Latest mortgage prices at the time of : Pricing dip, returning off into six%

Glen Luke Flanagan try good deputy editor at Chance Suggests whom concentrates on mortgage and you can charge card content. Their prior positions become deputy editor positions at Usa Now Formula and you can Forbes Coach, also elderly author on LendingTree-most of the focused on credit card benefits, credit scores, and you will related subject areas no credit check loans Kinsey.

Benjamin Curry is the director off posts from the Fortune Suggests. With well over 2 decades off news media sense, Ben possess widely protected economic markets and personal financing. Prior to now, he had been an elderly publisher at the Forbes. Before one to, the guy worked for Investopedia, Bankrate, and you can LendingTree.

The modern mediocre rate of interest for a fixed-speed, 30-year compliant real estate loan in the united states are 6.062%, with respect to the newest investigation offered by home loan tech and you may data organization Optimum Blue. Read on to see average prices for various types of mortgage loans and exactly how the current costs compare with the very last said go out past.

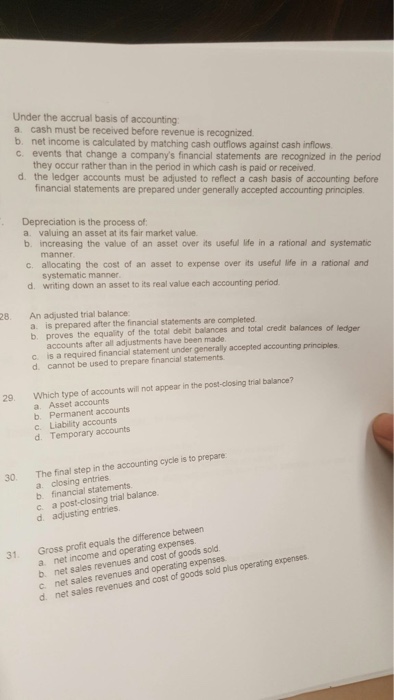

Historical mortgage pricing graph

Notice, there clearly was a lag of just one business day inside study revealing, which means most current rate to date is exactly what the fresh new graph reveals having Sep 20.

30-seasons conforming

The common interest rate, for each and every the most current analysis readily available during that composing, is 6.062%. That is off out of 6.088% the last said big date past.

30-season jumbo

What is actually an effective jumbo mortgage otherwise jumbo financing? This means, it is higher than the maximum amount to own a frequent (conforming) home loan. Fannie mae, Freddie Mac, additionally the Federal Houses Funds Department set so it restriction.

The typical jumbo home loan rate, for every single more newest study available at the creating, was 6.347%. Which is down out of six.542% the past reported go out prior.

30-seasons FHA

The new Federal Houses Administration provides home loan insurance to particular loan providers, as well as the loan providers in turn could offer an individual a far greater package towards the issues particularly to be able to be eligible for a good mortgage, possibly and make an inferior down-payment, and possibly providing a lesser price.

The typical FHA mortgage speed, for every many most recent studies offered at this writing, try 5.825%. Which is down out of 5.869% the last stated go out prior.

30-year Virtual assistant

A Va home loan exists by the a private bank, although Service off Veterans Affairs guarantees element of they (reducing chance on the bank). He is obtainable if you’re a You.S. armed forces servicemember, a veteran, or an eligible surviving partner. Including financing get often let the purchase of a property that have no deposit whatsoever.

An average Virtual assistant home loan speed, for every single many latest analysis available during that writing, is actually 5.487%. That’s up of 5.476% the past advertised go out earlier in the day.

30-season USDA

This new You.S. Service from Agriculture works applications to assist lower-income candidates go homeownership. Such as for example funds will help You.S. customers and you may qualified noncitizens get a house without down-payment. Note that there are stringent standards being be considered getting a beneficial USDA home loan, including earnings constraints together with domestic in an eligible outlying city.

The common USDA home loan speed, per probably the most most recent investigation offered at the composing, is 5.850%. Which is off away from 5.892% the very last reported day earlier.

15-seasons home loan cost

Good 15-12 months financial commonly usually mean large monthly payments but quicker notice paid back over the lifetime of the loan. The common speed to own a great 15-year compliant financial, for every single the most most recent data readily available at the writing, is actually 5.177%. That’s down out of 5.260% the last stated time past.

So why do mortgage prices transform?

If you’re yours borrowing from the bank profile have a tendency to naturally change the financial rate you are provided, there are even factors additional your own handle which affect their rate. Specific important factors tend to be:

Leave a Reply