Getting family shoppers, the newest Feds price clipped is likely simply a little action towards the affordability

The new Federal Put aside provided house consumers whatever they hoped for which week: a big speed slashed and you can a laws off much more slices so you can become.

Nevertheless, ambitious homeowners and you will homeowners eager to re-finance should disposition the expectations out-of a massive shed inside mortgage prices from here.

Because the Given does not set financial costs, the policy rotate do obvious a route to have financial costs to come down. But in this case, new Fed’s step are generally envisioned, thus costs moved lower long before the clipped happened to be revealed.

We seen the majority of the fresh reducing you to we’ll rating currently this season, said Danielle Hale, chief economist in the Real estate professional. I wouldn’t be totally surprised if the home loan costs ticked right up a section from here in advance of decreasing once again.

Whenever mortgage prices go up, they can put hundreds of dollars 1 month into the prices for consumers. The average rates into the a 30-12 months financial rose regarding less than step three% directly into good 23-season most of seven.8% last Oct. That coincided toward Provided jacking-up their standard interest to combat inflation.

Rates was indeed primarily declining because July from inside the anticipation off a beneficial Fed speed slashed. The average speed into a thirty-year mortgage is starting to become 6.09%, according to mortgage visitors Freddie Mac. That is down out of seven.22% in-may, their top to date this current year.

Even a modest drop inside mortgage prices normally translate into high coupons along side long run. To own property noted for once month’s average U.S. conversion process cost of $416,700, a purchaser when you look at the La who can make a beneficial 20% down-payment within most recent mediocre mortgage price create save yourself about $312 a month as compared to price of buying the exact same house in may.

While you are lower prices promote domestic buyers far more purchasing strength, a mortgage up to 6% is still not reduced sufficient for most Americans not able to afford property. Which is mostly while the home prices has leaped forty two% for the past five years, around twice as much development in wages. They are still near listing levels, propped up by a shortage of house in lots of places.

Mortgage costs will have to lose back to near material-base lows away from three years before, otherwise home values will have to fall sharply for many customers to cover the a property. None situation will occurs any time in the future.

Economists and mortgage world professionals expect home loan cost to keep near the latest levels, at the least this current year. Federal national mortgage association this week estimated the interest rate on the a thirty-year home loan tend to mediocre 6.2% on the October-December one-fourth and elizabeth quarter the coming year. They averaged 7.3% in identical several months inside 2023.

Lenders is increasingly leaning to the old date the pace adage because of the combining original financing having refinancing bonuses from the diving

Home loan costs are affected by numerous activities, and the way the bond markets responds towards Fed’s interest decisions. Which can circulate the new trajectory of 10-season Treasury yield, and that lenders explore once the the basics of prices home loans.

At some point, the pace of home loan and you can Provided rates declines was determined from the financial data, said Rob Prepare, vice president at Look for Mortgage brokers. When the future data means that the cost savings is slowing more than requested, it would boost pressure to your Provided for taking even more competitive step having speed cuts which could likely translate into all the way down financial rates offered to users.

Conversion process away from in earlier times filled U.S. residential property can be found in a-deep slump dating back to 2022, and you may dropped dos.5% past times. To date, the latest pullback inside the home loan rates provides yet so you can spur an important rebound, although transformation performed rise a little when you look at the July.

This new muted attitude to own home loan prices actually leaves potential buyers and manufacturers with a common problems: Take to the brand new housing marketplace today otherwise wait around having possibly lower pricing.

Nick Young, a lawyer just who went his friends this present year out-of Phoenix to Evergreen, Tx, keeps joined to lease immediately following enjoying exactly how competitive the fresh homebuying field was last spring.

Having a great homebuying budget ranging from $one million and you can $step one.5 billion, he and Columbus installment loan bad credit no bank account his awesome partner continue to be finding one to primary jewel – a house having five bedrooms to enhance for the through its three high school students.

Need for financial refinancing could have been increasing

They have been seeing mortgage rates, but also other variables, also rising prices, the healthiness of the newest discount complete, and the presidential election.

There’s not a huge amount of added bonus to buy currently, Younger said before the latest Fed statement. But timing the marketplace is actually a great fool’s errand.

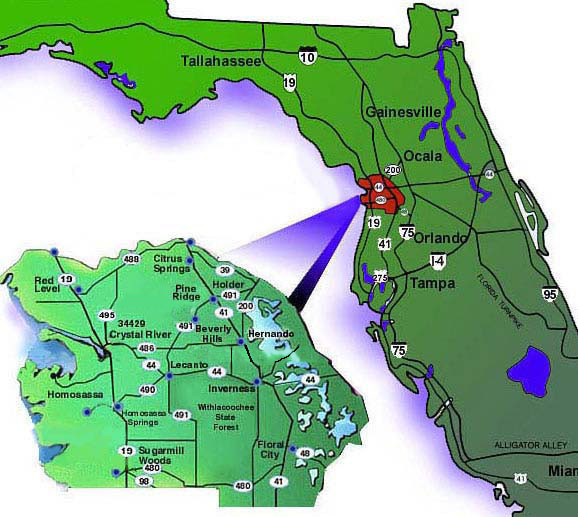

Real estate professionals of Phoenix so you’re able to Tampa, Florida, say of numerous household buyers try looking forward to home loan pricing to-fall less than 6%. Most are in hopes cost normally return to the fresh downs out of three in years past.

What i you will need to perform was render them back to fact, said Mike Opyd, an agent which have Re/Maximum Prominent into the Chicago. We tell them, when you find yourself serious about to get, get into today.

In order to Opyd’s section, the fresh new pullback from inside the home loan costs and a collection regarding the supply of residential property on the market lead to a great backdrop to have home consumers this fall, generally speaking a reduced time of the year getting household conversion process.

Awaiting pricing to help you perhaps ease after that next season you certainly will get-off buyers facing increased race toward domestic they need. Meanwhile, potential providers may still remain lay.

Remember that 76% men and women with a mortgage enjoys a speed less than 5%, said Leo Pareja, Chief executive officer out-of eXp Realty. Therefore, we would see the have-request imbalance actually rating a small worse throughout the close label.

From inside the February, Yae, a compensation analyst, was cited an effective seven% financial speed. By the time the offer was done, his rate got go lower just to from the six.63%.

I wish to re-finance from the 5% or 5.25%, however, I just do not know if that’s practical assuming that is browsing simply take more 24 months discover there, the guy said.

Yae could straight down his payment per month because of the more or less $three hundred 30 days if the he refinances his $407,000 mortgage in order to 5.5%.

You to principle to consider whenever refinancing is if your decrease your rate of the half to three-quarters out of a share section.

Just after people watched listing high rates of interest that peaked on the a beneficial year ago doing 8%, many are marketing has the benefit of you to definitely essentially bring people a means out of its newest rate immediately following it comes down back off given that a beneficial treatment for quell client hesitancy.

It is bringing significantly more focus, said Mike Fratantoni, master economist within MBA. Delivering secured towards the a great eight% speed permanently – getting an initial-day visitors, its frightening.

Navy Federal Credit Commitment said it come offering its prominent no-refi price lose within the 2023, that enables people to reduce the rates to have a good $250 commission while keeping all of those other terms for the unique mortgage.

Many homebuyers is opting for new brief speed buydowns and you will totally free refinancing, told you Darik Tolnay, branch manager regarding CrossCounty Financial during the Lakewood, Tx.

They all require a home, so if someone turns up that have a notion to make it economical, considering the standard belief, individuals are desperate to have choice, Tolnay told you.

Leave a Reply