SBI Financial Qualifications According to Salary

We are examining having now offers .

State Lender out-of Asia (SBI) mortgage qualification is dependent on an easy number of conditions that produces our home money open to a broad demographic out of individuals. There are various out of financial schemes having glamorous desire pricing and you can installment tenure to fulfill different standards.

SBI Financial Eligibility Conditions

- SBI Flexipay Mortgage: The most ages to try to get so it loan was forty five ages and you will 70 years ‘s the restrict many years to have cost.

- SBI Advantage Mortgage: Which home loan strategy are only for State and you will Central Government team and social industry financial institutions and you can Public Market Undertakings (PSUs) in addition to people who have pensionable services.

- SBI Shaurya Financial: That it financial strategy was simply for personnel of your own defence features that happen to be given expanded cost tenures minimizing interest levels compared to majority of folks.

- SBI Wise House Better Right up Financing: The new qualification requirements for it, aside from the almost every other conditions, is a beneficial CIBIL get more than 550. Around ought to be few other finest-right up loans that will be productive and you can a regular cost history of more 12 months once completion of any moratorium.

- SBI Mortgage brokers so you’re able to Non-Salaried – Differential Offerings: Apart from the present qualifications conditions, next need to be fulfilled: If for example the applicant was somebody for the a collaboration company or the dog owner regarding a beneficial proprietorship organization otherwise one of many Administrators in a family, then your organization otherwise organization should have started existent getting a good the least 3 years, made a net funds during the last two years, people current borrowing from the bank establishment will likely be simple and you will typical, just in case the latest proposed house is gotten from the joint labels of Exclusive business plus the Owner, the company are debt-totally free or a preexisting debtor of one’s bank.

- SBI Tribal Including: Minimal age of admission because of it mortgage program are 21 decades as well as the maximum ages are 60 years. The most mortgage period can be fifteen years.

State Financial away from India’s home loan eligibility utilizes a variety regarding products such as the age the latest applicant, credit history, and money or salary.

