Taxation implications out-of leasing your no. 1 quarters

Becoming a landlord is not just about sitting back and meeting book money. Landlords can play new role out-of an agent, a great negotiator americash loans Gaylordsville, an effective repairman and you will, some times, an evictor.

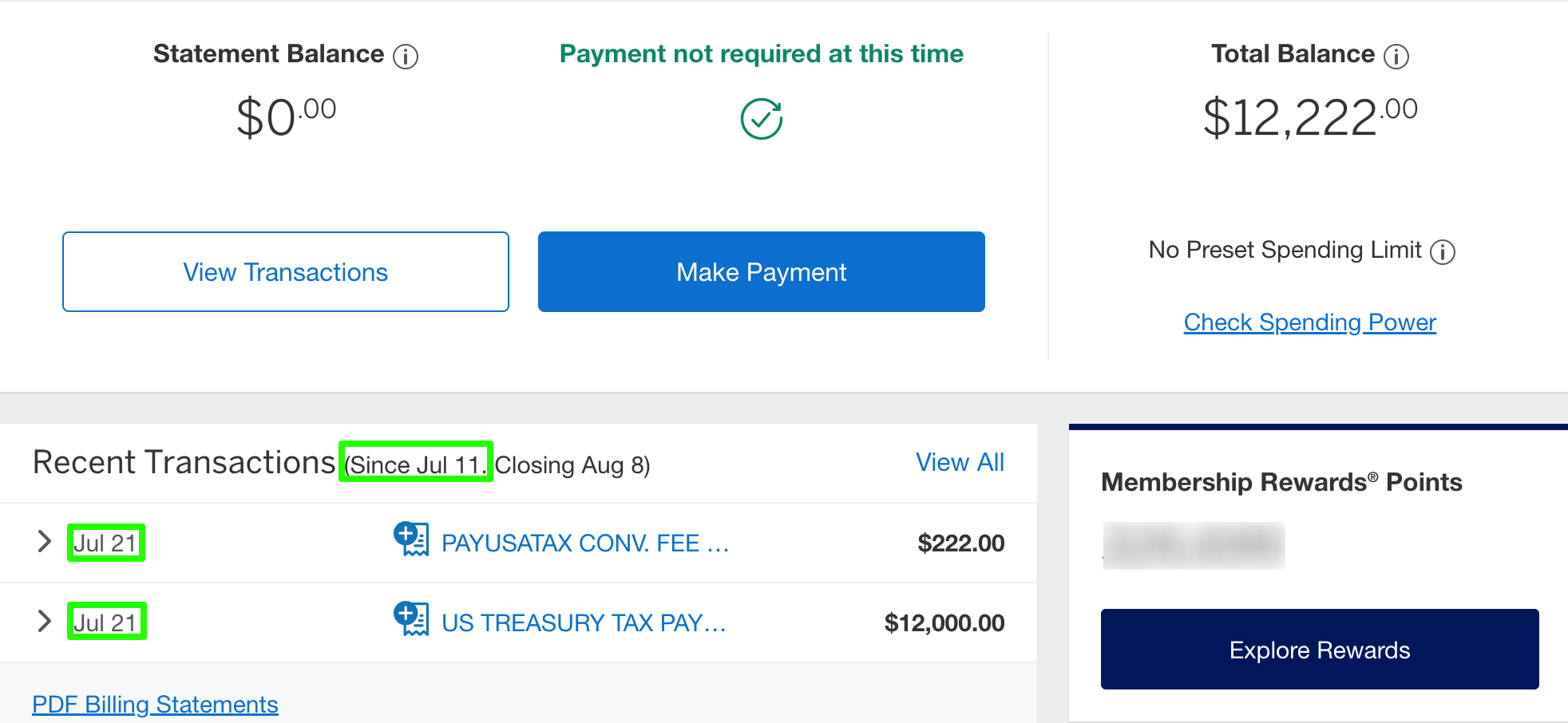

Becoming a landlord could complicate your earnings fees, one another on Internal revenue service plus country’s revenue department. New rent you get becomes nonexempt money, and since there isn’t any company withholding taxes from this income, your own yearly tax bill will be high.

To curb your taxation accountability, you could allege write-offs including property taxation, insurance costs, HOA dues, financial desire, the price of repairs and you may decline. This requires a beneficial checklist keeping all year round.

Always consult your accountant to get your taxation return proper. The brand new accountant’s charge can pay for on their own if the accountant understands throughout the tax positives your failed to know about.

Should i rent my top house?

Sure. But speak to your home loan servicer basic, specifically if you ordered our house in the last season. Together with, speak to your HOA having holder-occupancy criteria.

Do i need to rent element of my personal primary residence?

Sure. Might still need to follow property owner-tenant rules. That mortgage program, Fannie Mae’s HomeReady, lets you make use of this form of local rental money so you’re able to be eligible for a new mortgage.

Just how long can i book my personal number 1 house?

You could potentially rent out much of your residence because of the month or for an extended book. Many people like a half dozen- or twelve-month rent that will help be certain that constant leasing money while you are nonetheless making it possible for for autonomy pursuing the book expires.

Ought i rent out an area during my number one house?

Yes. That is a great way to help to make mortgage repayments. But you are nevertheless a property manager and may follow property manager-tenant laws to safeguard your self plus renter.

Would you book your main household?

Yes, however, make sure to speak to your mortgage company earliest, specifically if you ordered our house as an initial residence in this for the past season. To-be a landlord has actually taxation ramifications, therefore seek advice from a tax accountant, too.

Do i need to rent the house in the place of informing my personal lending company?

For almost all homeowners, residing our home for at least annually meets the new loan’s occupancy standards. If you’re not yes regarding the lender’s rules, be sure to have a look at prior to changing much of your quarters for the a good local rental. Even though you discover you’re in the brand new clear, they never ever hurts to let their bank find out about your preparations. Informing your lender are able to keep your escrow benefits on track since your home taxes and you will insurance premiums may raise.

What takes place basically dont give my bank I’m renting away my family?

Because it music insurance coverage and tax research, there’s a high probability their lender are able to find away you’re leasing most of your residence. The lender you’ll document con charge up against your to have misrepresenting the intent to reside in the home you financed.

How do i changes my first quarters to help you accommodations property?

You’ll want to get out, eliminate any individual belongings that will not participate the newest local rental, and offer the home for rent. But earliest, speak to your home loan servicer, read up on property manager-renter legislation, and you can look at the income tax implications to become a landlord. Without having going back to all of this more functions, you might have to focus on a house administration organization.

Just how appropriate to order property would you book it?

More often than not, you’ll want to hold off annually just before renting your domestic – for those who ordered the house given that a primary home. If you put an investment property financing purchasing the home, you might book your house instantly.

Leave a Reply