TrussFinancial: Proudly named a best Mortgage lender for the care about-operating

Since a personal-operating business owner, how will you qualify for a home loan with reduced pricing?

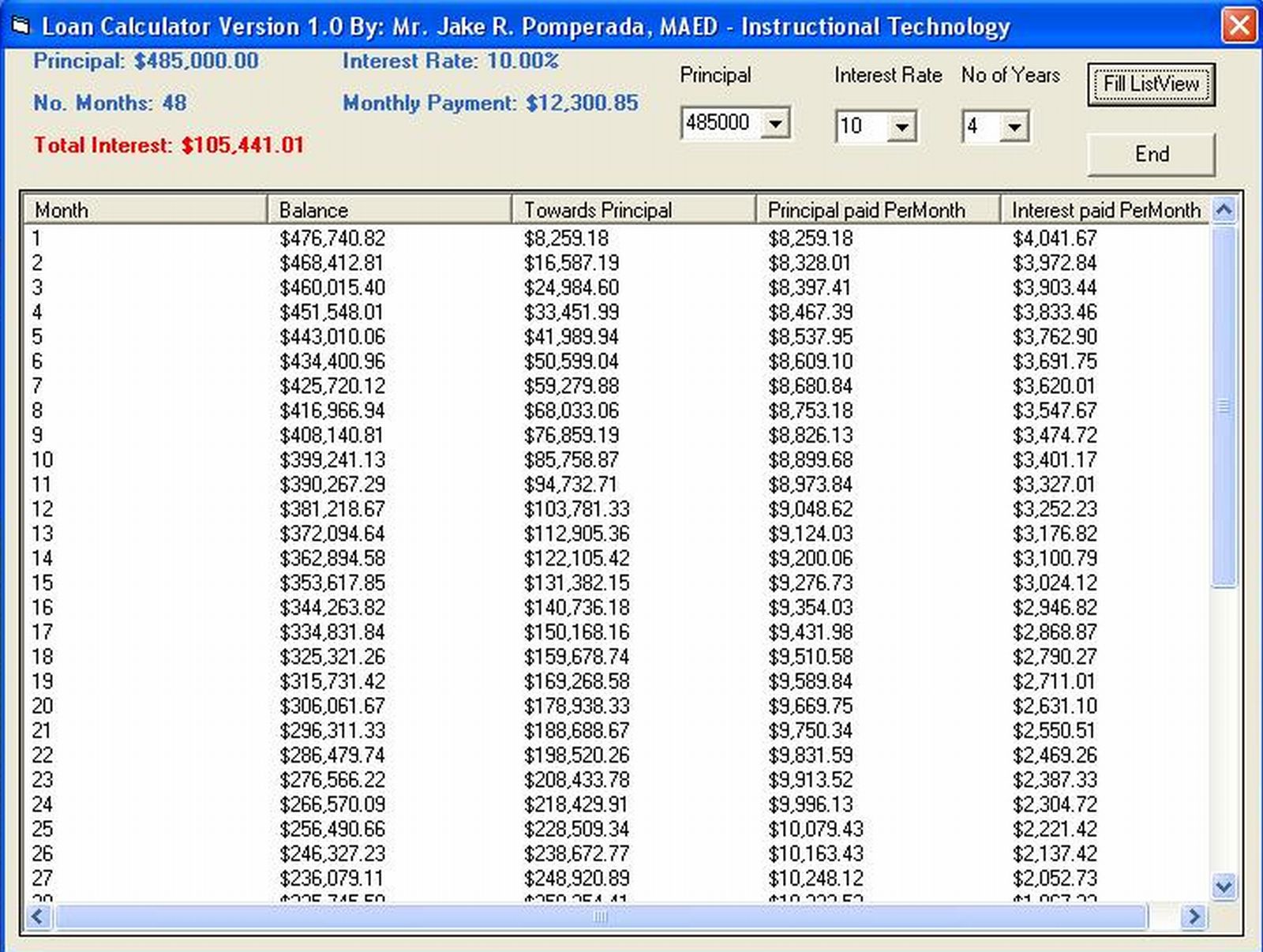

The solution is a bank Statement Mortgage, therefore dont actually you desire the taxation statements to help you be considered. Rather, i fool around with between step 3 so you’re able to two years away from deposit history, split they in half to compensate for the expenses, and employ the outcome so you’re able to file their month-to-month income.