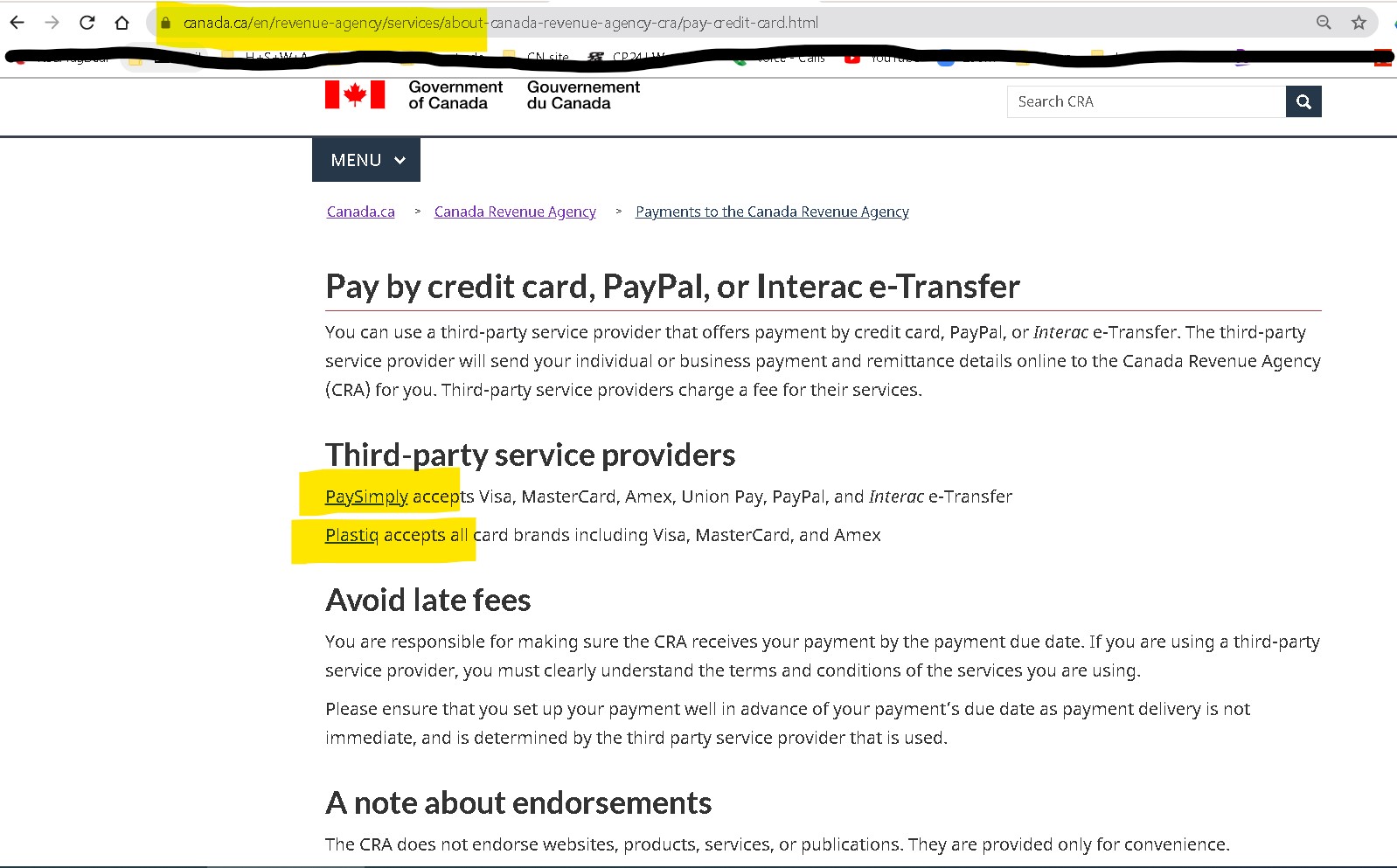

The fresh SBI financial qualifications calculator the following shows you brand new loan amount you are entitled to considering other ranges away from monthly earnings offered mortgage https://speedycashloan.net/loans/400-dollar-payday-loan/ out-of 6.95% p.an effective., the performing interest rate, and you can a maximum cost period away from three decades, and you will just in case there are no most other financial requirements towards Equated Month-to-month Instalments (EMI) to the other financing.

SBI Mortgage Qualifications Predicated on Many years

County Lender regarding India’s home loan payment period increases so you’re able to thirty years. Young the individual is when the home financing is removed, the greater amount of long-time they need to pay off the borrowed funds and vicce versa. Given below ‘s the restrict qualified period to own SBI lenders based on different age.

SBI Home loan Eligibility According to Worth of Property

The mortgage to Really worth (LTV) proportion ‘s the quantum of financing that is disbursed based on the worth of the house or property which you propose to buy. New LTV proportion for different financing amounts can be as listed below:

SBI Mortgage Qualifications Predicated on Credit rating

Your house financing qualifications is dependent on your credit score. The greater your credit rating, the lower the interest and you may vice versa. Here are the analysis a variety of credit ratings:

SBI Mortgage Qualifications for females

This new qualifications criteria for ladies are the same for most other people in the event women individuals are provided mortgage loan concession from 05 base issues.

SBI Mortgage Qualifications to own Co-Candidate

Condition Lender of India allows co-applicants offered he has got an everyday revenue stream otherwise income which have files as supplied while the proof of salary or earnings.

Activities Affecting SBI Mortgage Qualifications

- Applicant’s ages

- Applicant’s credit history

- Applicant’s paycheck or source of income

SBI Financial Qualifications FAQ

New eligibility standards for SBI’s harmony transfer from home loans or top-up fund are exactly the same because the that of typical money brand new applicant would be a keen Indian citizen/NRI and stay anywhere between 18 and you will 70 yrs old.

You can improve chances of being approved to own a state Bank out of India mortgage by adding a co-candidate who may have a consistent revenue stream, possess good credit, and you will suits this and Indian citizenship standards too.

You might be told when you yourself have removed new qualification requirements to have SBI mortgage brokers through the in the- idea approve and that’s provided from the bank’s authoritative webpages through your software techniques or from the bank’s specialized mobile app.

Leave a Reply