Fifth 3rd Bank home loan professional responses audience questions

Show this:

- Click to fairly share into LinkedIn (Opens in the new window)

- Mouse click to current email address a relationship to a friend (Reveals inside the the newest window)

Rating all of our mid-time publication provided for the email!

Over the past half a year, QCity Location enjoys asked website subscribers to submit their home-purchasing inquiries. Less than, Tori Calhoun, an elderly home loan maker within 5th Third Financial, have a tendency to answer these inquiries. Calhoun has been on 5th 3rd for more than thirteen ages and has now put many users in their fantasy house.

Tori has had new President’s System Prize that is constantly an excellent Platinum Top Performer during the 5th Third. She provides a massive number of mortgage knowledge to help you their unique people that’s able to overcome issues, demands, offer counseling, and you may get to know per financial predicament to make sure it’s the greatest fit for for each and every customer’s requires. Tori try local towards Charlotte town features lived-in New york all the their unique lives.

I would like to assist my personal mature daughter from inside the to order a property. Which ones solutions is the best: Do i need to become a beneficial co-signer into mortgage, definition one another my personal term and hers was towards the deed? Or, must i deliver the fund she means to own an advance payment/closing costs with only her identity into the financial? My credit rating (800s) exceeds hers. I reside in Charlotte; she stays in Maryland. The home my personal daughter commonly pick will be in Maryland, in which she has existed for the past 3 years. She actually is renting indeed there, and i am leasing today inside Charlotte. I offered my personal condo in the Charlotte into the , thus i understand that I would qualify a first-day homebuyer once the more three years has elapsed once the ownership.

Which is extremely nice of you to assist your own daughter which have their very first family purchase! She is a happy lady! I suggest alternative 2, for some factors. In case the de, it could be best to allow her to accomplish that in the place of as one taking up the debt and you can duty to repay it. After you co-sign for the loans, you to debt will get section of debt financial obligation. By letting her get it done on her behalf own, you are not responsible for your debt, neither might you bear one borrowing from the bank derogatory would be to she standard towards the borrowed funds. This 2400 dollar loans in Centennial CO is the best method to ensure that you keep the 800+ credit history while keeping debt obligations lowest. In addition, it enables you to remain eligible to become a first-date homebuyer again and possibly benefit from earliest-go out homebuyer programs as you are currently renting also and is lookin into the owning a home again in the future.

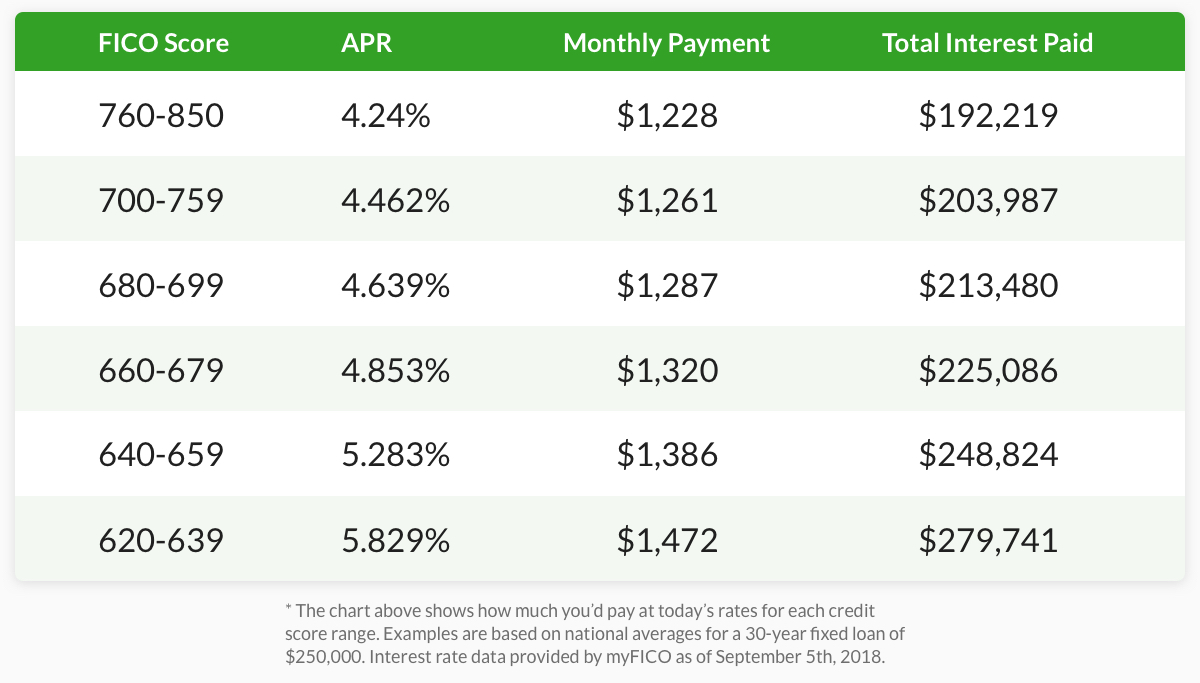

Credit rating versus home loan programs

A mortgage credit query is recognized as an arduous inquiry. It include a report regarding all of the around three credit reporting agencies – Experian, Equifax, and you may Transunion. Typically, this new perception was small and short term. Exactly how many points really does are different anywhere between each bureau, for each and every customer, as well as their overall credit history. Considering FICO, an arduous borrowing inquiry often miss your credit score between step 1 and 5 facts. While looking for a home loan, it is best to do so when you look at the a thirty-go out screen. Extremely credit scoring activities have a tendency to amount numerous issues as one, that helps shed the new feeling as well.

I’m frustrated! You will find a credit rating and two approval emails out-of financing organizations. However the price of our house I would like so elevated you to it exceeds the importance, and so i must assembled the real difference? Is this judge? Our home will certainly perhaps not appraise for this amount? Wink wink! Assist! I would like to buy property.

Leave a Reply