Truss can help you maximize extent you qualify for that have good a dozen-times Financial Report Home loan otherwise a twenty-four-few days Financial Report Home loan.

Bank Report loans for the mind-functioning

Until the economic crisis, entrepreneurs such as for instance all of us familiar with qualify for mentioned income mortgages. But then Congress enacted the latest Dodd-Honest Act requiring old-fashioned banking institutions to follow rigorous financing statutes and you can file per borrower’s ability to pay back. Quickly, self-employed folks who develop-out-of costs you are going to no longer qualify.But there’s great. Truss Financial Class makes it possible to be considered towards lower Financial Report loan pricing. Should your expenses are less than fifty%, the CPA provide an income and loss statement. So it adds to the monthly mentioned earnings, and offer your far more to invest in energy.

We provide many mortgage brokers into self-employed, in addition to Mentioned Earnings funds (a/k/a beneficial NonQualified money). We offer Bank Declaration finance, House Depletion funds plus. And if you are seeking fund accommodations property, we offer DSCR money centered on Loans Provider Publicity Ratio, and even No-Ratio fund.

Bank Report Mortgages

Should your company suggests consistent income, a bank Declaration Home loan can help you be eligible for a mortgage even after delivering of numerous generate-offs. I use from around step three-a couple of years of one’s business or personal lender report deposit background, upcoming divide they in half to pay for the expenses. We utilize the ensuing amount in order to document your month-to-month money and you will make it easier to qualify for a minimal-rate home mortgage.

Self-Working Mortgages

With regards to investment your home, being worry about-functioning causes it to be hard to qualify for an interest rate having low rates. But Truss Monetary Group possess imaginative a means to help you be considered and save money. We offer many Thinking-Employed Mortgages including Stated Income loans (Non Qualified funds), Bank Declaration financing, House Destruction funds and a lot more. Whenever resource a rental possessions, we offer Financial obligation Provider Publicity Proportion money, as well as No-Ratio financing.

Mentioned Income Mortgage loans

Since a self-functioning small company owner, a house individual, otherwise business person, you legally optimize your taxation deductions each year. So your tax returns never tell your genuine monetary facts and you will ability to pay back an interest rate. Once the self-employed a property dealers ourselves, we all know. That is why Truss even offers Stated Earnings Mortgage loans and option an approach to be sure your ability to settle.

Can you Bills Your very own Existence From the Organization?

Wth a financial statement mortgage, we don’t care about your own expenditures. We will take your 12 or twenty four few days put record and calculate your revenue making use of your real money. So it saves you time and you can will get you the no money confirmation mortgage you have earned.

Regardless if You are an entrepreneur, You might Qualify

Entrepreneurs and you can a house traders usually be unable to be eligible for financial funds out of old-fashioned finance companies. And sometimes they resort to funding due to difficult money lenders that costs higher rates which dramatically expands domestic will cost you and you may decreases to invest in fuel. Truss even offers a wide variety of an effective way to prove your capability to settle. Apply to a good Truss mortgage officer to obtain the mortgage money you desire during the costs you can afford.

The secret to a stated Earnings Mortgage: The proper Monetary Facts

The W2 or tax come back may well not provide the loan you prefer. 1040s offer a narrow glimpse of currency you have available. Truss does know this, and then we help you to obtain the complete image playing with other economic comments you have to own a stated income home loan.

Centered from the business owners for entrepreneurs

Jeff Miller and you will Jason Nichols composed Truss Monetary Class to aid clients prevent the disappointments they South Dakota title loans reviews on their own had educated once the thinking-functioning a home dealers. Adopting the financial crisis away from 2008, as well as in the brand new wake of greater bodies control out-of old-fashioned banks, Jeff and you will Jason got sick and tired of applying for conventional mortgage loans, taking denied, and turning to difficult money money during the higher pricing.

They set their particular state because of the combining a group of non-conventional finance companies and you can financial financing particularly to support the latest worry about-operating and a house traders. Today having ages of experience and you may a specialist mortgage credit class, you might not get a hold of advisers having an increased ability to help you be eligible for the mortgage you prefer within reasonable you can easily rates.

Leave a Reply