And therefore SA bank comes with the lower interest to your mortgage brokers?

Article bottom line

- For each and every lender enjoys different credit criteria, and lots of banking institutions you’ll present even more favorable rates than anybody else.

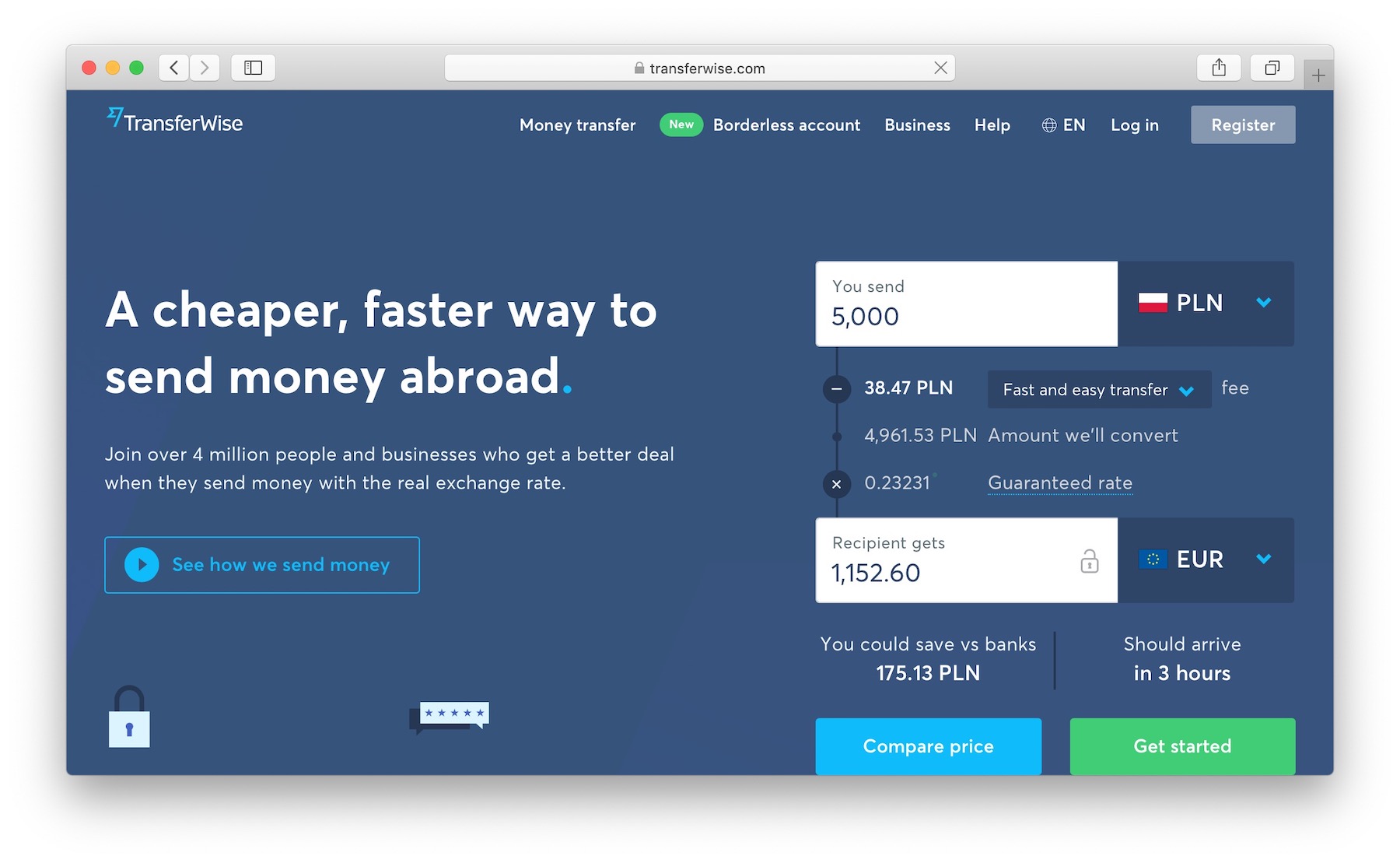

- With home financing analysis services such ooba Lenders, you can apply to several finance companies and evaluate the latest bundles it offer.

- Signing up to multiple financial institutions through home financing research solution provides the finest likelihood of securing a low rate of interest.

Home financing enables you to finance the purchase of your house or apartment with that loan in the financial, and then make homeownership a realistic option for the numerous, not only some of the.

Of course, the lending company reserves the right to refute your property application for the loan; and even whenever they approve it, you will have to shell out notice on loan amount.

We recommend that you don’t only connect with one to financial. For every lender has some other lending conditions, and some financial institutions you are going to offer you more favourable interest rates than others. Of a lot home buyers try not to even realise the benefit of doing your research to find the best contract.

The bank to your welfare rates

However, we could help you determine the best rates of interest already into give from the entry your application so you can several financial institutions.

Just how can finance companies influence interest levels?

- The South African Reserve Financial (SARB) sets theprime interest rate, which is the cause for every other interest rates, and home loan rates.

- Brand new bank’s interest rate on the home loan is linked so you’re able to the payday loan East Pleasant View top interest sometimes over otherwise below perfect, depending on your credit risk reputation.

What to realize about newest interest rates

- As of , the current finest interest rate was eleven.5%.

- There have been a great amount of current nature hikes to fight rising prices, however, positives expect those people nature hikes can be visiting an-end.

- That it anticipate is backed by the reality that the speed is left a similar at the meeting.

Alter your likelihood of providing a low interest

The interest rate on your own financial is based largely in your monetary circumstances. New a reduced amount of a threat the financial institution recognizes you to end up being, the reduced your interest rate.

Outside of the activities you have command over, the financing record is a vital. The financial institution spends the personal credit record to choose simply how much of a risk you are. You can improve your credit score by the:

- Paying off financial obligation.

You can buy prequalified that have ooba Lenders to determine their credit record along with your probability of being qualified to possess a mortgage. Therefore provides you with best of how beneficial their interest rates will be.

Applying for a mortgage via your private banker may not necessarily produce an educated price, as your banker’s basic consideration is to get the best contract to the lender.

Additionally, whether your application becomes rejected, might often need certainly to apply to another bank or hold out up to activities to you or your own financial transform.

Meanwhile, the newest time clock try ticking on the Render buying, and you will end up losing our home you have your own cardiovascular system intent on.

What are a knowledgeable lender having mortgage brokers

Home loan interest rates can vary depending on the financing criteria of one’s lender, together with financial predicament of one’s applicant. Therefore, it’s difficult to add a definitive means to fix issue of and that financial is the best for home loans, as it may be different for each candidate.

Thanks to this it assists to hire the services of an excellent home loan investigations service, including ooba Mortgage brokers. They’re able to apply at numerous finance companies for you, that assist you keep the deal with a minimal interest.

We also provide various tools that can make homebuying procedure convenient. Start by our very own Bond Calculator, up coming have fun with all of our Bond Indication to determine what you really can afford. Eventually, when you’re ready, you could potentially sign up for home financing.

Leave a Reply