3 Finest Peer-to-Fellow Credit Carries inside the 2022

When you find yourself considering the risks doing work in committing to peer-to-fellow funds and you may alternatively, would like to invest in the companies on their own, which is one strategy to use.Let us walk-through exactly how peer-to-fellow cashadvanceamerica.net/loans/parent-loans/.

Peer-to-peer (P2P) credit tunes exactly like what it is – a type of on line credit where personal dealers really works yourself with folks otherwise people trying to finance.

If you’re considering the threats involved in committing to fellow-to-peer fund and you can rather, like to invest in the companies by themselves, that’s you to path to take.

Let us walk through just how fellow-to-fellow credit really works, how to put money into peer-to-peer credit websites and also the ideal picks for this seasons.

Exactly how Peer-to-Peer Credit Really works

There are peer-to-peer fund to your online lending systems, and people who need fellow-to-fellow loans have to go through a great prequalification strategy to discover if they are eligible for the fresh new fund. A loan provider offers her or him a price of mortgage terminology, interest rate and you may costs. They may be able following fill out the application considering these types of prices. The financial institution might create a painful credit check as well as the candidate will discover whether or not they becomes acceptance of one’s loan.

2nd, the borrowed funds actions into investment stage, where multiple buyers look at the mortgage. Lenders can pick whether to funds most of the or an effective percentage of the loan, plus it mostly hinges on exactly how much we would like to use.

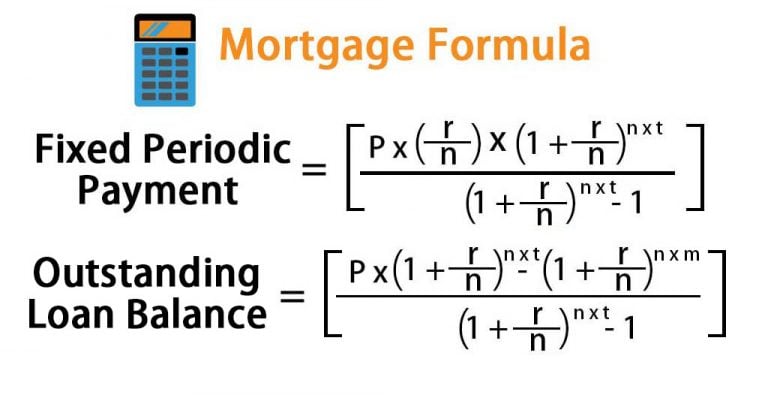

People who seek fellow-to-peer finance is gather adequate financing regarding enough lenders and you can located a digital transfer. Lenders will have your paid fixed monthly payments based on your payment terminology.

You should remember that whenever you are P2P lending try court within the the You.S., government entities doesn’t guarantee expenditures. If the debtor defaults into costs, buyers you may lose out on the entire capital.

An educated Peer-to-Peer Credit Internet to own Investors

Let’s look at the most readily useful peer-to-fellow credit web sites you could think about this year, both from committing to an openly traded team and you can direct capital given that a P2P bank.

Financing Pub Corp. (NYSE: LC)

LendingClub Corp., headquartered within the San francisco bay area, is actually an effective fintech marketplace lender you to lends knowledge, fund and you will car loan characteristics. The business offers individual, training and you may patient financing and you will automotive loans. Members is access a general a number of lending products and attributes courtesy a trend-motivated platform, and therefore is designed to help anybody save money whenever borrowing from the bank and you can secure way more whenever rescuing.

Financing Club confronted a record full season in the 2021, which have revenue away from $818.6 mil, up 157% compared to 2020. Marketplaces revenue is actually 136% highest and you will internet focus earnings became 259% 12 months over seasons. Credit Pub attained GAAP profits during 2021, that have net income off $18.six billion on season concluded , compared to an internet loss of $187.5 billion during the 2020.

Trick victory into the 12 months are obtaining and you may integrating the financial institution, merging the private, car refinance and buy finance fund on to you to definitely origination program, and you will accelerating registration buy.

A different sort of continual stream of internet attract earnings grew twenty-seven% sequentially in order to $83.1 million, as the bank’s financing collection increased twenty two% off . Net gain are adversely affected by $56.six million of notable circumstances: $39.5 billion from latest expected borrowing loss (CECL) provisioning, shorter online charge-offs and $17.one million out-of websites revenue deferrals one another inspired by strong hired financing development. Income each express thus transpired $0.53 into the Q4 2021.

Upstart Holdings Inc. (NASDAQ: UPST)

Upstart Holdings Inc., headquartered in the San Mateo, Ca, try a cloud-mainly based fake intelligence (AI) lending system. The company’s platform connects customers, finance companies and organization buyers through a shared AI credit program built on real chance. Upstart aims to improve usage of sensible credit while you are decreasing the risk and costs out-of financing because of the far more correctly determining chance and you will to avoid traditional borrowing-score established lending designs.

Inside the Q3 2021, Upstart’s complete cash was $228 mil, a rise out of 250% in the third one-fourth off 2020. Complete percentage cash are $210 billion, a growth from 235% YOY. Bank couples originated 362,780 fund and this totaled $step three.13 mil, up 244% from a year ago.

- Earnings away from operations is $twenty eight.6 billion, up away from $several.dos mil this past year.

- GAAP net income try $31.one million, right up regarding $9.eight million from inside the Q3 2020.

- Adjusted net income is actually $57.cuatro million, right up regarding $a dozen.step 3 mil during the 2020.

- GAAP toned down income per display try $0.29, and you can diluted adjusted earnings for each share are $0.sixty.

- Adjusted EBITDA try $59.1 million, right up of $15.5 mil last year.

Upstart needs Q4 revenue to boost regarding $255 million to $265 million, net gain of $sixteen so you can $20 mil, modified net income away from $forty-eight to $fifty million and you may modified EBITDA away from $51 so you can $53 million.

Excel

We’ll stop which have a low-publicly replaced solution. If you’d like to buy Do just fine, you have to always put money into its areas, within the signature loans and household equity. Help make your account and create a custom collection from the finding private fund or playing with Prosper’s vehicles purchase device. Money gets placed monthly into your Prosper membership. Prosper have facilitated more $20 mil during the fund to more than 1,190,000 some body because the 2005. Do just fine covers the loan servicing on the behalf of new matched up consumers and you can people.

Excel Areas, supported by best people along with Sequoia Resource, Francisco Lovers, Organization Promotion Partners and you may Borrowing Suisse 2nd Finance, can be a selection for your should you want to dedicate in a different way.

From inside the , everything 60% off mortgage originations was basically rated AA-B and you will mediocre mortgage proportions remained relatively flat week-over-day. The average monthly payment for the Do just fine loan to help you earnings (PTI) proportion to have December are 5.25%. New adjusted mediocre borrower price having December originations remained steady times-over-month.

Envision P2P Spending for brand new Potential

If you are searching with other possibilities, consider peer-to-fellow financing and also make an effect on their portfolio. They’re able to render a premier-produce alternative however it is important to understand that they show up which have risks. P2P financing systems need straight down minimal borrowing thresholds than just antique banking institutions, which could imply a top default exposure on the funds. Shop around prior to deciding whether P2P expenses is practical to you.

Leave a Reply