Why It Doesnt Sound right to take that loan from the 401(k)

Cash crunches are hard. When you require money straight away otherwise is refused of the loan providers, you may want to feel as if their sole option would be to need out a loan from your 401(k). Centered on look regarding Wharton School of your own University out-of Pennsylvania, 20% from 401(k) package proprietors obtain using their 401(k) plans each time. Researchers guess that on average 13,000 People in the us borrow money every month from their 401(k)s to have a median of around $4,600. But not, there are many reasons as to the reasons taking financing out of your 401(k) try a bad idea.

The mortgage gets owed when a position closes at the latest business

Accredited plans aren’t required to give loans, but if they are doing, they’re able to give doing one-50 % of your own vested balance otherwise a total of $50,000. When you take away that loan from the 401(k), you need to pay-off they back in complete within this five years, to make no less than quarterly costs which cover applicable costs for desire and you may dominant. For the not many instances, such as buying your prominent residence or undertaking army service, an effective 401(k) mortgage is paid-in a time period of more than four decades. Yet not, if you are let go, discharged, or end your job, the remainder balance of your loan will get due within this two months of one’s time away from cancellation of employment. Because the common U.S. worker lasts 4.6 age towards the a job hence you to-fifth away from You.S 1500 no credit check loan. workers are let go, there are good chance that you will not enjoys five full years to pay right back financing.

The unpaid harmony gets taxable income

If you can’t pay back the loan within five years otherwise two months just after conclude earlier employment, in that case your kept loan balance becomes nonexempt earnings. Perhaps not following your repayment schedule may turn your own 401(k) loan towards a non-licensed shipments. Including spending relevant income taxes, in addition to funding growth, men and women around years 59 1/2 is subject to an excellent 10% early detachment penalty from the Irs. Particular states can charge additional taxes and you may penalties. This carry out make you that have a big tax bill for this year’s income tax return.

New delinquent equilibrium cannot be rolling more

Unlike your own leftover vested equilibrium on the 401(k), an outstanding mortgage balance considered while the taxable income can’t be rolling more than to the a professional bundle with a brand new or existing workplace otherwise on the yet another or current IRA. As yearly you have a limit as to how far you could potentially subscribe their 401(k), shedding previous benefits try a primary blow with the nest egg. Just you eradicate the modern equilibrium, and in addition you overlook years of investment yields.

Twice as much 401(k) income tax payments

An option benefit of saving getting old age with good 401(k) is you postponed taxation to your that cash up until senior years whenever you might be expected to be in a lower taxation bracket. By firmly taking aside financing from your own nest-egg, you will be expenses a loan having immediately following-taxation bucks and using once again taxes up on old age. Today, that is a double whammy!

Additional 401(k) financing charge

Brand new National Agency from Monetary Lookup (NBER) unearthed that on 90% regarding 401(k) agreements costs charges to have fund. Near the top of mortgage regarding finest including 1% in order to dos%, you happen to be prone to pay an origination payment and you can annual repair percentage. Depending on the NBER, origination charges range from $twenty five to $100, which have a median of $fifty, and you may repair charge can move up so you’re able to $75, with a median regarding $25. Mortgage costs are very different for each plan, therefore contact your package officer for much more facts just like the you happen to be determining exactly how much the entire cost of your loan would-be.

Discover less credit choices available

If all of the grounds over just weren’t sufficient to persuade your up against taking financing from your own 401(k), remember that there any a great many other, so much more prices-productive choice.

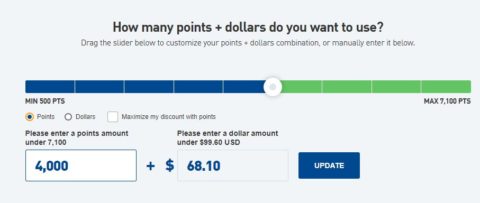

Comparing only the interest rates out of an excellent $10,000 mortgage using a lending institution in order to a good $ten,000 loan from your 401(k) is not oranges in order to apples. Considering the fresh new costs, attract charges, prospective fees in case there are default, and you will foregone money return, you can often find that real cost of a 401(k) loan is a lot greater than you would predict. Additionally, as it happens that when the pace on your own financing is leaner versus speed out of get back you happen to be earning towards holdings of one’s 401(k), the latest impact on pension offers try higher. You are able to miss out on a whole lot more prospective growth. Let’s assume that you really have an effective vested $fifty,000 harmony on your 401(k) and you’re considering a $ten,000 loan.

In this circumstances, might miss out on $250 off money productivity in a single season (referring to of course, if you only pay back the loan about same 12 months). You’ll also getting lost even more yields regarding the many years ahead because of a reduced balance.

Habit of do an adverse habit

You to dip into your 401(k) can very quickly turn into a new…plus one! In a-one-season examination of 180,000 consumers of 401(k) agreements, 25% of those got away a 3rd otherwise 4th financing, and you may 20% ones got out four or even more funds. In the contribution, getting financing from the 401(k) cannot sound right and in addition we strongly recommend up against they. Applicable charges, foregone financial support production, and you can potential tax charges normally every soon add up to produce big harm to their nest egg. As well as even worse, manage a spiral from most obligations. Visualize borrowing from the bank: Flickr

Damian Davila is actually a good Honolulu-mainly based creator that have a keen MBA regarding the College regarding Hawaii. The guy has actually helping anyone spend less and you will produces regarding the old-age, taxation, financial obligation, plus.

Leave a Reply