Contribution Margin Ratio Revenue After Variable Costs

We’ll start with a simplified profit and loss statement for Company A. It can be important to perform a breakeven analysis to determine how many units need to be sold, and at what price, in order for a company to break even. Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio.

Variable Costs

As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit.

Business Cards

The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. The contribution margin further tells you how to separate total fixed cost and profit elements or components from product sales. On top of that, contribution margins help you determine the selling price range for a product or the possible prices at which you can sell that product wisely. In the next part, we must calculate the variable cost per unit, which we’ll determine by dividing the total number of products sold by the total variable costs incurred. The Indirect Costs are the costs that cannot be directly linked to the production.

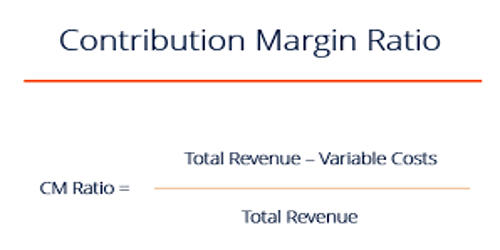

Formula to Calculate Contribution Margin Ratio

You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. Contribution margin analysis also helps companies measure their operating leverage. Companies that sell products or services that generate higher profits with lower fixed and variable costs have very good operating leverage. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits.

When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage. To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. Variable expenses directly depend upon the quantity of products produced by your company.

Formula

Now, this situation can change when your level of production increases. As mentioned above, the per unit variable cost decreases with the increase in the level of production. Direct Costs are the costs that can be directly identified or allocated to your products. For instance, direct material cost and direct labor what is the journal entry to record amortization expense cost are the costs that can be directly allocated with producing your goods. Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost. Such an analysis would help you to undertake better decisions regarding where and how to sell your products.

In order to calculate the contribution margin ratio, you’ll first need to calculate the contribution margin. In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable. This is because the breakeven point indicates whether your company can cover its fixed cost without any additional funding from outside financiers. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold.

- This analysis can aid in setting prices, planning sales or discounts, and managing additional costs like delivery fees.

- Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income.

- Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio.

- In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making.

- The contribution margin income statement separates the fixed and variables costs on the face of the income statement.

Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company.

A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales. In order to perform this analysis, calculate the contribution margin per unit, then divide the fixed costs by this number and you will know how many units you have to sell to break even. For every additional widget sold, 60% of the selling price is available for use to pay fixed costs.

For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. The contribution margin ratio is a formula that calculates the percentage of contribution margin (fixed expenses, or sales minus variable expenses) relative to net sales, put into percentage terms. The answer to this equation shows the total percentage of sales income remaining to cover fixed expenses and profit after covering all variable costs of producing a product. As mentioned above, the contribution margin is nothing but the sales revenue minus total variable costs.

These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc. The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure).

Leave a Reply