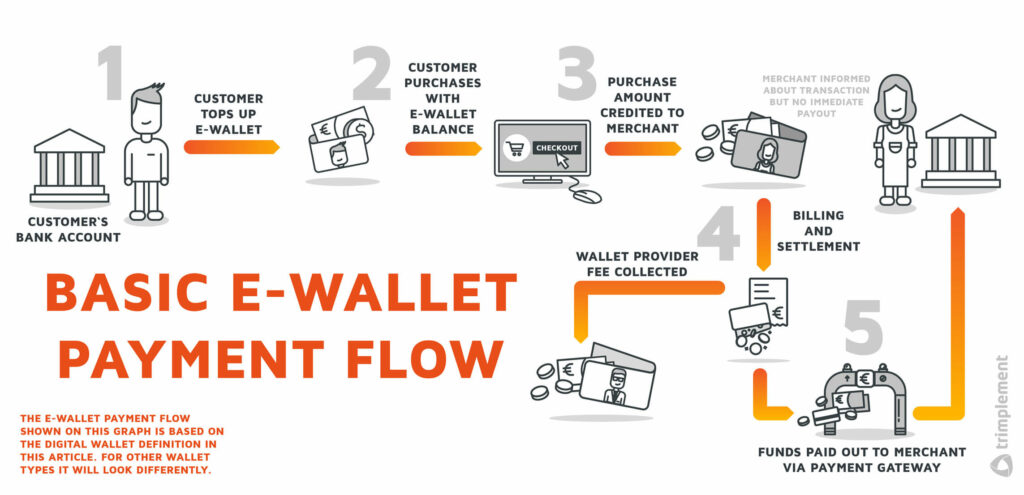

These types of apps promote relaxed borrowing criteria and flexible words

First responders was those who put their lifestyle at stake to simply help others. Of several earliest responders struggle to become approved for a home loan since of their employment. They often need to performs weird era, which could make it difficult in order to meet the needs place of the conventional lenders. Luckily, there are now several mortgage apps designed especially for first responders. If you’re a primary responder interested in a home, be sure to check out the basic responder home loan applications readily available in your area.

- Police

- Firefighters

- Paramedics

First responder mortgage software provide relaxed borrowing standards and flexible terms. This will make it more comfortable for basic responders locate accepted having home financing.

1) Helper Act

The newest Assistant Act stands for Property per regional Protector, Instructor, and Responder. and you may was produced in 2021 from the Senators Marco Rubio and you will Jon Ossoff.

The fresh Assistant Work is a proposed statement who would render so much more reasonable a mortgage in order to regional the police, firefighters, or any other social shelter pros. Consumers will pay an upfront mortgage premium (MIP) value nearly 4% of the full loan amount however, they are going to benefit from no off percentage otherwise geographic restrictions as long as their area code falls in this specific parameters.

2) HUD Good neighbor Across the street

The latest U.S navigate to these guys Department off Homes and you can Metropolitan Development’s (HUD) Good neighbor Nearby program is an excellent opportinity for societal servants (very first responders) to gain access to brand new housing marketplace if searching for to get or renting house that will be discover close portion with a high revitalization potentials! You should buy a home on 50% out-of their appraised worth whether it exists within designated regions.

3) Home to possess Heroes

Home getting Heroes couples which have realtors, lenders, and you will title companies to assist first responders save very well real estate expenditures. The program’s webpages states qualified business are cops firefighters EMS military (effective or resigned) medical care professionals teachers; that it organization even offers fund that go into paying off home loan stability once you join the reserves.

House to own Heroes was good nonprofit that provides army pros and active-duty employees having entry to reasonable property. It works due to its circle off experts, however they are not loan providers on their own you will need as an alternative to a target wanting far more competitive prices off family relations-had national financial institutions.

4) Antique Mortgages

Antique mortgage loans are perfect for very first responders, in just 5% off and you will repaired prices along side longevity of that loan. You will not get a hold of an increase in their fee when taking aside this kind of mortgage. So you can qualify just be sure to make up personal financial insurance coverage (PMI) that’s pricey but worth your while. You can easily benefit from fixed pricing more than your daily life so that you never ever spend over what is actually agreed upon in the for every payment per month several months when deciding how much home they want; individual lenders want credit ratings but do not check always them before granting funds just in case you meet particular certification.

5) FHA Mortgage loans

When very first responders want home financing, the latest Federal Houses Government (FHA) is actually a company that can assist. They offer financing which have flexible deposit standards and easy qualification standardsspecifically preferred one of first-day people because of their lower step three% demands. You just has actually good credit, which means that with this specific form of funding you can aquire even when their get isn’t as high!

6) Virtual assistant Mortgage loans

The newest armed forces is a fantastic education floor to possess coming the authorities officers. Many police officers and you can first responders has actually served regarding the equipped pushes, which means these are typically eligible to make use of Veteran Facts finance just FHA mortgages plus those with no advance payment demands! Such funds-amicable applications also provide unbelievable value with their reasonable pricing compared with other systems on the market today.

The new veterans’ financing program is one of the most preferred home loan choice because it doesn’t have downpayment and you can lowest pricing. The government also promises your money, that renders it a fascinating selection for the majority of people who want buying a home but could never be in a position if you don’t owed to help you monetary constraints and other explanations.

Very first responders and you may army teams could be qualified to receive downpayment guidelines as a result of multiple regulators applications. The fresh BorrowS, provided by Freddie Mac computer Family Possible or You to definitely mortgage lender try one such solution that give up to $dos,500 inside money if you satisfy certain guidelines out of home earnings level. The capacity to score a down-payment for the a person’s earliest responder solution is one thing that lots of anybody want and want. Luckily for us, you’ll find programs available at both regional peak as well due to the fact condition membership in the event you meet the requirements!

Very first responders will be the basic appearing for all of us inside times of dilemmas and it is today our obligation to show right up for them in the property processes. These day there are multiple mortgage guidelines programs customized specifically for very first responders. These types of apps promote casual borrowing from the bank requirements and flexible terminology for your convenience. When you are an initial responder shopping for a house, definitely investigate first responder mortgage advice software for sale in your neighborhood.

Smart Buyer Resources Talk w/ Our very own Very first Responder Home loan Pro Home loan Calculator: Calculate Your own PaymentsGet a speed Offer: Observe how Far Home You really can afford

Leave a Reply