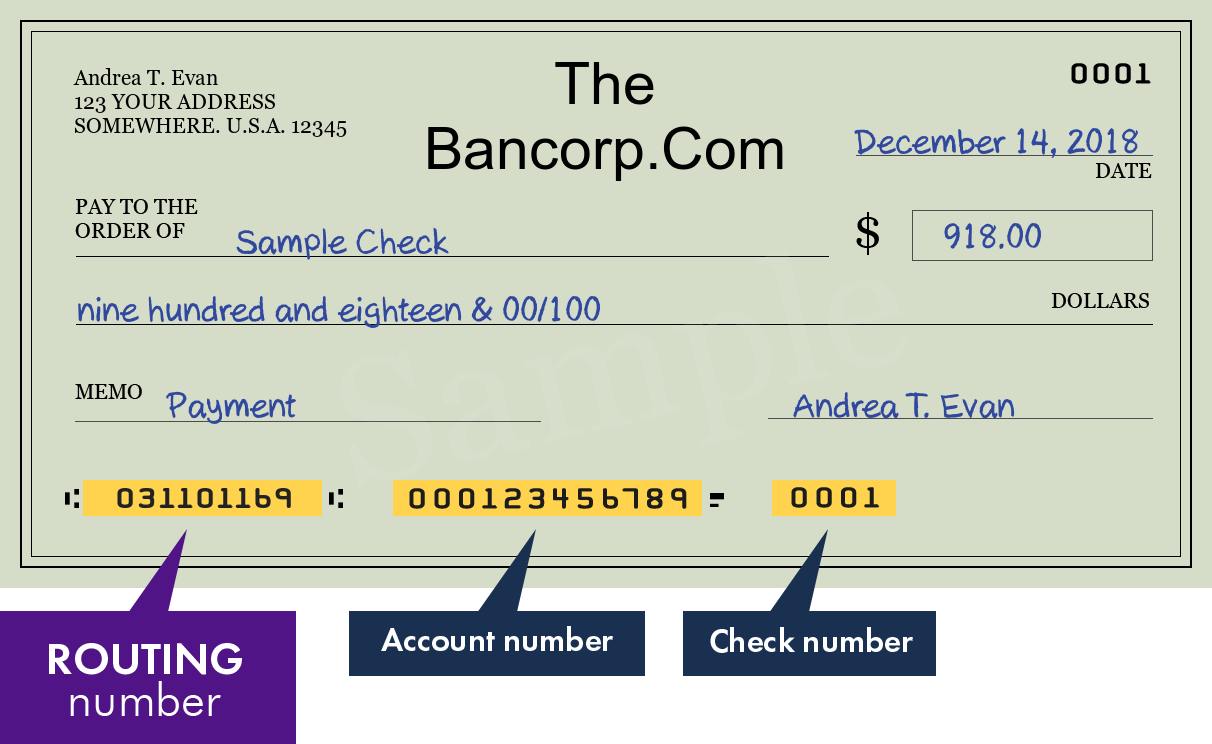

- Have an unbarred United kingdom checking account

Investing in property to book try a greatest choice for many although criteria to possess Purchase-to-Assist Mortgages is pretty rigid, commonly demanding highest levels of places together with a business package explaining brand new forecast earnings appearing the possibility leasing income.

There are not any restrictions having foreign nationals in great britain under either a level 2 visa otherwise a skilled performing visa, getting a purchase-to-Assist Financial for as long as this new standards will likely be met.

As with other kinds of lending products, the credit conditions vary anywhere between loan providers and that to possess an insight into industry standards and you may normal bank enjoy, we recommend that a scheduled appointment is made with a mortgage broker.

Tier 2 Charge Mortgages Summation

When you are a foreign national trying to buy a property into the United kingdom, please get in touch with our very own professional party from mortgage brokers. All of us gain access to a wide range of loan providers and you may mortgage products in purchase to obtain the best suits for the private situations.

Please feel free in order to connect with these friendly party of advisors so you can guide a first appointment to go over the options around.

Call us now on 03330 ninety sixty 31 otherwise feel free to get hold of us. Our advisers might be ready to talk courtesy all the of alternatives with you.

Leave a Reply