$354M in the Mortgage Recovery Accessible to Georgia People

Find out how you might be able to get mortgage help as a consequence of Georgia’s COVID homeowner-relief program.

At the beginning of 2021, President Joe Biden closed the fresh new American Cut Package Operate toward law. This rules composed a homeowner Assistance Funds, a national system, to give $ten billion with the states to help households that will be trailing on the mortgages or any other houses expenses due to COVID-19.

Qualified home owners inside the Georgia with experienced a monetaray hardship on account of COVID-19 can get a few of the up to $354 billion used on the state-around $fifty,000 for every single family-by making use of on the Georgia Financial Assistance system. This option spends federal currency to greatly help home owners generate home loan repayments and you will spend most other household-relevant costs.

Available Financial assistance to own Georgia Homeowners

- You could be able to qualify for fund so you’re able to reinstate your delinquent real estate loan. You could also meet the requirements locate possibly about three days out of extra mortgage payments for people who haven’t yet , retrieved economically.

- You might be eligible a-one-date percentage towards the financial to attenuate the total financial harmony (a main curtailment).

- You could feasibly get paid to spend delinquent non-escrowedproperty taxes, homeowners’ insurance policies, condo or homeowners’ association charge, and you will power money.

No matter if a foreclosure has started, you may still have time to acquire assistance from the new Georgia Financial Guidelines system. Notify your loan servicer that you’ve placed on the application. But not, you must know that applying for recommendations will most likely not avoid a foreclosures. Once you pertain, notify the application form manager in regards to the foreclosures and supply a copy of document showing you to a foreclosures product sales could have been arranged for your home so that your application can be fast-monitored.

You might also have time to work out an alternative to foreclosures with your financing servicer. And when you’ve got questions relating to the new foreclosures procedure within the Georgia or should understand prospective protections to a foreclosures, thought conversing with a property foreclosure lawyer.

Qualification Conditions on Georgia Home loan Advice System

So you’re able to qualify for respite from this program, you’ll want sustained a monetaray hardship (a material reduced earnings otherwise an increase in bills) after , on account of COVID-19. But if your financial hardship try healed which have a different sort of give or sort of guidelines, you aren’t eligible.

- Your house need to be based in Georgia.

- You should be currently located in our home since your no. 1 household, and also you have to have been residing in the house in the period of the difficulty. (2nd property, capital services, and you will unused services usually do not qualify. Are produced mortgage brokers, but not, are eligible.)

- Our home must be titled on identity regarding good pure individual, maybe not an LLC, trust, or team.

- For those who have home financing, it should have been a compliant mortgage during the origination.

- All your family members earnings have to be equivalent to otherwise lower than 100% of the town average income (AMI) to suit your county. Otherwise all your family members income need to be White Plains loans equal to or less than 150% of your county’s AMI for many who (the brand new resident), debtor, or partner is recognized as a good socially disadvantaged individual, like those that happen to be brand new target off racial otherwise cultural prejudice or social bias, or people with minimal English competence, eg.

Resident advice applications and needs changes have a tendency to, and not every loan providers and servicers engage. Be sure to check the official Georgia Financial Guidelines web site to have the most up-to-date guidance and you can qualification criteria.

Just how to Submit an application for Assistance from the newest Georgia Home loan Recommendations Program

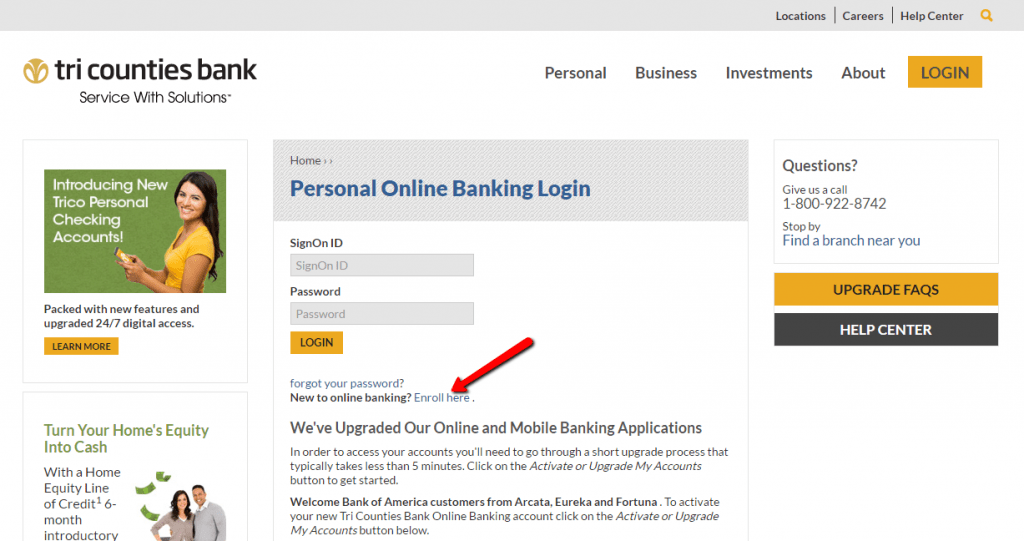

Visit the Georgia Mortgage Recommendations web site to apply for assist from this program. You will need to offer some documentation along with your software, including home loan comments or statements to suit your almost every other houses-related will cost you, proof earnings (instance spend stubs and you may tax returns), and you will a national-given ID (instance a license).

What’s the Due date to apply to the Georgia Mortgage Assistance Program?

The application form will stay through to the earlier out of , otherwise when the finance assigned to the application features come worn out. If you feel you could meet the requirements, you need to pertain immediately.

End Resident Advice Finance Scams

When you get an unsolicited promote from the cellular telephone, regarding the U.S. send, compliment of email address, or of the text offering financial save or foreclosures save your self services, be skeptical. Scammers both address property owners having problems with the casing repayments.

This new Georgia Home loan Guidelines system is free. In the event the individuals requires that shell out a fee to track down homes counseling or to discover foreclosures prevention qualities using this program, its a fraud. Make sure you report any cases of con.

Find out more about new Georgia Home loan Direction System

If you have questions otherwise need help together with your app, label 770-806-2100, 877-519-4443, email address , otherwise remark new Georgia Mortgage Assistance program Frequently asked questions.

Along with, think getting in touch with a HUD-recognized housing therapist that will aid you free of charge. To obtain a therapist towards you, visit HUD’s site or call 800-569-4287.

Leave a Reply